January 2021 Recap:

The Caldwell Canadian Value Momentum Fund (“CVM”) declined 0.9% in January versus a loss of 0.3% for the S&P/TSX Composite Total Return Index (“Index”)1. Consumer Staples (-5.3%) was the worst performing sector within the Index while Health Care (+35.3%) saw sharp gains on strong interest from retail investors in cannabis names following U.S. Democratic election wins. Energy (+2.7%) out-performed the Index for the second time in three months following an extended period of under-performance (prior to the noted period, Energy under-performed the Index in 9/10 months).

Top CVM performers in January were TFI International (TSX: TFII +29.6%) and Champion Iron Ore (TSX: CIA +8.5%)2.

We often speak to the catalyst-rich nature of the CVM and January provided a great example with TFII shares moving meaningfully higher on news it is buying UPS' Less Than Truckload (“LTL”) and Truckload (“TL”) businesses. Two catalyst drivers we speak to are acquisitions and strong end market demand; while a boom in e-commerce has driven strength in the latter, TFII also has a great history of adding value through acquisitions. This particular deal is highly accretive as it materially increases TFII's revenue and provides attractive margin improvement opportunities.

CIA's share price momentum continued into January and was validated by another strong quarter where results continued to beat consensus estimates.

Three stocks were added to the portfolio in January: Secure Energy Services (TSX: SES), Paramount Resources (TSX: POU), and Magna (TSX: MG).

SES, the leader in oil field waste management in the Montney, is seeing improving investor sentiment on stronger gas pricing and improving free cash flow yields. It stands to benefit as production and field activity normalize following the conclusion of government-mandated curtailments and a stronger pricing environment.

POU is also benefiting from a recovery in energy markets and is well positioned after selling non-core assets and improving its balance sheet.

MG is seeing improving demand for auto components as global vehicle sales recover. The company should be in a good position to leverage this recovery after a cost rationalization program. It also recently signed a joint venture with LG Electronics to strengthen its position in the power train electrification market, which could drive additional multiple expansion.

The Fund held a 24.0% cash weighting at month-end. The CVM has generated substantial value to investors over its long-term history driven by the combination of strong company-specific catalysts and a concentrated portfolio. We continue to look forward to strong results as we progress through 2021 and beyond.

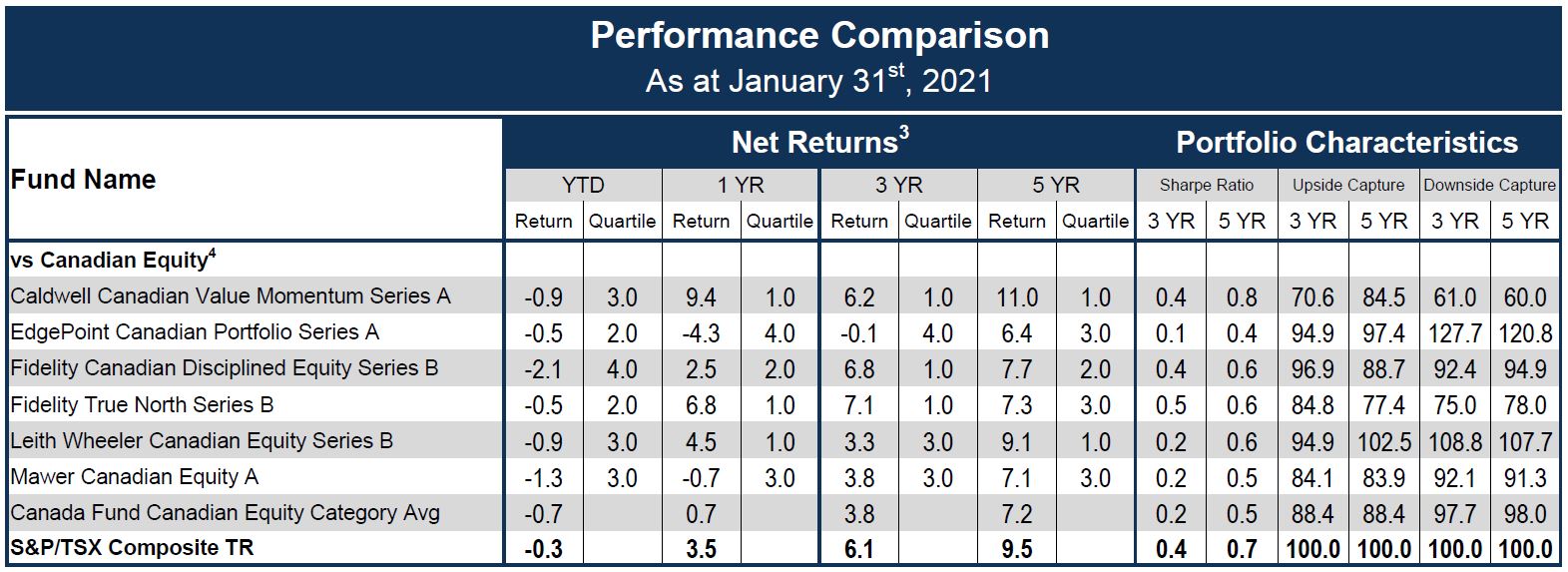

1See Performance Comparison table (page 2 of the PDF) for standard performance data.

2Actual Investments, first purchased: CIA 6/28/2019, TFII 1/27/2017.

3Return since August 15, 2011 (Perf. Start Date): CVM 9.9%, Index 6.6%. | Returns are annualized for periods greater than one year. | Source: Morningstar

4Categories defined by Canadian Investment Funds Standards Committee (“CIFSC”).

The CVM was not a reporting issuer offering its securities privately from August 8, 2011 until July 20, 2017, at which time it became a reporting issuer and subject to additional regulatory requirements and expenses associated therewith.

Unless otherwise specified, market and issuer data sourced from Capital IQ.

As the constituents in the Canadian Equity category largely focus on securities of a larger capitalization and CVM considers, and is invested, in all categories, including smaller and micro-cap securities, we have also shown how CVM ranks against constituents focused in the smaller cap category. The above list represents 6 of a total of 375 constituents in the Canadian Equity category.

The information contained herein provides general information about the Fund at a point in time. Investors are strongly encouraged to consult with a financial advisor and review the Simplified Prospectus and Fund Facts documents carefully prior to making investment decisions about the Fund. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Rates of returns, unless otherwise indicated, are the historical annual compounded returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed; their values change frequently and past performance may not be repeated.

The Refinitiv Lipper Fund Awards are based on the Lipper Leader for Consistent Return rating, which is a risk-adjusted performance measure calculated over 36, 60 and 120 months. Lipper Leaders fund ratings do not constitute and are not intended to constitute investment advice or an offer to sell or the solicitation of an offer to buy any security of any entity in any jurisdiction. For more information, see lipperfundawards.com. The CVM in the Canadian Equity Category for the 5-year period (out of a total of 74 funds) ending 7/31/2020 with corresponding Lipper Leader ratings of 4 (3 years) and 5 (5 years).

FundGrade A+® is used with permission from Fundata Canada Inc., all rights reserved. The annual FundGrade A+® Awards are presented by Fundata Canada Inc. to recognize the “best of the best” among Canadian investment funds. The FundGrade A+® calculation is supplemental to the monthly FundGrade ratings and is calculated at the end of each calendar year. The FundGrade rating system evaluates funds based on their risk-adjusted performance, measured by Sharpe Ratio, Sortino Ratio, and Information Ratio. The score for each ratio is calculated individually, covering all time periods from 2 to 10 years. The scores are then weighted equally in calculating a monthly FundGrade. The top 10% of funds earn an A Grade; the next 20% of funds earn a B Grade; the next 40% of funds earn a C Grade; the next 20% of funds receive a D Grade; and the lowest 10% of funds receive an E Grade. To be eligible, a fund must have received a FundGrade rating every month in the previous year. The FundGrade A+® uses a GPA-style calculation, where each monthly FundGrade from “A” to “E” receives a score from 4 to 0, respectively. A fund’s average score for the year determines its GPA. Any fund with a GPA of 3.5 or greater is awarded a FundGrade A+® Award. For more information, see www.FundGradeAwards.com. Although Fundata makes every effort to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by Fundata

Publication date: February 10, 2021.