The market's behavior in the 4th quarter ("Q4") of 2018 was downright ugly. The S&P 500 in the U.S. was down 13.7% in Q4 (with a peak to trough decline of ~20%) for a full year return of -6.2%. This was the S&P 500's worst quarterly decline since Q3 2011 and only 8 of the 72 quarters since the turn of the century have experienced greater losses. In Canada, the S&P/TSX Composite was down 10.9% in Q4 (with a peak to trough decline of ~16 %) for a full year return of -11.6%.

The investment industry spends a lot of time attempting to explain "what happened." Trump, trade, interest rates, central bank balance sheets, credit spreads, Brexit, global debt levels, recession risks, etc. But why now?

To be clear, corporate earnings were very strong in 2018. S&P 500 revenue growth was 9% while earnings grew 20%, partly aided by tax cuts. Economic growth continues to be strong with the following comments coming from CEOs of some of the companies closest to main street:

Delta Airlines (the largest airline in the US), Q3 Earnings Call: October 11, 2018 "The revenue environment is the best we've seen in years..."

JP Morgan (the largest diversified bank in the US), Q3 Earnings Call: October 12, 2018 " I would say that as we look at the economy, we don't see it slowing down. It seems to be continuing to grow pretty solidly.”

Robert Half (a leading U.S. staffing agency): Q3 Earnings Call: October 23, 2018 "I'd say, so far, the sentiment does remain quite strong, as does confidence. Trade issues and higher rates have not yet trickled into the conversations we have with clients or their buying habits. So, so far, so good. There's no question, given our results, given our data, the underlying U.S. economy is quite strong, particularly for small to middle-size businesses.”

As you can see, these comments were made not that long ago. So, what happened? As Howard Marks points out in his timely book, "Mastering the Market Cycle," nothing in the economy changes that dramatically in only 3 months. And while corporate probability has greater ebbs and flows than the economic cycle, even corporate fundamentals don't change that quickly. That brings us to the market cycle, which is the most volatile because it is driven by human emotion.

Sure, some of these, like trade, have escalated recently. Trade frictions have eroded confidence in China which has slowed growth there. The fear, it seems, is that slower growth will permeate across borders and into the U.S. and globally. There is also the concern that, given economies are built on confidence, the market's decline in anticipation of a global economic slowdown will become a self-fulfilling prophecy: businesses and consumers both rein in spending due to the heightened 'uncertainty.' However, it seems to us that trade tensions can get resolved just as quickly as they escalated. Central banks will adjust their strategies so as not to jeopardize a recovery. As we have previously discussed, the big headwind to global growth going forward is debt levels. That is why we believe a targeted investment strategy makes the most sense in this environment - investors will no longer be able to fall back on broad based economic or market growth.

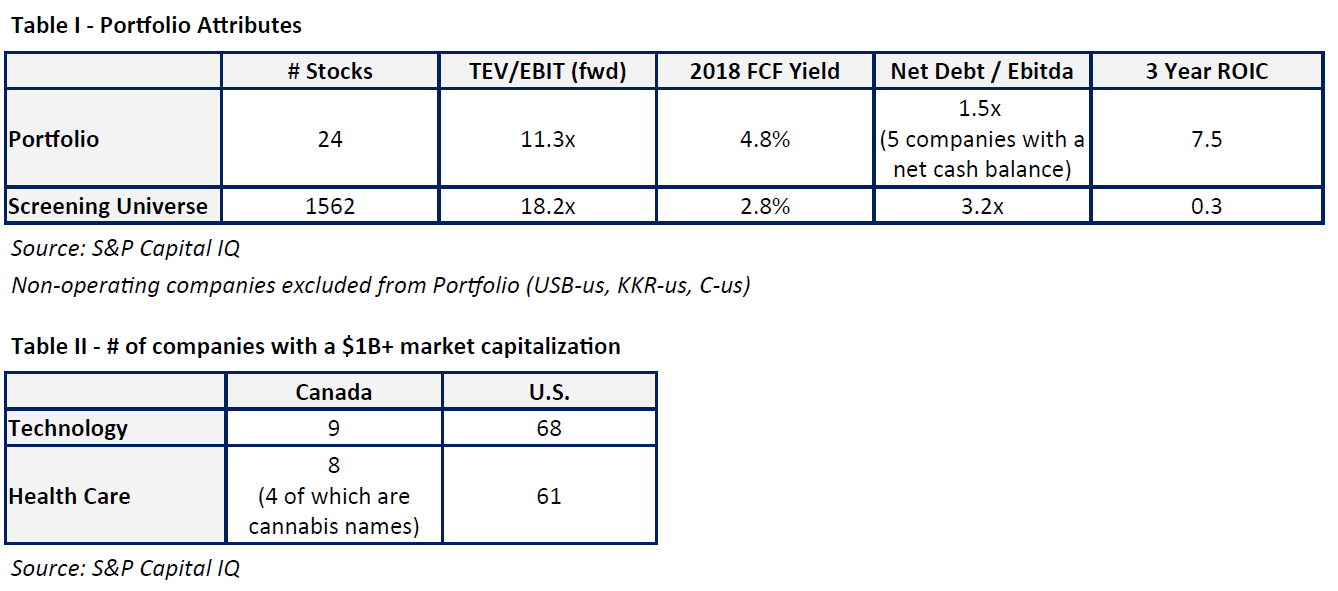

Taking it down to the portfolio level, our core investment principles have not changed: protect and grow our investors' capital through discounted valuations, strong balance sheets, good management teams and attractive business environments. Please see Table I for how our portfolio stacks up against our screening universe on key metrics that reflect this strategy. We did well to have more invested in the U.S. over Canada. Canada has now under-performed the U.S. market in 7 of the last 8 years. Canada lacks meaningful exposure to the more relevant Technology and Health Care sectors (Table II) while having over 50% exposure to Energy and Financials. Oil prices were down ~25% in 2018 with heavy discounts on Canadian oil adding to the pain.

Top performers in the portfolio in 2018 were Keysight Technologies, Mitel Networks and Parkland Fuel. Keysight is the world’s largest electronic measurement company with solutions that enable customers to design, test, and manufacture electronic products. Keysight is benefiting from several secular growth drivers such as the 5G upgrade cycle, the electrification of autos, and the connected vehicle. Mitel Networks is a global provider of business communication services. The stock performed well as they reaped synergies from a large acquisition and continued their transformation to the cloud, with the stock subsequently being acquired by private equity firm Searchlight Capital. Parkland Fuel is Canada’s largest independent marketer and distributor of fuels and petroleum products in Canada. Parkland performed well on the back of two very large and accretive acquisitions. The company continues its consolidation strategy which will further expand its scale advantage.

On the other end of the spectrum, the portfolio struggled with companies exposed to the factors listed above - specifically, trade tensions and higher interest rates. Delphi Technologies and LCI Industries were particularly hard hit. Delphi, a tier one powertrain parts supplier, was affected by a worsening auto situation in China and growing pains on the back of strong order bookings as they now need to invest heavily to meet demand. LCI Industries, a supplier to the RV industry, was affected by inventory reductions at the dealer level given the uncertainty around how higher financing rates might impact RV demand.

While the quickness and intensity of the market downturn create uneasy feelings for investors, we note that many stocks in our portfolio are trading at all-time low valuations. This suggests that much of the uncertainty is already priced into these stocks. Using history as a guide, the longer one's time in the market, the better one's odds of earning a positive return. It is also true that the risk/return profile facing investors today is much more attractive than it was 3 months ago.

As always, we appreciate our investors’ support, particularly during these times of market uncertainty.

Please feel free to reach out to us at any time.

Best Regards,

Portfolio Management Team

All data is as of January 8, 2019 unless otherwise indicated. The information contained herein provides general information about the Fund at a point in time. Investors are strongly encouraged to consult with a financial advisor and review the Simplified Prospectus and Fund Facts documents carefully prior to making investment decisions about the Fund. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Rates of returns, unless otherwise indicated, are the historical annual compounded returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed; their values change frequently and past performance may not be repeated. Principal distributor: Caldwell Securities Ltd. Publication date: January 8, 2019.

12303168464egw4gwe4g

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/