Management Update TMX: UDA.UN October 2017

Dear Investor,

Equity markets in the United States (S&P500) rose 1.9% in September. Canada was up 2.8% (S&P/TSX Composite Index) on the back of an impressive 9.4% increase in the price of West Texas Intermediate oil (“WTI”). Europe (Euro Stoxx 50) and Japan’s (Nikkei 225) equity markets were also quite impressive, rising 5.1% and 3.6% respectively.

U.S. markets continue to hit fresh all-time highs. Equity investors brushed off the downward adjustment in third quarter earnings estimates partly due to Hurricanes Harvey and Irma. Investors are looking past the near term effects of the recent hurricane season and towards President Trump’s tax plan. The tax plan cleared a key hurdle in Congress this month and tax cuts would certainly give the market a boost if they passed.

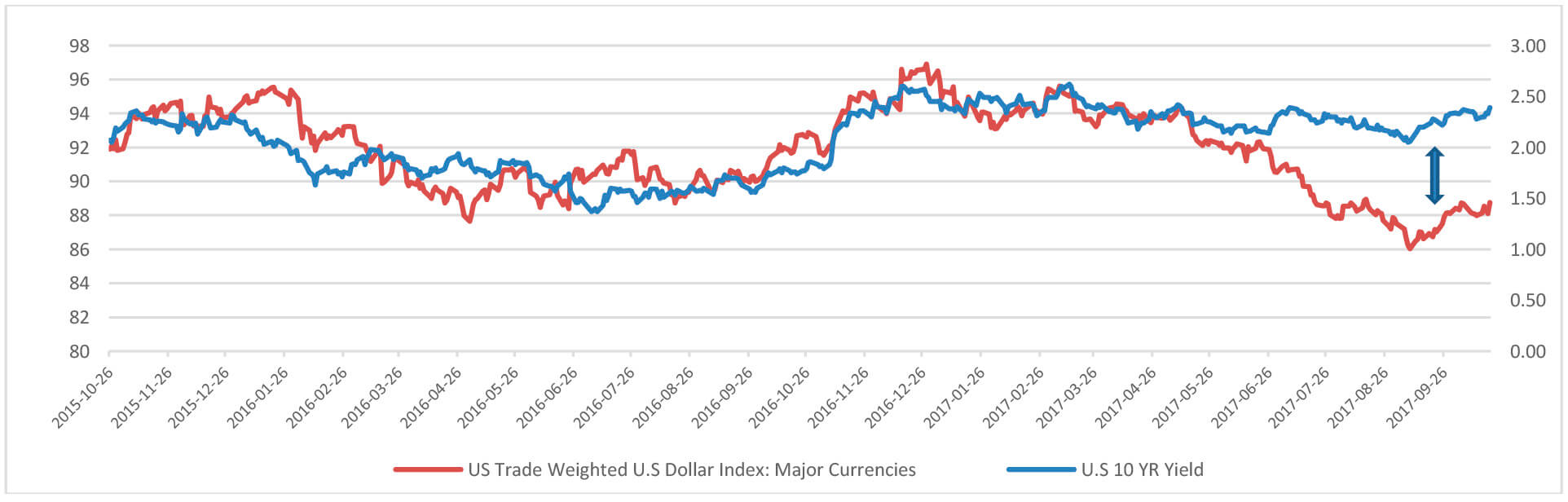

The Federal Reserve (“The Fed”) released their Beige Book this month and it revealed a well anchored economy despite lost ground from weather related disruptions in September. The data compiled in the last Beige Book showed a strong economy underpinned by a strong labour market, increased business capital spending, and a steady upswing in housing. All this data supports the Fed raising interest rates in December. Markets are now pricing in a near 100% chance of 25 basis point interest rate hike at its December meeting. Consensus now is that President Trump will choose John Taylor as the next Fed Chair, replacing current chair Janet Yellen. Many view Mr. Taylor as a hawk in the same camp as Ms. Yellen. He will most likely stay the course of the four more rate hikes between now and the end of 2018. This has caused bond yields to rise in the United States and edged the U.S. dollar higher against most world currencies. The market is currently pricing in around two interest rate hikes by December 2018. The appointment of Mr. Taylor should increase that expectation and cause the U.S. Dollar to appreciate.

Source: Federal Reserve of St. Louis

Global energy markets are strengthening. WTI has steadied above $52 a barrel as U.S. crude oil inventories have declined 46 million barrels since mid-September. The large outage of refineries in the gulf coast due to hurricane damage has impacted gasoline and distillates. In the third week of October gasoline and distillate inventories dropped by 5.5 and 5.2 million barrels respectively. This outage in refinery capacity in combination with steady increases in total miles driven has helped energy inventories back towards levels pre-2014. WTI prices should also get a boost as Saudi Arabian Crown Prince Mohammed bin Salman backed the extension of Organization of the Petroleum Exporting Countries (“OPEC”) production cuts beyond March 2018, making it all but certain that the cartel and its allies will rollover curbs when OPEC meets next month.

It has been two years since the U.S. federal government ended a decades old restriction on crude oil exports. Now the U.S., long the world’s largest oil consumer, is on track to surpass Nigeria and Venezuela to become one of the world’s ten largest oil exporters. Helped by OPEC production cuts, the abundance of shale oil from western Texas paved the way for a surge in U.S. exports. Shipments are likely to reach a record 2 million barrels a day (“MM b/d”) this quarter while U.S. oil production will reach 9.9 MM b/d in 2018, also the highest in history. Output from the Permian basin in Texas alone is expected to reach 2.7 MM b/d in November, up more than half a million barrels from a year before.

The U.S. is relying less and less on OPEC for its energy needs and is now becoming a direct competitor for market share. U.S. foreign policy in the Middle East has evolved from explicitly benevolent to implicitly threatening from Saudi Arabia’s perspective. The U.S., until recently, has been a major supporter of the Saudi Kingdom. From an American geopolitical perspective, the relationship made sense: Saudi Arabia gave the U.S. a dependable energy supply and in return U.S. would supply them with state-of-the-art armaments and U.S. military would maintain an active presence in Middle East. This stance has changed in the last decade. The U.S. has been deleveraging from the Middle East since 2008. Back then troop levels peaked at 250,000 and have now dropped to below 50,000. American withdrawal in the Middle East have given the Saudi’s reason to pivot towards an alliance with the Russians. Russia and Saudi Arabia both fear American expansion into the oil market and with their new alliance, the Saudi’s have replaced their American military alliance with Russia. This is important because previously Russian involvement with OPEC cuts were met with healthy skepticism; Russia never complied with previous OPEC and non-OPEC production cuts. This skepticism has diminished as Russian production has come down by 300,000 b/d from Q4 2016. Now it appears that the Saudi-Russian relationship is deepening to include military and economic partnerships. This foray into the world energy markets by the U.S. could have much deeper geopolitical meaning. The U.S. is slowly releasing its military hegemony with the rise of China and strengthening of Russia. Leaving the Middle East could be the first of many changes to come in the global economy.

The Bank of Canada (“BoC”) kept interest rates unchanged at their meeting in October. The BoC cited low inflation from a strong Canadian Dollar (“CAD”) and North American Free Trade Agreement (“NAFTA”) uncertainty. The appreciation of CAD was featured prominently in the policy statement. The BoC is concerned that a strong CAD will slow inflation and hurt export growth. The BoC still cites concerns about Canadian personal debt levels and is still waiting to see how the two previous rate hikes permeate through the economy. Before the BoC decides to move again, there will have to be some clarity regarding NAFTA and its associated trade policies. One external factor that could change the BoC is a strengthening oil market. This will greatly help out the struggling province of Alberta and should cause our dollar to appreciate. If CAD appreciates for this reason, the BoC might continue to hold back on rate hikes for the time being.

The Information Technology sector has been the best performing sector in the S&P 500 year to date (“YTD”). At the end of September, the U.S. Dividend Advantage Fund (“the Fund”) had 14.7% of Net Assets in this sector. One of the strongest performers within this sector for the Fund has been Microsoft (NASDAQ: MSFT). MSFT reported fiscal first quarter earnings this week and beat market expectations by a hefty margin. MSFT is now a major player in the cloud computing business. Cloud Revenue has increased 55% Yearover-Year (“YoY”) to eclipse the lofty $20 Billion USD goal set by management in 2015. Cloud gross margins increased dramatically from 52% to 57% due to high operating leverage within the business. It is possible that Microsoft could double its cloud revenue within the next three years and from its economies of scale, greatly increase margins. Windows and Office revenues should stay flat for MSFT but remain healthy cash cows for years to come. Free cash flow for the quarter (”FCF”) grew 10% YoY and was over $10 billion for the quarter. Microsoft returned $4.8 billion to shareholder in the form of dividends and share repurchases while still leaving them with a healthy source of funds to reinvest in its business. MSFT also is seeing the benefits of their LinkedIn acquisition with the division contributing $1.1 billion of revenue this quarter. LinkedIn gives MSFT the potential to take on Salesforce.com’s dominance in the cloud Client Relationship Management market and improve MSFT’s market share. This goes along with MSFT moving from selling hardware towards recurring revenue business lines. MSFT has reshaped its business from cloud computing, artificial intelligence, and edge computing.

Source: Microsoft Investor Relations

We believe that technology stocks such as MSFT will be a strong performer in 2017 and beyond. We believe U.S. dividend-paying equity securities that possess a combination of low volatility and high profitability will significantly and disproportionately benefit from the continued U.S. economic expansion.

Unitholders are reminded that the Caldwell U.S. Dividend Advantage Fund offers a Distribution Reinvestment Plan (“DRIP”) which provides Unitholders with the ability to automatically reinvest distributions and realize the benefits of compounded growth. Unitholders can enroll in the DRIP program by contacting their Investment Advisor.