August Recap:

The Fund was +0.15% vs. +0.4% for the S&P/TSX Composite Total Return Index ("Index”). Energy was a big negative for the market, down 3.5% in August on a nearly 6% decline in the price of crude oil. Year to date, the Energy sector is down 16% which makes it the worst performing sector in the country. While the TSX price index is down slightly year-to-date, only Energy (-16.0%) and Health Care (-13.8%) are in negative territory; all other sectors have produced positive returns. This illustrates the advantage that selective market exposure can give investors, something that CCVMF investors have benefited from since the Fund's inception over 6 years ago.

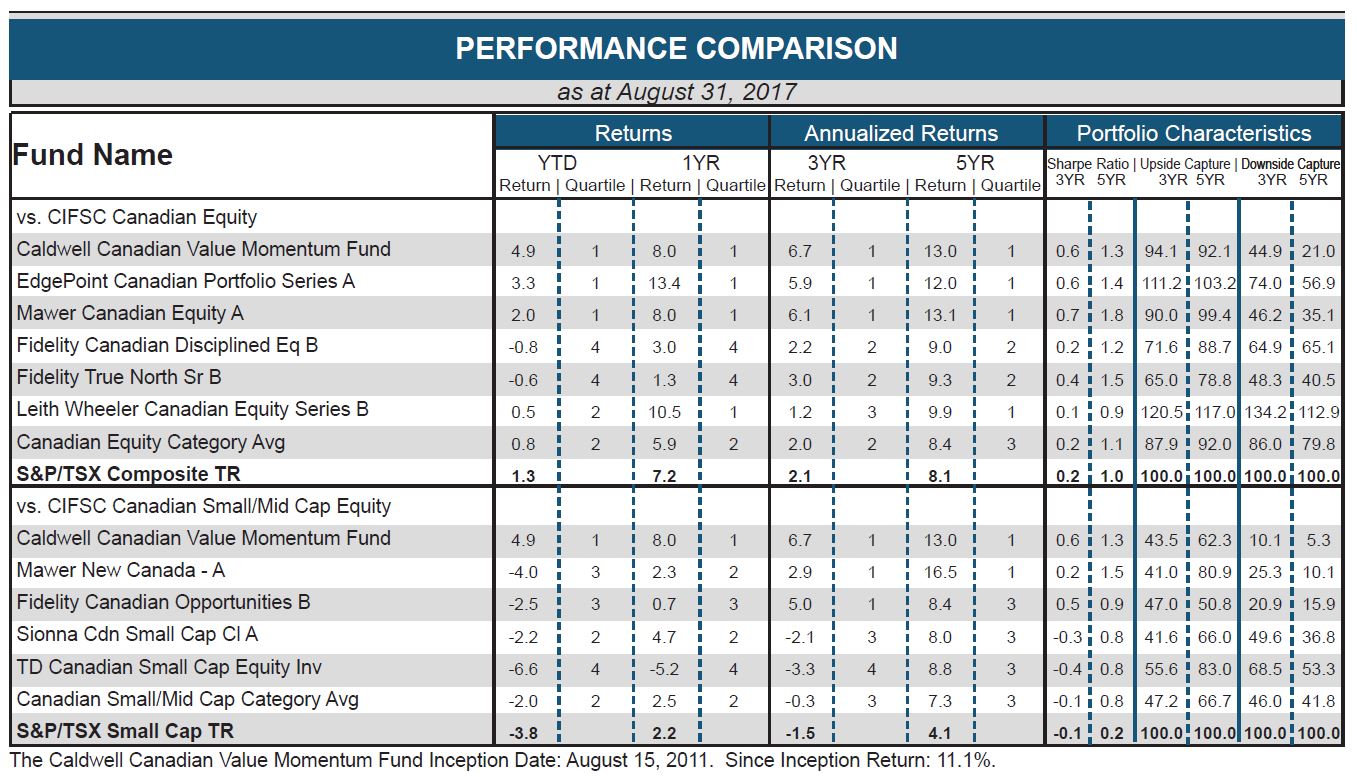

Happy 6th Birthday! The CCVMF celebrated its 6th birthday in August. Since inception, the CCVMF is +11.1% versus the TSX +6.2%, and continues to be one of the top performing Canadian Equity funds in the country. We include a table, below, that shows the performance of CCVMF relative to competing funds in both the Canadian Equity category and the Canadian Small/Mid Cap category. While top-quartile returns are attractive, the CCVMF also performs well on risk metrics, including the up/down capture. In addition, correlation analysis shows the CCVMF as an attractive compliment to other investment strategies available to Canadians. This is important because lower correlations between investment strategies reduce overall portfolio volatility and result in more attractive risk-adjusted returns.

Top CCVMF performers in August were Premium Brand Holdings. (+9.5%) and Martinrea. (+8.2%). Premium Brands had a very strong quarter driven by organic growth and better than expected margins. The outlook continues to be positive given strong demand and the new sandwich facility tracking ahead of schedule. The strong result prompted analysts to increase the Consensus 2018 EPS estimate by 8%. Martinrea also reported a very strong result with continued progress on margins and new contract awards. The company's progress is leading to increased investor confidence in the company's margin targets, which should help move the valuation higher.

No stocks were added to the portfolio in August.

The Fund held a 14% cash weighting at month end. We look forward to tracking the progress of the portfolio’s holdings as we see a meaningful and diverse set of catalysts to drive continued growth.

We thank you for your continued support.

The CCVMF Team

The information contained in this document is designed to provide general information related to investment alternatives and strategies and is not intended to be investment or any other advice applicable to the circumstances of individual investors. We strongly recommend you to consult with a financial advisor prior to making any investment decisions. Unless otherwise specified, information in this document is provided as of the date of first publication and will not be updated. All information herein is qualified in its entirety by the disclosure found in the CCVMF’s most recently filed simplified prospectus. Information contained in this document has been obtained from sources we believe to be reliable, but we do not guarantee its accuracy. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing in this product. Unless otherwise indicated, rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed; their values change frequently and past performance may not be repeated. The CCVMF is a publicly offered mutual fund that offers its securities pursuant to simplified prospectus dated July 20, 2017. The CCVMF was not a reporting issuer prior to that date and formerly offered its securities privately as follows: Series F and Series I since March 28, 2014 and Series O since August 8, 2011. The expenses of the CCVMF would have been higher during the period prior to becoming a reporting issuer had the fund been subject to the additional regulatory requirements applicable to a reporting issuer. Principal Distributor: Caldwell Securities Ltd.

12303168464egw4gwe4g

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/