April Recap:

The Fund gained 2.4% in April versus a gain of 3.2% for the S&P/TSX Composite Total Return Index ("Index”). Sector performance for the Index was led by Consumer Discretionary (+7.0%), Technology (+6.4%) and Financials (+5.2%), partially offset by losses in REITs (-3.7%) and Materials (-2.5%) led by Gold (-5.5%).

Top CCVMF performers in April were North American Construction Group (“NOA”: +12.1%) and Badger Daylighting ("BAD": +11.3%).

NOA rebounded after weaker performance in March. The company released a good "beat and raise" earnings report late in the month despite poor weather conditions, prompting analysts to increase price targets. The business outlook remains positive with a robust upcoming summer construction season and meaningful bidding opportunities. Despite significant price out-performance year-to-date, we believe substantial upside exists to fully reflect the company's transformation.

This is the 2nd consecutive month that BAD showed up as a top performer. While there was no incremental news in April, outside of a new CFO appointment, there is growing evidence that hydrovac excavation is gaining wider acceptance due to its safety and efficiency advantages over traditional techniques. The runway for growth is significant with BAD aiming to once again double its revenue base.

As telegraphed in last month's note, we have initiated several new positions in the Fund. Three stocks were added to the portfolio in April: Brookfield Asset Management ("BAM.A"), Element Fleet Financial ("EFN") and DIRTT Environmental Solutions Ltd. ("DRT").

BAM.A is one of the largest alternative asset managers in the world with over $300 billion in AUM. They are value investors in the alternative space (real estate, infrastructure, private equity) which is seeing secular tailwinds from institutional investors, increasing allocations to alternative asset classes. BAM.A has raised $20B in capital in the last 12 months and is expected to generate significant free cash flow over the coming decade, providing it with multiple levers for value creation.

EFN is the largest publicly traded fleet management company in North America. The new CEO has executed well on the turnaround story with material earnings improvement targeted over the next several years. We like turnaround stories, especially in uncertain economic climates, as value levers are in management's control and expect the stock's multiple to re-rate higher as ROE metrics improve.

DRT is another turnaround story that is also redefining commercial interior design and construction processes through its proprietary software and manufacturing capabilities. Despite a 20%+ 5-year revenue CAGR, virtually all senior management positions have been replaced so as to create a company that can scale the significant growth opportunity in front of it. The strategy is to leverage DRT’s technology and position it as a technology solution (vs. a construction solution) alongside bringing in better processes/KPIs/accountability into sales, marketing, manufacturing and capital allocation. Demand for DRT solutions is strong, evidenced by strong growth rates, particularly 59% growth in health care and 29% growth in education, with a massive growth runway given < $400M in current revenue against a $150B market. Other catalysts include a U.S. listing and potential for additional sell-side coverage given only 6 analysts currently cover the company.

The Fund held a 27.7% cash weighting at month-end, down from 45.7% at the end of March. The fund has generated substantial value to investors over its long-term history, driven by the combination of strong company-specific catalysts and a concentrated portfolio. We continue to look forward to strong results as we progress through 2019 and beyond.

We thank you for your continued support.

The CCVMF Team

The Fund was not a reporting issuer offering its securities privately from August 8, 2011 until July 20, 2017, at which time it became a reporting issuer and subject to additional regulatory requirements and expenses associated therewith.

Unless otherwise specified, market and issuer data sourced from Capital IQ.

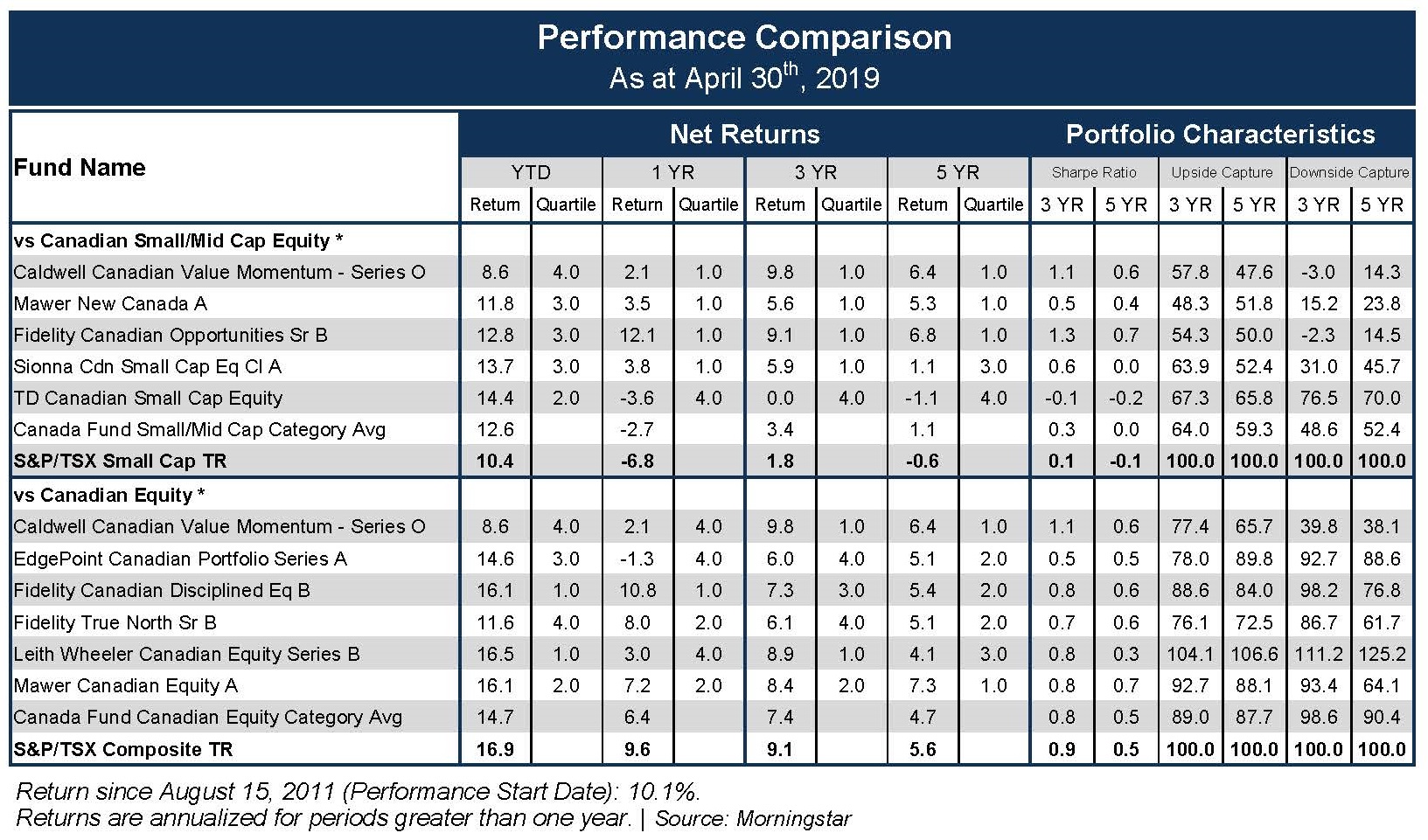

As the constituents in the Canadian Equity category largely focus on securities of a larger capitalization and CCVMF considers, and is invested, in all categories, including smaller and micro-cap securities, we have also shown how CCVMF ranks against constituents focused in the smaller cap category. The above list represents 6 of a total of 365 constituents in the Canadian Equity category and 5 of a total of 111 constituents in the Canadian Small/Mid Equity category.

The information contained herein provides general information about the Fund at a point in time. Investors are strongly encouraged to consult with a financial advisor and review the Simplified Prospectus and Fund Facts documents carefully prior to making investment decisions about the Fund. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Rates of returns, unless otherwise indicated, are the historical annual compounded returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed; their values change frequently and past performance may not be repeated. Publication date: May 9, 2019.

FundGrade A+® is used with permission from Fundata Canada Inc., all rights reserved. The annual FundGrade A+® Awards are presented by Fundata Canada Inc. to recognize the “best of the best” among Canadian investment funds. The FundGrade A+® calculation is supplemental to the monthly FundGrade ratings and is calculated at the end of each calendar year. The FundGrade rating system evaluates funds based on their risk-adjusted performance, measured by Sharpe Ratio, Sortino Ratio, and Information Ratio. The score for each ratio is calculated individually, covering all time periods from 2 to 10 years. The scores are then weighted equally in calculating a monthly FundGrade. The top 10% of funds earn an A Grade; the next 20% of funds earn a B Grade; the next 40% of funds earn a C Grade; the next 20% of funds receive a D Grade; and the lowest 10% of funds receive an E Grade. To be eligible, a fund must have received a FundGrade rating every month in the previous year. The FundGrade A+® uses a GPA-style calculation, where each monthly FundGrade from “A” to “E” receives a score from 4 to 0, respectively. A fund’s average score for the year determines its GPA. Any fund with a GPA of 3.5 or greater is awarded a FundGrade A+® Award. For more information, see www.FundGradeAwards.com. Although Fundata makes every effort to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by Fundata.

* Categories defined by Canadian Investment Funds Standards Committee ("CIFSC")

12303168464egw4gwe4g

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/