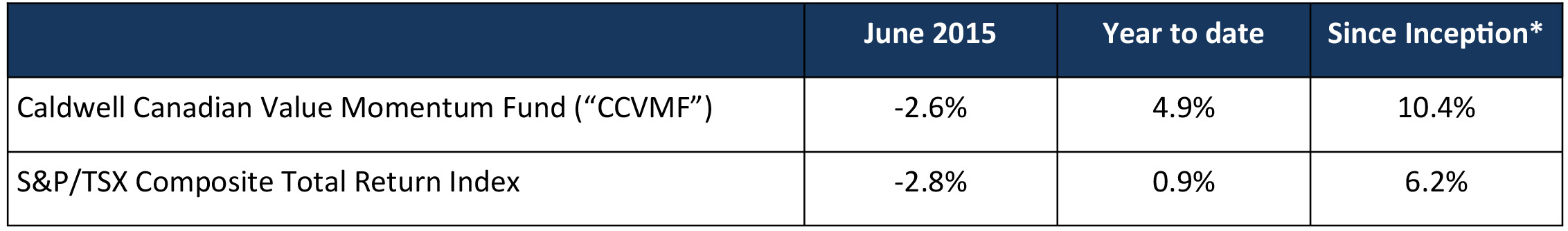

Update on Caldwell Canadian Value Momentum Fund June 2015

*Compounded Annual Return Since August 15, 2011

The Fund had another positive month in terms of down-capture versus the market. Year to date, the Index has seen 3 negative months and in each case, the Fund has outperformed. Limited down-capture, or the ability for the Fund to perform better when the market is down, is a distinguishing feature of the Fund. Since the Fund’s inception, there have been 18 months where the Index was negative; the Fund performed better in 14 of those months, or close to 80% of the time. It is also the case that the Fund often produces positive returns in negative Index months, having done so in 8 of the 18 months.

Our goal in the Fund is to invest in companies that have strong industry or company specific drivers, which make these stocks more resilient to the overall moves in the market. Couche-Tard was the top performing stock this month. The company is very good at operating gas stations and their associated convenient stores and is benefiting from consolidating that market as global energy companies divest these assets. Chorus Aviation saw continued strength in the share price as the market digests its new agreement with Air Canada and other growth initiatives. CCL Industries is another consolidation story, focused on labels and packaging. Dirtt came off in June after a very strong run in its share price. The company has technology that is revolutionizing interior construction by vastly reducing the time and money required to complete projects, while still offering a great deal of design flexibility. Sandvine pre-announced that revenue would be weak in Q2 given timing of projects. This is simply the nature of Sandvine’s business. We note the company had a similar issue in October 2014 and the stock subsequently appreciated 80% as deals closed.

The Fund added Uni-Select, Intertain and Tricon in June. Uni-Select is another consolidation story being the largest distributor of automotive paint in the U.S. and one of the largest auto parts distributors in Canada. Intertain is the world’s largest online Bingo operator and is using the benefits of that scale to enter new markets. Tricon invests in U.S. housing for its own and 3rd party capital. It focuses on the U.S. Sunbelt where job and population growth is above national averages. The Fund held a 10% cash balance at month end.

Wishing you and all of our investors continued success,

The CCVMF Team