Management Update TMX: UDA.UN May 2017

Equity markets in the United States gained 1.2% in April. Canada (S&P/TSX Composite Index) fell 1.5%. Europe (Euro Stoxx 50) lost 0.1%, and Japan (Nikkei 225) moved up 2.4%. Crude oil (“WTI”) fell 2.1%.

Politics dominated the headlines in May but that did little to stop U.S. equity markets from grinding higher. Equity markets slumped 2% on news of an investigation into U.S. President Donald Trump. Market participants feared that the American government would take longer than expected on its campaign promised tax reforms. This sell-off proved to be a buying opportunity for investors with the market moving to new highs by month-end.

The market’s attention has moved to the Federal Reserve (“The Fed”) which meets June 13th-14th. The Fed released their Summary of Commentary on Current Economic Conditions (“Beige Book”) at the end of May in advance of the meeting. It envisions the U.S. economy advancing at a modest to moderate pace with moderate improvement in manufacturing, balanced with softening in consumer spending. The Fed sees labour markets continuing to tighten but is waiting for confirmation in wage growth. Certain industries, specifically knowledge based ones like Science, Technology, Engineering, and Mathematics (“STEM”), have seen wages grow faster than the overall labour market. These industries have found it difficult to locate and hire workers. This workforce takes a long time to educate and develop workers for demand. Typically, demand for this workforce is sourced globally because of its high degree of expertise. Recently, it has been difficult to bring in workers from abroad to fill the labour void due to President Trump’s executive order in April. The executive order has been put in place to review and overhaul the H-1B visa program, where the vast majority of visas go to STEM workers. The Fed believes wage growth should begin to work down to less educated labour classes as slack continues to tighten in the U.S. labour market overall.

On balance, the Fed’s assessment of the U.S. economy appears to be upbeat. Inflation continues to be steady and around the targeted 2% level. Gains in construction activity resulted in a pickup in the prices associated with building materials, while manufacturers saw increases in lumber, steel, and other commodities. This is consistent with the data coming in from single family home sales, mortgage applications and non-residential leasing activity. While this last set of data has softened in the first quarter of 2017, it had to do with the large amount of investment that took place in the fourth quarter of 2016.

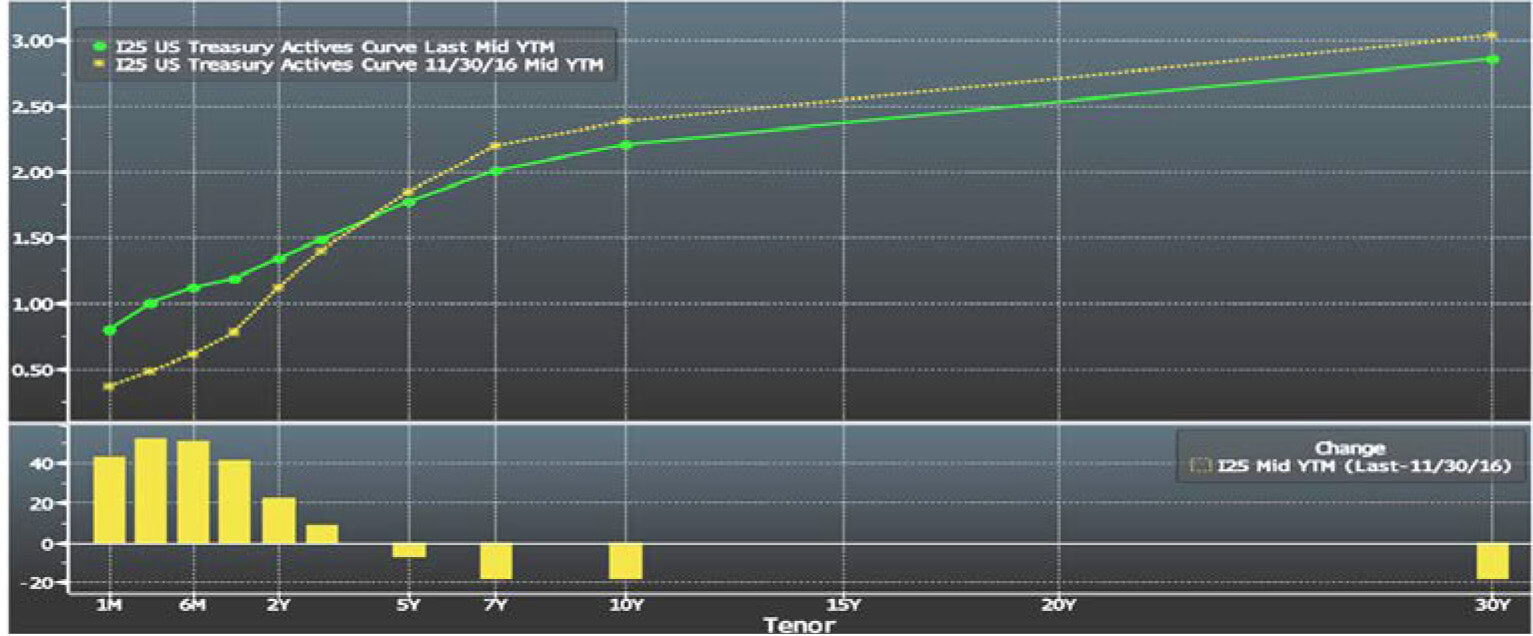

A great quantity of 2017 demand was pulled forward into the back half of last year as investors and home buyers alike were fearful that interest rates would rise significantly in 2017. As depicted in the graph below, which compares the yield curve on November 30th 2016 following the Trump election to the current yield curve, the U.S. yield curve has flattened this year amidst a strengthening labour market. This should provide a positive tailwind for the housing market and the trend of rising home ownership rates should continue for the remainder of 2017.

Source: Bloomberg

European markets scored a major victory with the election of Emmanuel Macron, President of France, in the month of May. The Euro-zone has been grappling with an existential crisis since the first Greek bailout of 2010. Many nations openly wondered why they would share responsibility for the poor governance of other members. Britain leaving the European Union has given validation to this economic nationalism and has had many ask if the Euro can continue in its current form. A victory for Macron has put these fears on hold. Broad improvement in Euro-zone economic data should further help politicians in Brussels breathe a sigh of relief. The 19-country bloc’s unemployment rate fell further to 9.3% in April with consumer confidence in the region at a post crisis high. The Euro (EUR/USD) moved over 3% upwards in the month of May on the back of this good news. Europe is not completely out of the woods yet. It is beginning to look like Italy will call an election in the back half of 2017 which will elevate the region’s political risk. Italy has a much lower support for the Euro-zone relative to its peers. Its move to a purely proportional electoral system increases the likelihood a nationalist party will emerge in the next election. Four months of solid economic growth could change this and possibly the fortunes of Europe.

In Canada, market participants are increasingly wary of vulnerabilities in the financial system and particularly the housing market. Canada’s financial system remains resilient as the economy has strengthened along with the American economy and international commodity markets. However, the level of household indebtedness continues to rise with a high portion of increased debt loads coming from mortgages and home equity lines of credit located in the greater Toronto and Vancouver areas. Last year, the federal government introduced changes to housing finance policies aimed at improving the quality of borrowing. This has helped decrease the proportion of insured mortgages (where more than 80% of the cost of the home is borrowed) and means on balance, people are putting more equity into their home purchase than before. Housing fundamentals, such as population and wage growth, remain very strong in both these regions but fundamentals alone are not enough to explain the price increases. The Bank of Canada (“BoC”) remains focused on this segment of the economy because a recession caused by an external shock could amplify the drop in home prices and the effect on the depth and length of an economic downturn. It is positive that the BoC is taking proactive steps to monitor this market as confidence is vital to its health. Recently, a Canadian mortgage company, Home Capital Group (TMX:HCG), nearly failed when struck with a confidence crisis by investors and depositors. Even though its mortgage portfolio had mortgage defaults lower than the Canadian average, questions over its lending practices alone caused investors to withdraw deposits at an intense rate. Confidence is crucial to housing and the financial system as a whole so we will continue to monitor this market closely.

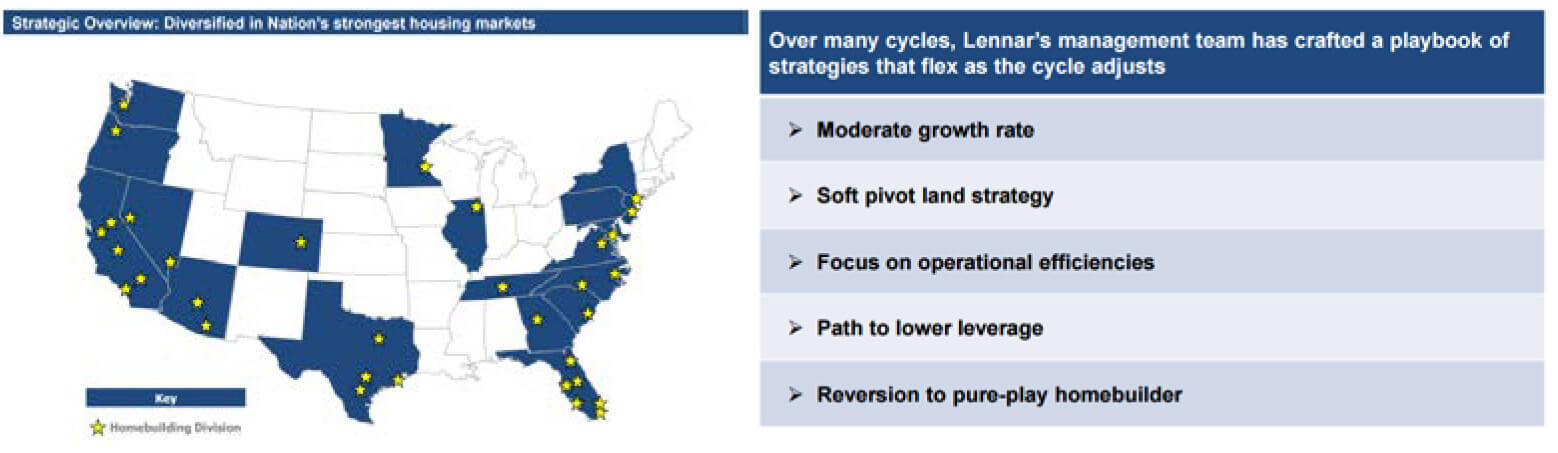

The housing cycle in the U.S. is far less mature than Canada’s. To take advantage of this strengthening market, the Portfolio Managers added Lennar Corporation (NYSE: LEN) to the investment portfolio. LEN is amongst the most geographically diverse homebuilders in the U.S., operating across 58 markets in 17 states. Florida is its largest market, accounting for 30% of closings, followed by Texas (20%) and California (15%). LEN caters to the move-up segment which makes up 68% of current home closings with only 28% going to entry-level buyers. LEN intends to shift its focus to the entry-level over the next few years in markets it already operates within. Given its broad geographic reach, LEN plans to grow organically in existing markets, instead of expanding through M&A, which will continue to increase margins through operational efficiencies. In addition, LEN’s deep market share in its top markets is a competitive advantage that enables the company to drive economies of scale with trades and suppliers while also supporting the ability to source new land deals.

Source: Lennar 2017 Investor Presentation

A core component of LEN’s mid-cycle strategy is to pivot to a more land-light operating model which will free up its balance sheet to focus on home building. The strategy calls for purchasing land in core markets that can be built on and sold within two to three years. LEN was one of the most active companies buying land during the downturn and accumulated a low cost land base. This will help LEN drive significant margins throughout this current cycle that will drive earnings and dividend growth which is why we believe that LEN will be a strong performer in 2017.

Unitholders are reminded that the Caldwell U.S. Dividend Advantage Fund offers a Distribution Reinvestment Plan (“DRIP”) which provides Unitholders with the ability to automatically reinvest distributions and realize the benefits of compounded growth. Unitholders can enroll in the DRIP program by contacting their Investment Advisor.

12303168464egw4gwe4g

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/