May Recap:

The Caldwell Canadian Value Momentum Fund (“CVM”) declined 0.6% in May versus a gain of 0.1% for the S&P/TSX Composite Total Return Index (“Index”). Energy was a notable outperformer while Financials and Utilities were the only two other sectors to record positive performance. Healthcare lagged materially driven by the ongoing sell off of cannabis stocks. Gold and Materials rounded out the bottom three performing sectors. For the year-to-date period ending May 31st, CVM posted a positive return of 0.8%, outpacing the Index by more than 2%.

Top performers in CVM's portfolio for the month of May were Cenovus ("CVE", +23.5%), Tourmaline Oil ("TOU", +20.3%) and NuVista Energy ("NVA", +18.2% ), all of which continued to benefit from leverage to higher energy prices. Shares of CVE moved higher following solid earnings results announced near the end of April where the dividend was increased threefold and an updated capital allocation framework projected greater returns to shareholders over time as the company reduces leverage. TOU moved higher on better than expected earnings results, a base dividend increase and a special dividend declaration with more expected to follow throughout 2022. While NVA announced relatively in-line results, the company's updated capital allocation framework provides for continued debt reduction and re-instating share repurchases.

During the month of May, the Fund initiated a position in Parkland Fuel ("PKI"), Element Fleet Management ("EFN"), CGI Inc. ("GIB") and Capital Power Corp ("CPX"). PKI is a leading marketer of refined fuel and convenience products across North America (“NA”), and should benefit from rebounding retail fuel demand. A highly fragmented industry and strong acquisition integration capabilities bode well for expanding the store footprint fivefold, and increasing earnings before interest, taxes, depreciation and amortization ("EBITDA") 40% by 2025. Its growing renewable fuel production business provides attractive exposure to a fast growing market and is expected to account for 10% of earnings by 2030. EFN is the largest pure-play automotive fleet management company in the world, managing more than 3 million vehicles in 5 countries. While demand has remained strong through the pandemic, difficulty obtaining supply has weighed on origination revenues. Strong earnings and increased 2022 guidance suggests this overhang may be fading at the same time servicing revenue is benefiting from new customer wins and wallet share gains. GIB is a leading information technology (“IT”) and business consulting firm. The company is experiencing accelerated demand for its services given the need for digital transformations across nearly every industry. It intends to increase the pace of acquisitions in the near to medium term, particularly in its IP solutions segment, which should support growth while improving overall profitability. CPX is an independent power producer with around 6,600 megawatts of generation capacity at 27 facilities across NA. A strong pricing environment is likely sustainable given favourable supply/demand dynamics for power pricing, particularly in a key market like Alberta. Specifically: oil and gas demand is returning; aging thermal power generation assets in the industry are being retired with no significant replacements until 2024-25 and; marginal costs to produce are higher than pre-pandemic. CPX is in an envious position, having sold forward roughly 60% of 2023 baseload generation while locking in 90%+ of its natural gas feedstock requirements at well below market rates.

The Fund held a 27% cash weighting at month‐end. CVM has generated substantial value to investors over its long‐term history driven by the combination of strong company‐specific catalysts and a concentrated portfolio. We continue to look forward to strong results as we progress through 2022 and beyond.

2Actual Investments, first purchased: NVA 12/03/2021, TOU 12/03/2021, CVE 01/06/2022.

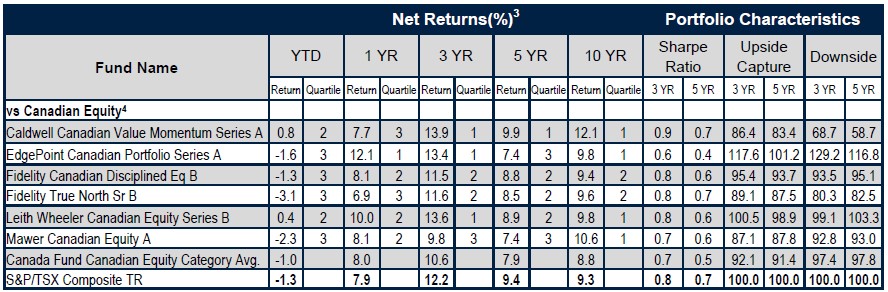

3Return since August 15, 2011 (Perf. Start Date): CVM (Series A) 10.96%, Index 7.84%. | Returns are annualized for periods greater than one year.

4Categories defined by Canadian Investment Funds Standards Committee (“CIFSC”).

The CVM was not a reporting issuer offering its securities privately from August 8, 2011 until July 20, 2017, at which time it became a reporting issuer and subject to additional regulatory requirements and expenses associated therewith.

Unless otherwise specified, market and issuer data sourced from Capital IQ & Morningstar Direct.

As the constituents in the CIFSC Canadian Equity category largely focus on securities of a larger capitalization and CVM considers, and is invested, in all categories, including smaller and micro-cap securities, we have also shown how CVM ranks against constituents focused in the smaller cap category. The above list represents 6 of a total of 398 constituents in the CIFSC Canadian Equity category.

The information contained herein provides general information about the Fund at a point in time. Investors are strongly encouraged to consult with a financial advisor and review the Simplified Prospectus and Fund Facts documents carefully prior to making investment decisions about the Fund. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Rates of returns, unless otherwise indicated, are the historical annual compounded returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed; their values change frequently and past performance may not be repeated.

FundGrade A+® is used with permission from Fundata Canada Inc., all rights reserved. The annual FundGrade A+® Awards are presented by Fundata Canada Inc. to recognize the “best of the best” among Canadian investment funds. The FundGrade A+® calculation is supplemental to the monthly FundGrade ratings and is calculated at the end of each calendar year. The FundGrade rating system evaluates funds based on their risk-adjusted performance, measured by Sharpe Ratio, Sortino Ratio, and Information Ratio. The score for each ratio is calculated individually, covering all time periods from 2 to 10 years. The scores are then weighted equally in calculating a monthly FundGrade. The top 10% of funds earn an A Grade; the next 20% of funds earn a B Grade; the next 40% of funds earn a C Grade; the next 20% of funds receive a D Grade; and the lowest 10% of funds receive an E Grade. To be eligible, a fund must have received a FundGrade rating every month in the previous year. The FundGrade A+® uses a GPA-style calculation, where each monthly FundGrade from “A” to “E” receives a score from 4 to 0, respectively. A fund’s average score for the year determines its GPA. Any fund with a GPA of 3.5 or greater is awarded a FundGrade A+® Award. For more information, see www.FundGradeAwards.com. Although Fundata makes every effort to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by Fundata.

Publication date: June 9, 2022.

-

Caldwell Investment Management Ltd.https://caldwellinvestment.com/author/caldwell-investment-management-ltd/

-

Caldwell Investment Management Ltd.https://caldwellinvestment.com/author/caldwell-investment-management-ltd/

-

Caldwell Investment Management Ltd.https://caldwellinvestment.com/author/caldwell-investment-management-ltd/

-

Caldwell Investment Management Ltd.https://caldwellinvestment.com/author/caldwell-investment-management-ltd/