September Recap:

The Fund gained 1.5% in September versus a loss of 0.9% for the S&P/TSX Composite Total Return Index ("Index”). The Index was driven by Consumer Discretionary (-4.6%, driven by Dollarama (“DOL”: -17.5%)) and Energy (-3.6%). Health Care (+12.1%) and Technology (+0.1%) were the only positive sectors.

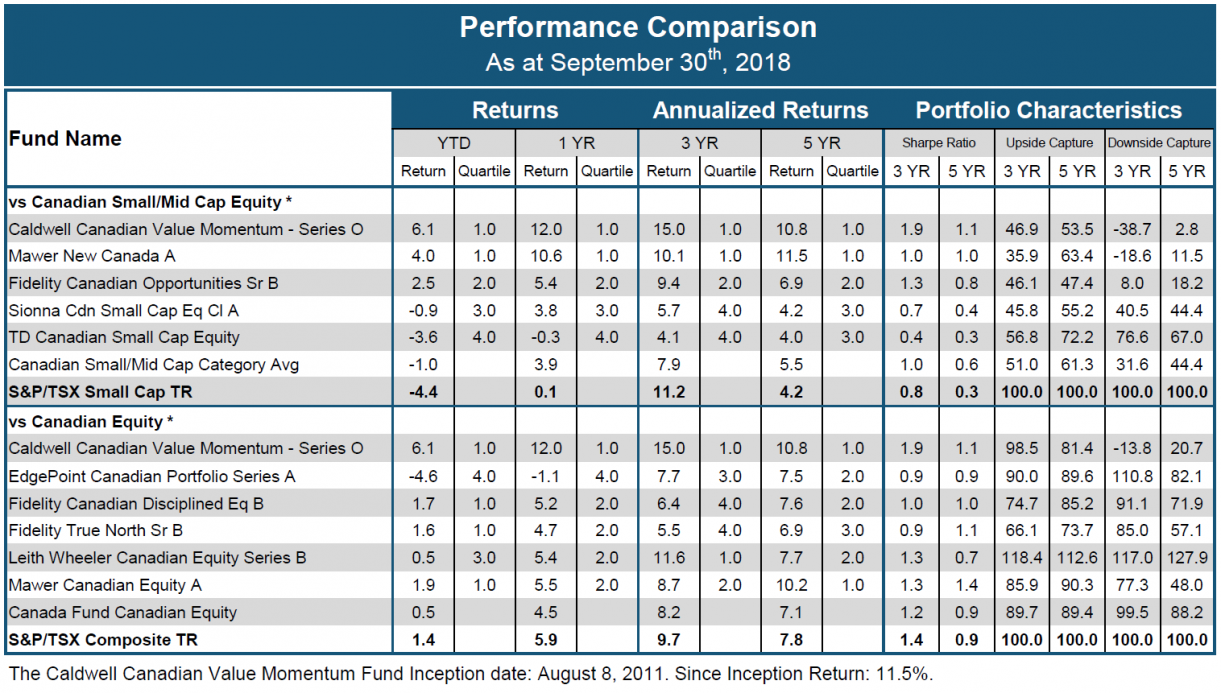

This is the 5th consecutive time the CCVMF outperformed the Index in a down market. Since inception (August 2011), the fund has outperformed the Index in 25 of 32 down months for a 78% success ratio. The CCVMF's down capture in September was actually negative (a good thing) given the Fund posted a positive return in a negative market. The fund held 10 stocks that posted a positive return in a down month. Over the last 3 years, the CCVMF has a negative down capture (-26.9%) alongside a strong up-capture (95.9%).

Top CCVMF performers in September were North American Energy (“NOA”: +26.5%) and Cargojet (“CJT”: +10.6%). Note that these stocks were also top performers in August on the back of strong earnings reports. NOA has also been busy on the M&A front, expanding its services in Northern Canada through a 49% stake in Nuna Logistics. Additionally, subsequent to month end, NOA announced the acquisition of Aecon's heavy construction fleet. This is a significant acquisition with NOA stating 2019 EPS could exceed $1.60 per share (versus Street estimates of $0.99 per share at the time). While the stock has performed very strongly year-to-date, there appears to be a significant amount of upside remaining.

One stock was added to the portfolio in September: Parkland Fuel (“PKI”). The company is an independent fuel marketer and distributor in Canada and the U.S. and is building a scale advantage through an acquisition strategy. PKI recently raised their annual synergy target on their CCL acquisition from $80M to $180M and the runway of growth opportunities remains robust, including U.S. expansion, convenience store sales and commercial fuel growth. Subsequent to month end, PKI made another transformative acquisition, expanding into the Caribbean market and establishing a new Gulf Coast focused supply platform. The deal is expected to be immediately accretive to distributable cash flow per share by 17%.

The Fund held a 29.5% cash weighting at month end. Cash balances have been slow to move lower; while we have added new stocks, others have fallen out of the portfolio. We will continue to be disciplined in what we own in the portfolio and expect cash balances to move lower over time. In the meantime, we look forward to tracking the progress of the portfolio’s current holdings as we see a meaningful and diverse set of catalysts to drive continued growth.

We thank you for your continued support.

The CCVMF Team

The information contained in this document is designed to provide general information related to investment alternatives and strategies and is not intended to be investment or any other advice applicable to the circumstances of individual investors. We strongly recommend you to consult with a financial advisor prior to making any investment decisions. Unless otherwise specified, information in this document is provided as of the date of first publication and will not be updated. All information herein is qualified in its entirety by the disclosure found in the CCVMF’s most recently filed simplified prospectus. Information contained in this document has been obtained from sources we believe to be reliable, but we do not guarantee its accuracy. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing in this product. Unless otherwise indicated, rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed; their values change frequently and past performance may not be repeated. The CCVMF is a publicly offered mutual fund that offers its securities pursuant to simplified prospectus dated July 20, 2017. The CCVMF was not a reporting issuer prior to that date and formerly offered its securities privately as follows: Series F and Series I since March 28, 2014 and Series O since August 8, 2011. The expenses of the CCVMF would have been higher during the period prior to becoming a reporting issuer had the fund been subject to the additional regulatory requirements applicable to a reporting issuer. Inception Date: August 8, 2011. Principal Distributor: Caldwell Securities Ltd.

FundGrade ratings are to be used for information purposes only and are not intended to provide financial, tax, accounting, legal or investment advice. You should not rely FundGrade ratings in any way. If you need information about a specific financial, tax, accounting, legal or investment issue, you should consult an appropriately-qualified professional adviser. Fundata does not make any recommendations regarding the advisability of investing in any particular security or securities generally. You agree that these ratings or any other information made available through Fundata are not a substitute for the exercise of independent judgment and expertise.

* Categories defined by Canadian Investment Funds Standards Committee ("CIFSC")