November Recap

The Fund declined 1.7% in November versus a gain of 1.4% for the S&P/TSX Composite Total Return Index ("Index”). The Index was driven by strength in defensive sectors, with Consumer Staples (+7.6%), Telecom (+7%) and Gold Sub-Industry (+5%) leading the way. Weakness in Energy continued (-3.0% in November; -15.4% year-to-date) while Health Care (-5.8%) was dragged down by a reduced appetite for cannabis stocks.

Canopy Growth ("WEED": -6.8%), Aurora Cannabis ("ACB": -15.0%) and Aphria ("APHA": -33.1%) now account for 3 of the 5 largest companies in Canada's Health Care sector. Collectively, these 3 companies generated negative $417 million in cash from operations and spent another $916 million in capital expenditures for a cash burn of $1.3 billion over the last 12 months. At the time of writing, the market cap of these companies was $23.3 billion, down from approximately $43 billion at their peak in mid-October. This is a great example of how the CCVMF is different from pure momentum strategies; because the CCVMF combines value and momentum, these companies did not screen as buy candidates despite strong momentum going into their peaks. This strategy protected our investors from substantial losses.

The Top Performer in November was CGI Group ("GIB.A": +4.6%). The company reported another strong earnings result, creating a positive set-up for 2019 as client spend on IT continues.

No stocks were added to the portfolio in November.

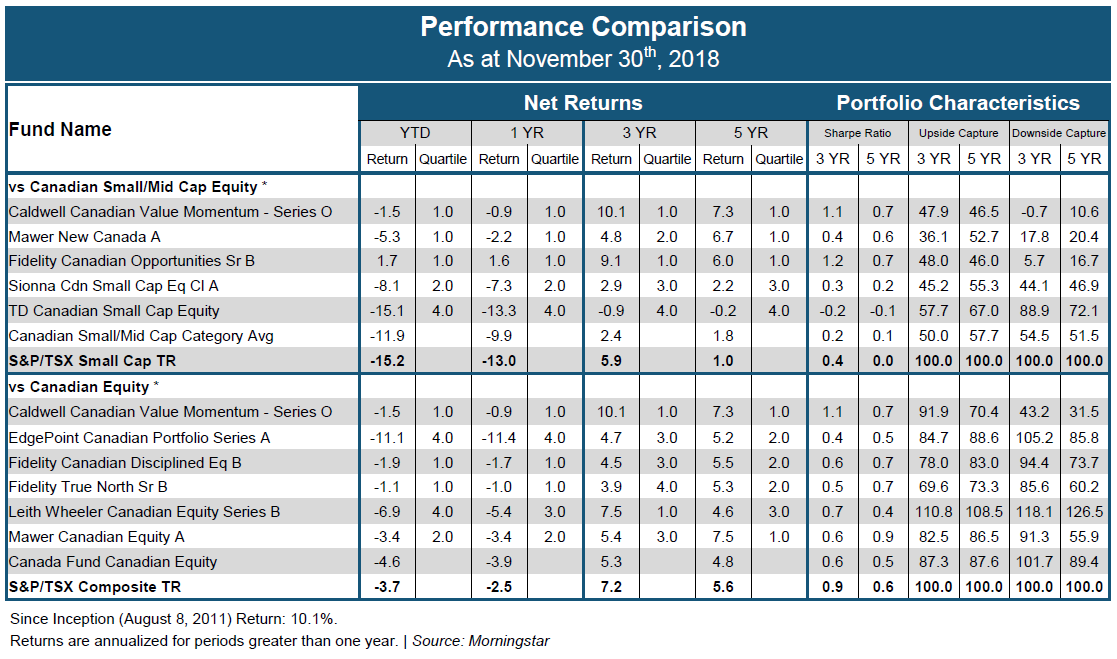

The Fund held a 41.1% cash weighting at month end and is over 50% cash at the time of this writing. There has been strong 'risk off' sentiment to the market these last two months with investors focusing more on macro issues (trade/global growth and interest rates) over company-specific drivers. During more challenging markets, it is important to remember the fundamental reasons for owning an investment. Specific to the CCVMF, the fund has generated substantial value to investors over its long-term history. The Fund's performance ranks in the top 1% of all Canadian equity funds over the past three years, and top decile over all annualized periods up to and including the past five years.

We thank you for your continued support.

The CCVMF Team

The Fund was not a reporting issuer offering its securities privately from August 8, 2011 until July 20, 2017, at which time it became a reporting issuer and subject to additional regulatory requirements and expenses associated therewith.

Unless otherwise specified, market and issuer data sourced from Capital IQ.

As the constituents in the Canadian Equity category largely focus on securities of a larger capitalization and CCVMF considers, and is invested, in all categories, including smaller and micro-cap securities, we have also shown how CCVMF ranks against constituents focused in the smaller cap category. The above list represents 5 of a total of 374 constituents in the Canadian Equity category and 6 of a total of 114 constituents in the Canadian Small/Mid Equity category.

The information contained herein provides general information about the Fund at a point in time. Investors are strongly encouraged to consult with a financial advisor and review the Simplified Prospectus and Fund Facts documents carefully prior to making investment decisions about the Fund. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Rates of returns, unless otherwise indicated, are the historical annual compounded returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed; their values change frequently and past performance may not be repeated. Principal distributor: Caldwell Securities Ltd. Publication date: December 17, 2018.

FundGrade ratings are to be used for information purposes only and are not intended to provide financial, tax, accounting, legal or investment advice. You should not rely FundGrade ratings in any way. If you need information about a specific financial, tax, accounting, legal or investment issue, you should consult an appropriately-qualified professional adviser. Fundata does not make any recommendations regarding the advisability of investing in any particular security or securities generally. You agree that these ratings or any other information made available through Fundata are not a substitute for the exercise of independent judgment and expertise.

* Categories defined by Canadian Investment Funds Standards Committee ("CIFSC")

12303168464egw4gwe4g

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/