April Recap:

The Caldwell Canadian Value Momentum Fund (“CVM”) declined 2.3% in April versus a decline of 5.0% for the S&P/TSX Composite Total Return Index (“Index”)1. Energy, Consumer Staples and Communication Services were top performing sectors while Information Technology ("IT"), Health Care and Industrials were notable underperformers. High energy prices and ongoing supply-demand imbalances continued to benefit Energy companies while a weakening macro outlook prompted investors to rotate into more defensive sectors, such as Consumer Staples. In the context of the current inflationary environment, investors also sought companies with strong pricing power and in that regard, Consumer Staples' companies within the Index performed better than expected over the last few quarters. Lastly, companies in the Communication Services sector benefited from investor repositioning given their defensive characteristics such as high barriers to entry, low customer turnover and stable dividends. Investor repositioning and a continued sell-off in the shares of Shopify continue to weigh on the IT sector. The sell-off in Marijuana companies adversely impacted the Health Care Sector's performance while the sell-off in Industrial names was more broad based.

Top performers in CVM's portfolio for the month of April were Tourmaline Oil ("TOU", +14.9%), Cenovus ("CVE", +14.0%) and Interfor ("IFP", +5.3%)2. A positive structural change is underway in the Energy sector. Along with a recovery in demand exiting the pandemic, companies are placing a greater emphasis on sustainable growth versus the 'growth at all costs' mentality of the last oil cycle. The events in Ukraine have recently driven energy prices to new highs. However, we believe strong fundamentals underpin continued support for energy prices for the foreseeable future, including favourable earnings releases, continued capital spending discipline and positive management guidance. Additionally, companies are holding true to their second promise: sustainable profitability and shareholder returns through the cycle. To that end, many companies within the sector have announced material dividend and share buyback increases in recent months while continuing to reduce balance sheet leverage. In all, we view the combination of high energy prices, sustainable growth and strong free cash flow return as highly positive for shareholders. A significant overweight in the Energy sector has been a key contributor in the Fund's outperformance to date. While lumber prices have pulled back from the highs in March, they remain elevated relative to pre-COVID levels. In addition to significant capacity additions and debt reduction over the last 2 years, IFP is in a position to generate strong free cash flows over the medium term as it capitalizes on strong housing demand in North America.

During the month of April, the Fund initiated a position in Alimentation Couche-Tard ("ATD"). ATD is a consolidator in the convenience store/gas station industry, leveraging its scale to reduce costs and improve margins of acquired chains. Even with 12,500 locations across North America and Europe, it and 7-eleven only have approximately 15-20% of the market. The company's balance sheet and stated leverage targets leave ample room for a large acquisition which could aid in its ability to consolidate the market. In addition, the company's recent entry into the Asian market increases topline growth prospects. Lastly, ATD should benefit from the continued reopening of the economy as regular commuting and land-based travel activities resume during the warmer months ahead.

The Fund held a 24% cash weighting at month-end. CVM has generated substantial value to investors over its long-term history driven by the combination of strong company-specific catalysts and a concentrated portfolio. We continue to look forward to strong results as we progress through 2022 and beyond.

1See page 2 for standard performance data.

2Actual Investments, first purchased: CVE 1/6/2022 , IFP 11/13/2020, TOU 6/11/2021.

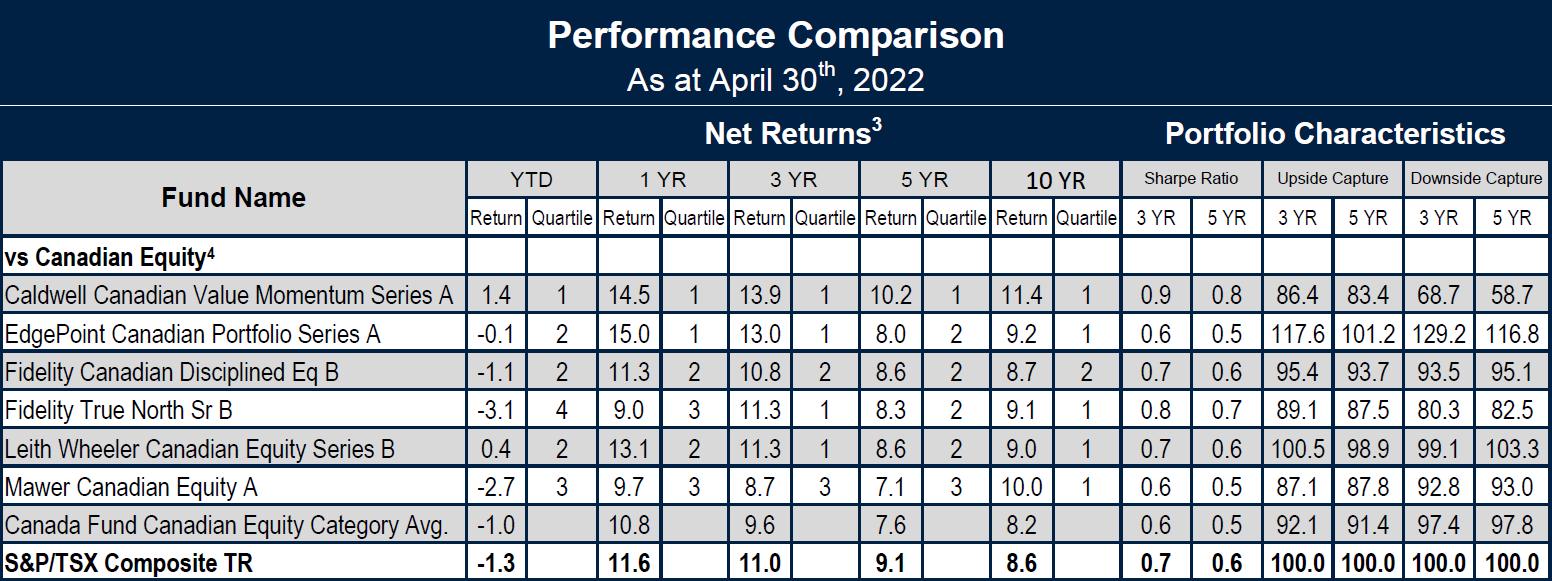

3Return since August 15, 2011 (Perf. Start Date): CVM (Series A) 11.1%, Index 7.9%. | Returns are annualized for periods greater than one year.

4Categories defined by Canadian Investment Funds Standards Committee (“CIFSC”).

The CVM was not a reporting issuer offering its securities privately from August 8, 2011 until July 20, 2017, at which time it became a reporting issuer and subject to additional regulatory requirements and expenses associated therewith.

Unless otherwise specified, market and issuer data sourced from Capital IQ & Morningstar Direct.

As the constituents in the CIFSC Canadian Equity category largely focus on securities of a larger capitalization and CVM considers, and is invested, in all categories, including smaller and micro-cap securities, we have also shown how CVM ranks against constituents focused in the smaller cap category. The above list represents 6 of a total of 398 constituents in the CIFSC Canadian Equity category.

The information contained herein provides general information about the Fund at a point in time. Investors are strongly encouraged to consult with a financial advisor and review the Simplified Prospectus and Fund Facts documents carefully prior to making investment decisions about the Fund. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Rates of returns, unless otherwise indicated, are the historical annual compounded returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed; their values change frequently and past performance may not be repeated.

FundGrade A+® is used with permission from Fundata Canada Inc., all rights reserved. The annual FundGrade A+® Awards are presented by Fundata Canada Inc. to recognize the “best of the best” among Canadian investment funds. The FundGrade A+® calculation is supplemental to the monthly FundGrade ratings and is calculated at the end of each calendar year. The FundGrade rating system evaluates funds based on their risk-adjusted performance, measured by Sharpe Ratio, Sortino Ratio, and Information Ratio. The score for each ratio is calculated individually, covering all time periods from 2 to 10 years. The scores are then weighted equally in calculating a monthly FundGrade. The top 10% of funds earn an A Grade; the next 20% of funds earn a B Grade; the next 40% of funds earn a C Grade; the next 20% of funds receive a D Grade; and the lowest 10% of funds receive an E Grade. To be eligible, a fund must have received a FundGrade rating every month in the previous year. The FundGrade A+® uses a GPA-style calculation, where each monthly FundGrade from “A” to “E” receives a score from 4 to 0, respectively. A fund’s average score for the year determines its GPA. Any fund with a GPA of 3.5 or greater is awarded a FundGrade A+® Award. For more information, see www.FundGradeAwards.com. Although Fundata makes every effort to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by Fundata.

Publication date: May 11, 2022

12303168464egw4gwe4g