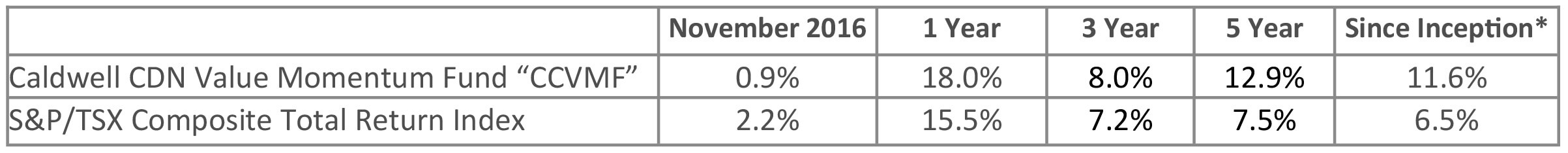

Update on Caldwell Canadian Value Momentum Fund November 2016

*Compounded Annual Return since August 15, 2011

November Recap: The Fund gained 0.9% in November versus a gain of 2.2% for the S&P/TSX Composite Total Return Index (“Index”). November saw a sharp rotation in market sentiment following Trump’s election win with money flowing out of defensive sectors (Consumer Staples -3.2%, Telecom -4.2%, Utilities -5.3% and Gold -14.4%), and into more economically-sensitive sectors. This is the exact opposite of what was expected by most investment commentators and is a great example of the market climbing the proverbial ‘wall of worry.’ It is also a great example of how difficult it is to ‘time’ the market.

Top CCVMF performers in November were Cargojet (+14.9%) and New Flyer Industries (+12.8%). Cargojet, a recent purchase, reported solid Q3 results (even with the Canada Post strike). The company is executing on its plan to improve asset utilization, which is driving higher operating margins, and announced further progress in this area with the expansion of the AC Cargo agreement to Germany. New Flyer delivered a positive outlook on bus deliveries for 2017 along with a nice uptick in its bid universe. The NJ transit issue, which was a temporary overhang on the stock, is now behind them.

Air Canada was added to the portfolio in November. The company has been executing on a cost-program that has driven a solid improvement in margins. The company’s cash flow profile is set to increase as it comes off of a significant capital investment period. This improved cash profile will be used to bring down debt and refinance to lower borrowing costs. The company continues to have a multi-year runway in its cost program and is seeing success in its international expansion initiative. The stock trades at a 30-40% discount versus airline peers and we believe these initiatives will help continue to close that valuation gap.

The team has worked through due-diligence on over a dozen names in the last few months, with only a few being added to the portfolio. We have been cautious on this latest batch of buy signals as they have been focused in commodity-driven industries (energy and agriculture, specifically). A key part of our due diligence process is understanding a company’s momentum drivers and assessing their sustainability. Our caution around these names is that momentum is often almost entirely attributable to commodity price movements. While we are not opposed to owning companies with commodity exposure, we like to see added elements of value-creation that are within management’s control.

The Fund ended November with a cash balance of 10.2%. We look forward to tracking the progress of the portfolio’s holdings as we see a meaningful and diverse set of catalysts to drive continued growth.

Wishing you and all of our investors continued success,

The CCVMF Team