Market Commentary

Markets continued to recover in the third quarter (“Q3”) as economies and business conditions improved off of second quarter (“Q2”) lows. The S&P/TSX Composite Index gained 3.9% in Q3 while the S&P 500 gained 8.5% (or 6.4% in Canadian Dollar terms given the decline in the U.S. Dollar). In Canada, companies within the Industrials sector led the market higher as the outlook for industrial activity improved, including expectations for higher infrastructure spending. In the U.S., companies within the Consumer Discretionary sector led the market higher, especially those benefiting from the significant shift in consumer spending towards the home. Energy stocks continued their under-performance in both geographies, despite improving underlying commodity prices.

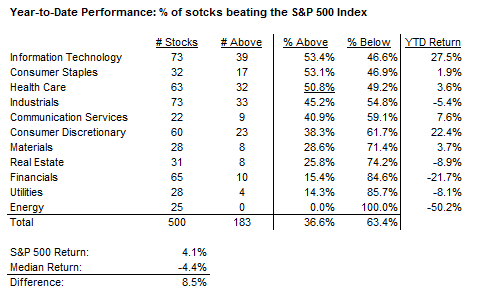

The negative skew to the market's performance continued in Q3, with nearly two thirds of stocks in the S&P 500 under-performing the S&P 500's return in the first three quarters of the year (Chart I). Simply put, most stocks are not keeping up with the overall market's return. The skew is so notable that there is an 8.5 percentage point difference between the S&P 500 return (+4.1%) and the median (midpoint) return of -4.4%.

Portfolio Commentary

Taking it down to the portfolio level, our core investment principles have not changed: protect and grow our investors' capital through discounted valuations, strong balance sheets, high quality management teams and attractive business environments.

Top performers in Q3 were Tricon Residential (“TCN” +20.7%), Premium Brands (“PBH” +16.1%) and Middleby (“MIDD” +13.6%)*. Tricon, one of the largest providers of single family home rentals in the U.S., is seeing strong demand for its housing, especially as people relocate from crowded urban centers. Premium Brands moved higher on strong operational execution through the COVID-19 environment, along with growing sales momentum and acquisition opportunities. Lastly, Middleby's stock continued to recover as it, too, navigated the COVID-19 environment well.

We continue to look for opportunities within market dislocations to further improve the quality of businesses we own in your portfolio. One such stock was added to the portfolio in Q3: Boston Scientific (“BSX”). Our investment thesis has the stock moving higher on both industry and company-specific catalysts. BSX is a medical device company with a focus on minimally-invasive technologies engineered to diagnose and treat a wide range of medical conditions. The medical device industry experienced COVID-19 headwinds as people delayed doctor visits and surgical procedures. However, industry fundamentals remain attractive with an aging population, increasing chronic disease, high barriers to (competitive) entry driven by innovation and sticky consumer preferences (its very hard to convince a surgeon to switch products). Specific to BSX, the company is well positioned in attractive markets after a new CEO took over in 2016 and re-positioned the portfolio. Eighty-five percent of the company's revenues are tied to procedures that cannot be deferred longer than six months, and procedure volumes have already improved significantly from their lows at the height of the COVID-19 panic. The company has a strong pipeline of new innovation coming to market over the next several years, which should drive industry-leading growth rates, strong pricing, and continued upside to margins and earnings per share. The stock currently trades at a valuation discount to peers, which we believe will close as it executes on the above.

Looking Forward

We have written in past notes about the market's willingness to largely ignore valuations on companies with strong growth outlooks. However, there are signs that this might be changing. Now that investors have seen what a 'worst-case-scenario' looks like, appetite for lower-valuation cyclical companies has been increasing and their stock prices have started to perform better. After years of under-performance by this group, we believe there is significant upside in closing the gap with the market's darlings. The portfolio is well positioned for this rotation towards value as we have remained disciplined on valuation and have avoided chasing returns.

We will continue to look for opportunities resulting from COVID-19 related disruption. Cash planning remains key so speak with your Investment Advisor if you need to draw on cash within the next 2 years.

*Current investments, first purchased: TCN 6/8/2016, PBH 4/25/2019, MIDD 1/4/2019.

Performance shown is for Q3 only. All data is as of September 30, 2020 sourced from Capital IQ, unless otherwise specified. The information contained herein provides general information about the Fund at a point in time. Investors are strongly encouraged to consult with a financial advisor and review the Simplified Prospectus and Fund Facts documents carefully prior to making investment decisions about the Fund. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Rates of returns, unless otherwise indicated, are the historical annual compounded returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed; their values change frequently and past performance may not be repeated.

On 11/16/2020 unitholders voted in favour of an investment objective change and corresponding change in the name of the fund to the Caldwell North American Fund. Refer to the amendment #1 to the Simplified Prospectus dated 10/13/2020.

Publication date: November 16, 2020.