August 2020 Recap:

The Fund declined 0.7% in August versus a gain of 2.4% for the S&P/TSX Composite Total Return Index (“Index”)1. Index performance was predominantly driven by strength in Financials (+6.7%) given its heavy weight within the Index. Of the remaining 10 GICS sectors, only Industrials (+4.2%) beat the Index return in August, while 5 out of 11 sectors actually saw negative returns: Health Care (-7.5%), Consumer Staples (-4.7%), REITS (-2.2%), Utilities (-2.1%) and Materials (-0.8%).

Top CVM performers in August were BRP Corp. (“DOO” +18.1%) and Cargojet (“CJT” +7.3%)2.

DOO reported very strong Q2 results with EBITDA more than doubling analyst estimates and retail sales increasing 38% year over year. Interestingly, the company noted that 77% of powersports customers were new to DOO this quarter, with 41% being new to powersports in general. This accelerated demand is likely due to consumers choosing to purchase powersports products as an alternative to travel vacations amid travel restrictions.

CJT also reported a very strong quarter with EBITDA growing 142% over last year and nearly doubling analyst estimates. The company has benefited from accelerating e-commerce penetration and demand for charter capacity. The main weakness in the portfolio came from the software names, which sold off after very strong quarterly results.

Two stocks were added to the portfolio in August: Richelieu Hardware (“RCH”) and Maxar Technologies (“MAXR”).

RCH is an importer, distributor and manufacturer of specialty hardware and related products (130,000+ SKUs) with a strong history of value creation from innovation and acquisitions. The company operates in a fragmented industry, supporting years of attractive growth runway, and is currently seeing strong demand from retailers and renovation superstores as consumers shift spending towards the home.

MAXR provides earth intelligence (satellite imagery) and space infrastructure solutions to government and commercial (mainly communication) clients. MAXR is a turnaround story with a new CEO having taken over in January 2019. Recent results have significantly exceeded expectations, the balance sheet is improving, the space infrastructure business is coming off of a cyclical bottom, and margins and free cash flow are expected to inflect higher going forward. We believe this will prompt investors’ focus to shift to the company's leadership position in satellite imagery, which is economically resilient and comes with highly visible/recurring revenue.

The Fund held a 9.2% cash weighting at month-end. The CVM has generated substantial value to investors over its long-term history driven by the combination of strong company-specific catalysts and a concentrated portfolio. We continue to look forward to strong results as we progress through 2020 and beyond.

We thank you for your continued support.

The CVM Team

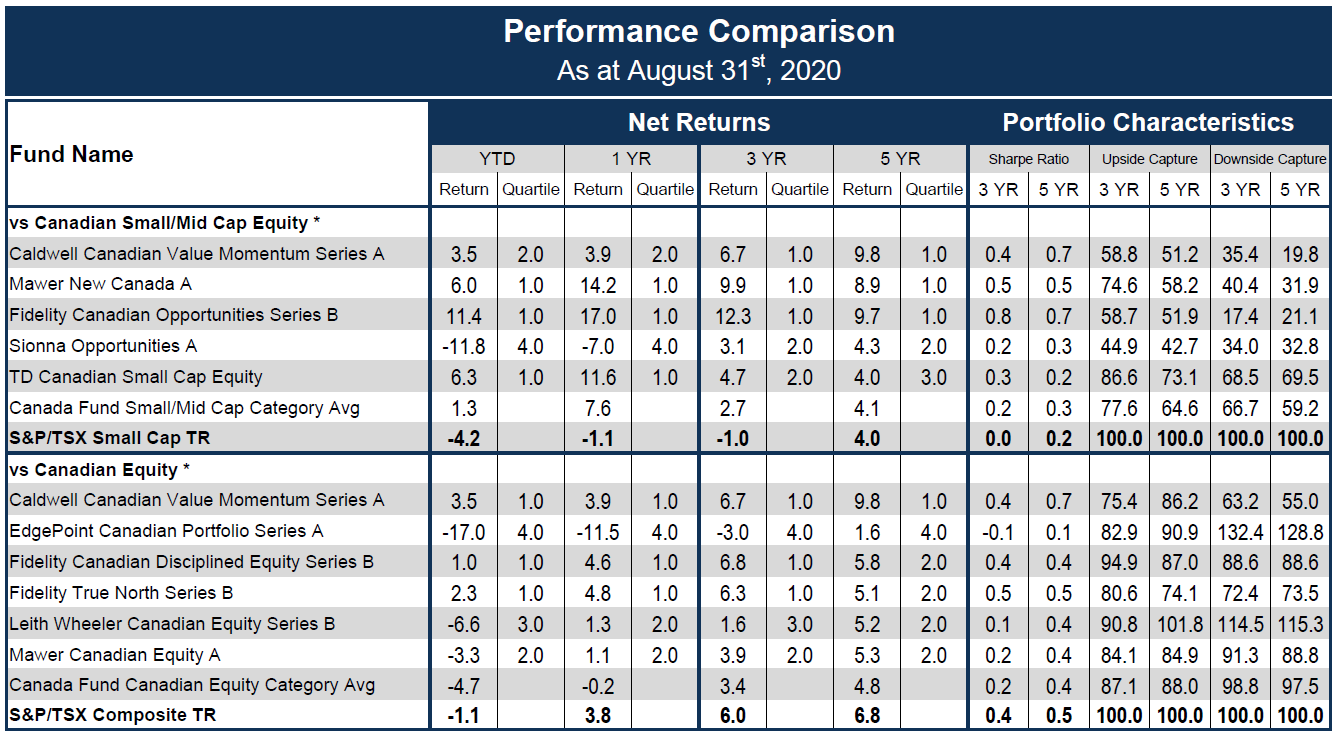

1See table for standard performance data.

2Actual Investments, first purchased: CJT 9/28/2016 , BRP 4/6/2017.

Return since August 15, 2011 (Performance Start Date): CVM 9.6%, Index 6.1%. | Returns are annualized for periods greater than one year. | Source: Morningstar

The CVM was not a reporting issuer offering its securities privately from August 8, 2011 until July 20, 2017, at which time it became a reporting issuer and subject to additional regulatory requirements and expenses associated therewith.

Unless otherwise specified, market and issuer data sourced from Capital IQ.

As the constituents in the Canadian Equity category largely focus on securities of a larger capitalization and CVM considers, and is invested, in all categories, including smaller and micro-cap securities, we have also shown how CVM ranks against constituents focused in the smaller cap category. The above list represents 6 of a total of 363 constituents in the Canadian Equity category and 5 of a total of 98 constituents in the Canadian Small/Mid Equity category.

The information contained herein provides general information about the Fund at a point in time. Investors are strongly encouraged to consult with a financial advisor and review the Simplified Prospectus and Fund Facts documents carefully prior to making investment decisions about the Fund. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Rates of returns, unless otherwise indicated, are the historical annual compounded returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed; their values change frequently and past performance may not be repeated.

The Lipper Fund Awards are based on the Lipper Leader for Consistent Return rating, which is a risk-adjusted performance measure calculated over 36, 60 and 120 months. Lipper Leaders fund ratings do not constitute and are not intended to constitute investment advice or an offer to sell or the solicitation of an offer to buy any security of any entity in any jurisdiction. For more information, see lipperfundawards.com. Lipper Leader ratings change monthly. Lipper Fund Awards from Refinitiv, ©2019 Refinitiv. All rights reserved. Used under license. The Caldwell Canadian Value Momentum Fund Series A in the Canadian Equity Category for the 5-year period (out of a total of 69 funds) ending July 31, 2019. Lipper Leader ratings: 5 (3 years) and 5 (5 years).

FundGrade A+® is used with permission from Fundata Canada Inc., all rights reserved. The annual FundGrade A+® Awards are presented by Fundata Canada Inc. to recognize the “best of the best” among Canadian investment funds. The FundGrade A+® calculation is supplemental to the monthly FundGrade ratings and is calculated at the end of each calendar year. The FundGrade rating system evaluates funds based on their risk-adjusted performance, measured by Sharpe Ratio, Sortino Ratio, and Information Ratio. The score for each ratio is calculated individually, covering all time periods from 2 to 10 years. The scores are then weighted equally in calculating a monthly FundGrade. The top 10% of funds earn an A Grade; the next 20% of funds earn a B Grade; the next 40% of funds earn a C Grade; the next 20% of funds receive a D Grade; and the lowest 10% of funds receive an E Grade. To be eligible, a fund must have received a FundGrade rating every month in the previous year. The FundGrade A+® uses a GPA-style calculation, where each monthly FundGrade from “A” to “E” receives a score from 4 to 0, respectively. A fund’s average score for the year determines its GPA. Any fund with a GPA of 3.5 or greater is awarded a FundGrade A+® Award. For more information, see www.FundGradeAwards.com. Although Fundata makes every effort to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by Fundata.

*Categories defined by Canadian Investment Funds Standards Committee (“CIFSC”).

Publication date: September 11, 2020.