Management Update TMX: UDA.UN December 2017

Dear Investor,

Equity markets in the United States (S&P500) rose 2.8% to finish November. Canada was nearly flat with gains of 0.3% (S&P/TSX Composite Index) even as oil (“WTI”) continued its march upward of 5.6%. Europe (Euro Stoxx 50) lost 2.8% while Japan (Nikkei 225) added 3.2%.

There is an old Chinese proverb that translates roughly to English as “May you live in interesting times”. The adage is typically used with a degree of irony as “interesting” can also mean a lack of stability, possibly crisis, but in the case of 2017 it has been both interesting and profitable.

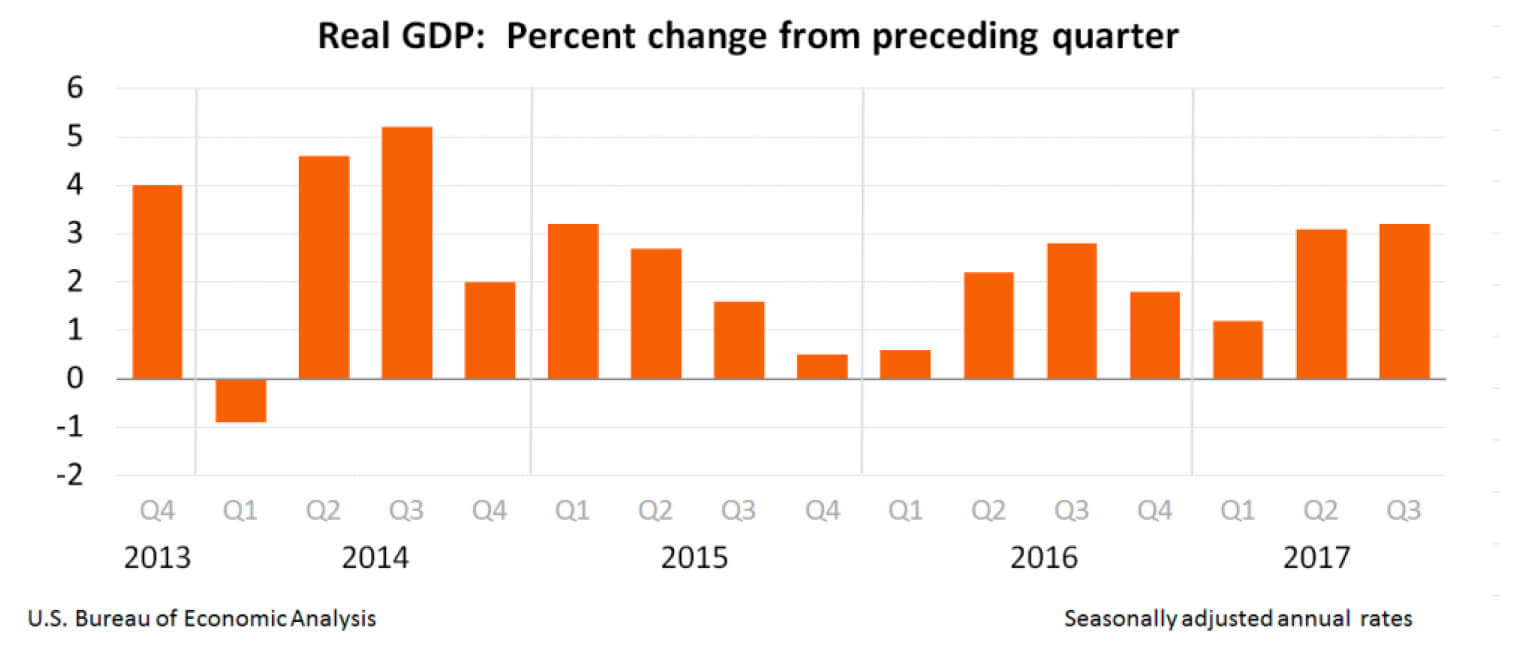

2017 will be tough to leave. This has been one of the greatest years for the U.S. equity markets ever. The good news is that there is reason to believe that the good times will continue into the first half of 2018. The Federal Reserve (“The Fed”) painted a very rosy picture of the U.S. economic growth in their December meeting which gives us great optimism for 2018. General Domestic Product (“GDP”) appears to be growing at a very healthy pace as Real GDP has grown by over 3.0% in the last two quarters as measured by the U.S. Bureaus of Economic Analysis (chart below).

Three things should help keep U.S. GDP above the 3% level for the next two quarters. The first is that energy prices have strengthened globally. 2015 had major headwinds from energy prices collapsing and lead to widespread bankruptcy and job losses. S&P 500 earnings per share (“EPS”) were also dinged as energy companies booked large asset write downs along with poor revenues. Now, U.S. energy firms are as strong as ever. Thanks in part to increased technological efficiencies in shale drilling and the ability of American energy firms to now export oil to foreign markets. This will be a major source of job growth in 2018 for the American labour market and a significant boost to S&P 500 EPS.

Source: Yardini and Associates

The second is that inflation, as measured by Personal Consumer Expenditures (“PCE”), remained below 2% in October, lower than levels early in the year. While energy and housing should accelerate inflation data in the back half of 2018, for now it appears to be muted. This will temper investors’ fears that the Fed will act aggressive and raise rates more than their forecasted three interest rate increases in 2018. Currently, survey based measures of longer run inflation have changed little on balance. We believe inflation is underestimated by the market but in the near term it should be fine. Once PCE and wage growth remain above 2% in tandem for two consecutive quarters then the market should adjust and the yield curve might invert. Until then, party on!

Third, the job market is booming south of the border. Total nonfarm payroll employment increased strongly in October and November. The national unemployment rate fell to 4.1%, one of the lowest levels in the past thirty years! A strong labour force is absolutely essential to a U.S. economy. As two-thirds of the U.S. economy is consumption, having a strong labour force should cause this segment of the economy to rise. Americans have spent the last decade deleveraging from the housing mania that gripped the country before the great financial crisis. Now, America is near full employment, their banks are willing to lend after passing all the Fed’s stress tests for the first time since 2009, and their citizens are beginning to buy homes again. Housing prices and new homes sales will continue to rise in 2018 thanks to the labour market. Wage gains still remain modest as average hourly wages rose 2.5% but as companies begin to compete for workers, this number should rise.

Source: Federal Reserve of St. Louis

The Canadian economy has also enjoyed a fabulous 2017. GDP for Canada is on pace for 3% growth for the year which would be the strongest among the Group of Seven (“G7”) economies. Incredibly, as of November 2017, 350,000 jobs have been created in Canada so far this year (this is the same as 3.5 Million jobs in the U.S. – an absolutely staggering number!). Canada is now starting to see signs of life in business investment thanks to a strong recovery in oil and mining. Precious and Industrial metals such as copper, zinc, iron ore, and gold have all had strong years that have helped rebound a long suffering sector of the Canadian economy. High house prices and household debt still remain concerns. More than 80% of household debt is comprised of mortgages and home equity lines of credit (“HELOCs”). HELOCs have been convenient for households to access increasing net worth tied to rising home values but increase vulnerability in the financial system in case of a housing shock. The Bank of Canada (“BoC”) has taken measures to increase lending standards and strengthen the financial system. It will be interesting to see in 2018 how the housing market responds to these new standards and how the Canadian economy holds up to them.

Source: International Energy Agency

In energy markets, the Organization of Petroleum Exporting Countries (“OPEC”) and Russia have surprised the markets with the success of their alliance. Oil continues to rise to price levels not seen since 2014, but should bring some challenges with it in 2018. U.S. production will continue to rise as energy prices increase which will grow American market share. This will most likely cause discontent among OPEC and Russian companies as they see American firms bring in record profits and production. It is unlikely production cuts will continue in the second half of 2018, however, even this may not be enough to stem the rise of energy prices. Large scale energy projects take as long as a decade to come into production and current OPEC nations have greatly underfunded capital investment in current projects. Global demand is up over 4 million barrels a day in the last three years, with huge consumption gains in both China and India that do not appear to be dissipating any time soon. 2018 should be an interesting year indeed for the energy markets.

We believe that 2018 will be another strong year for investors but will not be free of challenges. We believe U.S. dividend-paying equity securities that possess a combination of low volatility and high profitability will significantly and disproportionately benefit from the continued U.S. economic expansion.

Unitholders are reminded that the Caldwell U.S. Dividend Advantage Fund offers a Distribution Reinvestment Plan (“DRIP”) which provides Unitholders with the ability to automatically reinvest distributions and realize the benefits of compounded growth. Unitholders can enroll in the DRIP program by contacting their Investment Advisor.