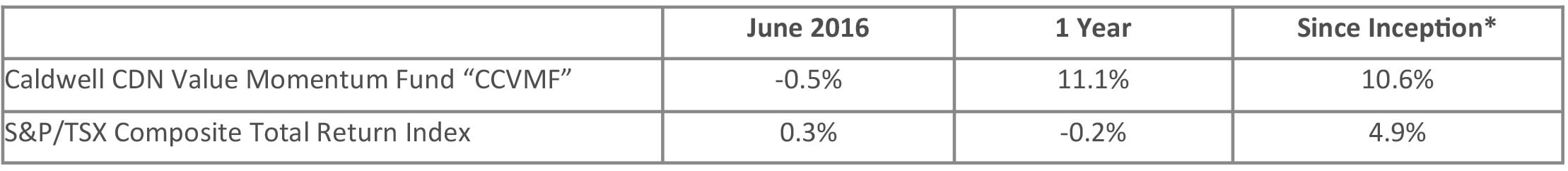

Update on Caldwell Canadian Value Momentum Fund June 2016

*Compounded Annual Return since August 15, 2011

June Recap: The Fund declined 0.5% in June versus a gain of 0.3% for the TSX Total Return Index. Macro events continued to drive the market as Britain’s vote to leave the European Union injected added uncertainty to the global growth outlook. Gold continued to be a safe haven for investors as the gold index surged another 18% in June with the majority of gains coming after the Brexit vote.

Top CCVMF performers in June were Tree Island Steel (+8.3%) and Imvescor Restaurant Group (+5.9%). Tree Island held an analyst day where investors walked away with greater confidence around the company’s growth and margin opportunity. This recent purchase has worked very nicely for the portfolio, having gained nearly 30% since we purchased the stock in May. Imvescor had another strong quarter, showing continued progress on their restructuring initiatives. Traffic trends are improving as the company gets ‘back to basics’ and there remains a long runway of opportunity as it executes its plan. The discount to the restaurant peer group remains significant and we see a lot of value in this name.

While not a top performer this month, Hardwood Distribution announced a sizeable acquisition which will make it the largest North American distributor in the industry. The deal is immediately accretive to earnings and cash flow per share and provides incremental growth opportunity to consolidate the market and leverage their leading share position. There were no changes to the portfolio in June; however, choppy markets tend to create turnover in the quantitative buy list and this is what we are seeing today. Our active overlay has generated significant alpha and we are currently working through the due diligence process on new names, taking care to avoid false buy signals created by the market’s volatility. The Fund ended June with a cash balance of 15%. We look forward to tracking the progress of the portfolio’s holdings as we see a meaningful and diverse set of catalysts to drive continued growth.

Wishing you and all of our investors continued success,

The CCVMF Team