December Recap:

The Fund gained 0.6% in December versus a gain of 1.2% for the TSX Total Return Index. The Index finished 2017 with a strong commodity and 'risk on' rally with the Materials and Industrials sectors up 3.4% and 2.0%, respectively, in December, while traditionally defensive sectors were all in the negative: Telecom (-2.1%), Utilities (-1.2%), Gold (-0.4%) and Consumer Staples (-0.2%). Top CCVMF performers in December were Cargojet (CJT: +11%) and Imvescor Restaurant Group (IRG: +8.5%). We suspect that CJT moved higher on the back of strong online retail sales through the holiday season. The CCVMF sold its position in IRG following a take-out offer by MYT Group which implied a 2017 EBITDA multiple of 13.8x. The IRG trade was a successful one for the CCVMF with the stock +70% since the initial purchase on February 2, 2016 versus 38% for the TSX Total Return Index. Gains were a function of both multiple expansion and earnings growth - IRG was trading at 8.6x trailing EBITDA at the time of purchase and EBITDA grew over 20% through our holding period.

One stock was purchased in December: Rocky Mountain Dealerships (RME). The company owns and operates agricultural equipment dealerships with over 35 locations across Alberta, Saskatchewan, and Manitoba. After several years of weak equipment sales, the market cycle seems to have bottomed and the company is well positioned to benefit from a multi-year up-cycle. Cost and inventory reductions should lead to strong profitability as the company looks to enter a fragmented U.S. market. The CCVMF ended the year with a 38% cash position. As noted last month, we expect the cash balance to move lower as we progress through our due-diligence process on new opportunities.

Full Year 2017 Recap:

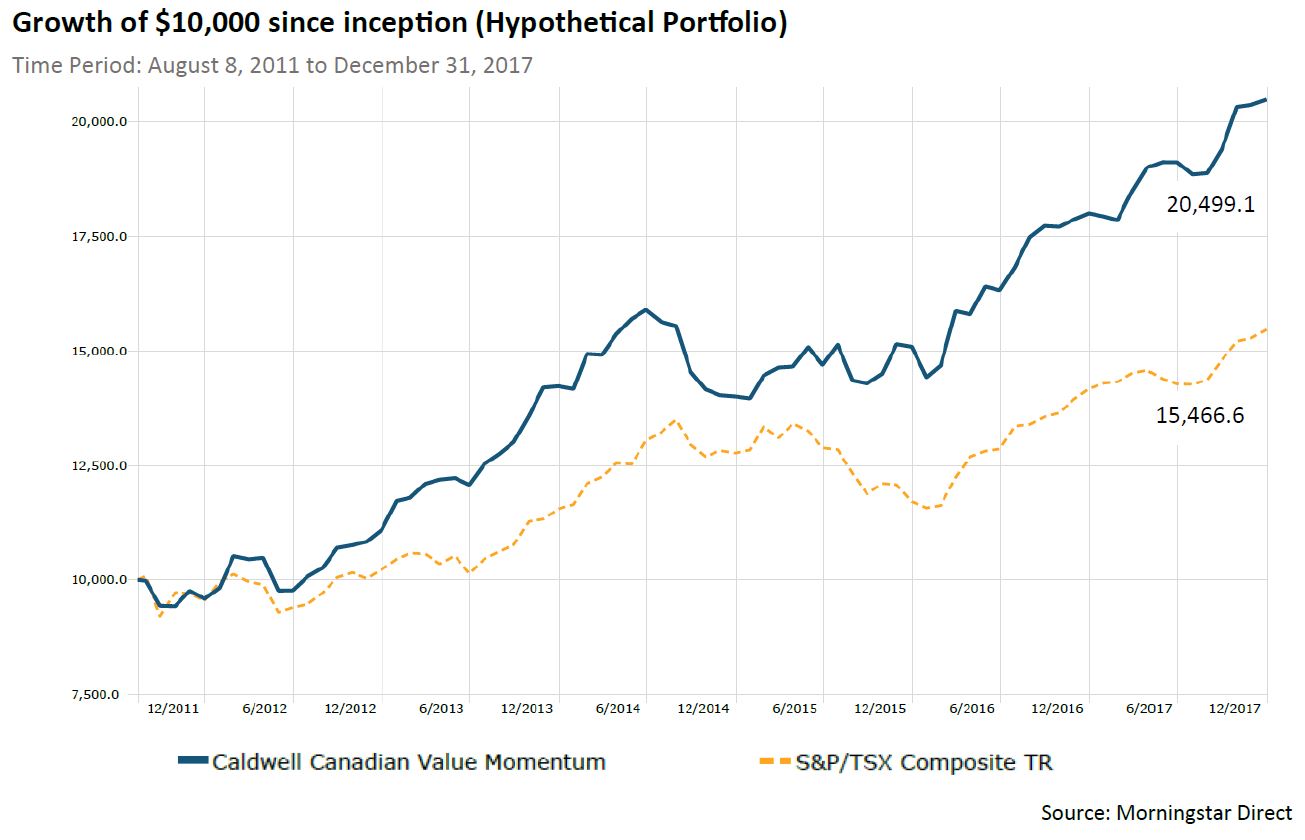

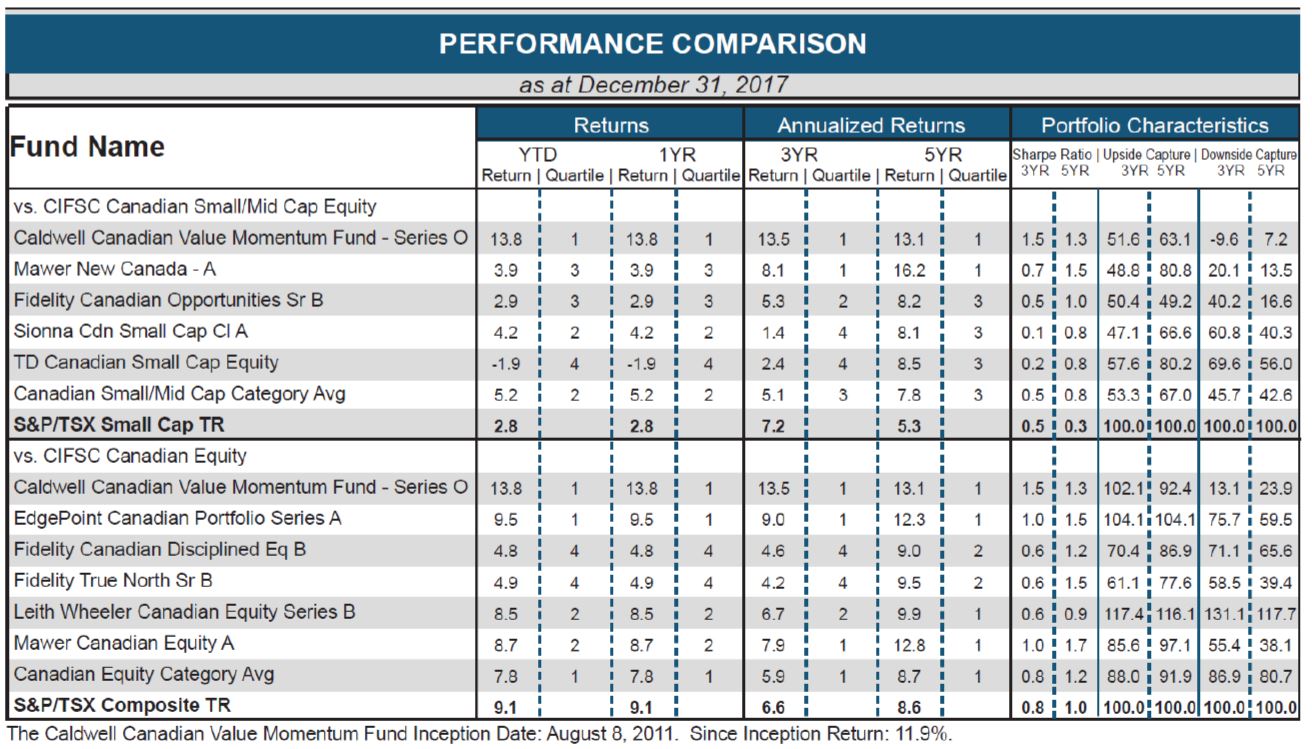

2017 was another successful year for the CCVMF as it once again significantly out-paced its benchmark. The Fund gained 13.8% in 2017 versus a gain of 9.1% for the TSX Total Return Index for out-performance of 4.7%. *Please see below for standard performance data. Gains in the Index were broad-based with only the Energy sector (-10%) showing a decline. Looking into the CCVMF's performance, success in 2017 was driven by both sector allocation (i.e. being in the right sectors) and security selection (i.e. being in the right stocks), with the former accounting for 2/3 of the out-performance versus the Index.

Top contributors from a sector standpoint included:

- Security selection in Consumer Discretionary stocks, driven by Martinrea, Cogeco and BRP Inc;

- The CCVMF being over-weight the Industrials sector, which out-performed the broader market;

- The CCVMF being under-weight the poorly performing Energy sector.

Top detractors included:

- Security selection in Technology stocks, driven by Celestica and Wi-Lan;

- The CCVMF being under-weight the Financials sector, where the fund missed out on the strong performance of the banks;

- Security selection in the Energy sector - although the CCVMF was under-weight energy stocks, the stocks it did own - Enerflex, North American Energy Partners and High Arctic Energy - under-performed.

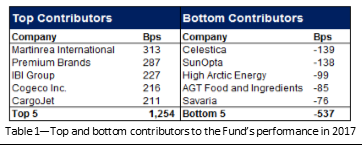

As Table 1 shows, the top individual stock contributors out-paced the bottom contributors by a factor of 2.3x. The CCVMF also added to its winning streak of out-performing in months when the TSX Total Return Index was negative. Specifically, the Index posted negative returns in May, June and July and lost 2.1% over this three month period. Meanwhile, the CCVMF out-performed the Index in both May and June - including posting a positive return in May - and only declined 0.8% over the three month period. Since inception, the CCVMF has out-performed the Index in a down-month 20/27 times (74% success ratio) and posted a positive return 11/27 times (40% success ratio).

The strong result in 2017 puts the CCVMF in the top 4% of our Morningstar Canadian Equity peer group. The CCVMF's success is a function of a concentrated portfolio of 15-25 stocks where each position has a strong set of catalysts to increase its value. We continue to look forward to strong results as we progress through 2018 and beyond.

We thank you for your continued support.

The CCVMF Team

The information contained in this document is designed to provide general information related to investment alternatives and strategies and is not intended to be investment or any other advice applicable to the circumstances of individual investors. We strongly recommend you to consult with a financial advisor prior to making any investment decisions. Unless otherwise specified, information in this document is provided as of the date of first publication and will not be updated. All information herein is qualified in its entirety by the disclosure found in the CCVMF’s most recently filed simplified prospectus. Information contained in this document has been obtained from sources we believe to be reliable, but we do not guarantee its accuracy. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing in this product. Unless otherwise indicated, rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed; their values change frequently and past performance may not be repeated. The CCVMF is a publicly offered mutual fund that offers its securities pursuant to simplified prospectus dated July 20, 2017. The CCVMF was not a reporting issuer prior to that date and formerly offered its securities privately as follows: Series F and Series I since March 28, 2014 and Series O since August 8, 2011. The expenses of the CCVMF would have been higher during the period prior to becoming a reporting issuer had the fund been subject to the additional regulatory requirements applicable to a reporting issuer. Inception Date: August 8, 2011. Principal Distributor: Caldwell Securities Ltd.

12303168464egw4gwe4g

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/