July Recap:

The Caldwell Canadian Value Momentum Fund (“CCVMF”) gained 3.2% in July versus a gain of 0.3% for the S&P/TSX Composite Total Return Index ("Index”). The CCVMF saw broad-based strength with 75% of its holdings out-pacing the Index return and half of its holdings gaining over 5%. As for the Index, Health Care (-13.3%), driven by weakness in cannabis stocks, was the worst performer, while Energy (-4.0%) continued to lag.

Top CCVMF performers in July were North American Construction Group (“NOA”: +17.3%) and Air Canada (“AC”: +14.4%). We have written in the past about earnings announcements being helpful catalysts to re-focus investors on company-specific fundamentals (versus macro noise) and that is exactly what happened with these two names.

NOA continued to post strong results on solid activity in core oil sands, ramping of third party repair and maintenance work and strong performance from recent acquisitions. The company provided an upbeat outlook which included incremental contract wins and guidance that exceeded analyst expectations.

Air Canada had a strong operational quarter that exceeded analyst expectations despite negative impacts from the grounding of Boeing's 737 MAX aircraft. The company is executing well on several initiatives designed to further increase shareholder value.

No stocks were added to the portfolio in July.

The Fund held a 15.0% cash weighting at month end. The CCVMF has generated substantial value to investors over its long-term history driven by the combination of strong company-specific catalysts and a concentrated portfolio. We continue to look forward to strong results as we progress through 2019 and beyond.

We thank you for your continued support.

The CCVMF Team

The Fund was not a reporting issuer offering its securities privately from August 8, 2011 until July 20, 2017, at which time it became a reporting issuer and subject to additional regulatory requirements and expenses associated therewith.

Unless otherwise specified, market and issuer data sourced from Capital IQ.

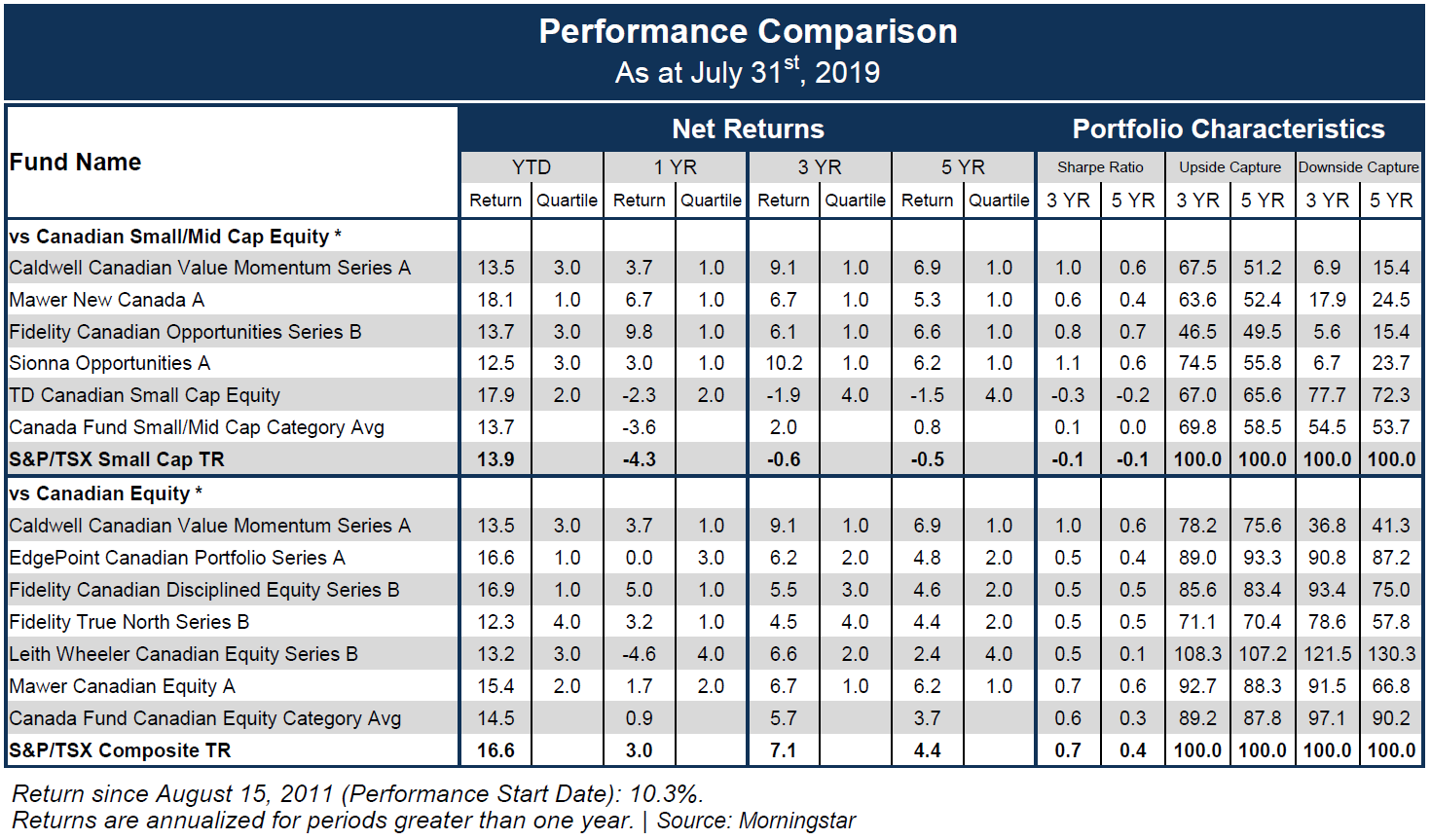

As the constituents in the Canadian Equity category largely focus on securities of a larger capitalization and CCVMF considers, and is invested, in all categories, including smaller and micro-cap securities, we have also shown how CCVMF ranks against constituents focused in the smaller cap category. The above list represents 6 of a total of 371 constituents in the Canadian Equity category and 5 of a total of 110 constituents in the Canadian Small/Mid Equity category.

The information contained herein provides general information about the Fund at a point in time. Investors are strongly encouraged to consult with a financial advisor and review the Simplified Prospectus and Fund Facts documents carefully prior to making investment decisions about the Fund. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Rates of returns, unless otherwise indicated, are the historical annual compounded returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed; their values change frequently and past performance may not be repeated. Publication date: August 15, 2019.

FundGrade A+® is used with permission from Fundata Canada Inc., all rights reserved. The annual FundGrade A+® Awards are presented by Fundata Canada Inc. to recognize the “best of the best” among Canadian investment funds. The FundGrade A+® calculation is supplemental to the monthly FundGrade ratings and is calculated at the end of each calendar year. The FundGrade rating system evaluates funds based on their risk-adjusted performance, measured by Sharpe Ratio, Sortino Ratio, and Information Ratio. The score for each ratio is calculated individually, covering all time periods from 2 to 10 years. The scores are then weighted equally in calculating a monthly FundGrade. The top 10% of funds earn an A Grade; the next 20% of funds earn a B Grade; the next 40% of funds earn a C Grade; the next 20% of funds receive a D Grade; and the lowest 10% of funds receive an E Grade. To be eligible, a fund must have received a FundGrade rating every month in the previous year. The FundGrade A+® uses a GPA-style calculation, where each monthly FundGrade from “A” to “E” receives a score from 4 to 0, respectively. A fund’s average score for the year determines its GPA. Any fund with a GPA of 3.5 or greater is awarded a FundGrade A+® Award. For more information, see www.FundGradeAwards.com. Although Fundata makes every effort to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by Fundata.

* Categories defined by Canadian Investment Funds Standards Committee ("CIFSC")

12303168464egw4gwe4g