Market Commentary

Despite an acceleration of global COVID-19 cases, continued layoffs (an additional 38.5 million U.S. citizens filed for unemployment in the second quarter of 2020 (“Q2”)) and a dramatic increase in chapter 11 bankruptcy filings, the S&P 500 (“Index”) gained 20.0% in Q2, putting the Index within 10% of its all-time high. In an attempt to help offset the economic impact of COVID-19 shelter-in-place measures, governments around the world have enacted unprecedented levels of monetary and fiscal stimulus. These measures have provided liquidity to businesses, individuals, and to markets, which have greatly benefited from the stimulus.

Year-to-date, the S&P 500 is down 4.0% but a look at the performance of its underlying constituents paints a very different picture. Only 36% of stocks are out-pacing the Index return, putting the median return at -12.3%, a full 8.3 percentage points below the Index return. Breaking it down further, the winners are concentrated within the Health Care and Technology sectors with 7 of 11 sectors having less than 1/3 of their stocks out-performing the Index. Energy was the standout on the negative side with only 1 of 26 stocks beating the Index.

Performance Summary

The Caldwell U.S. Dividend Advantage Fund Series F ("Fund") gained 9.6% in Q2 compared with the 15.2% for the S&P 500 Index*. The currency tailwind the Fund experienced in Q1 reversed in Q2, with the USD depreciating by 4.0%. The remaining under performance was largely a result of allocations to the Industrial, Consumer Staples and Communication Services sectors and a drag from cash holdings. Performance was positively impacted by allocations to the Information Technology, Health Care and Financial sectors.

Contributors to Performance

Microsoft Corporation (“Microsoft”) was a leading contributor of performance, gaining 29.0%. The work from home shift drove strong demand for the company’s office productivity suite, cloud computing services and personal electronics, leading to a fiscal third quarter that surpassed consensus expectations. In April, management noted that COVID-19 had accelerated the shift to the cloud, with clients now contemplating when, as opposed to if, they would make the switch. The Teams platform was also a strong competitor to Zoom, recording 75 million daily active users in April, a 70% jump from March. In all, the quarter served as validation to our long-term thesis that Microsoft will leverage its stronghold in the enterprise IT market to drive Azure cloud adoption. We remain enthusiastic about Microsoft’s long term growth prospects and ability to increase profitability over time.

Quest Diagnostics (“Quest”) was a leading contributor of performance in the quarter, gaining 41.9%. Quest also beat consensus expectations with management highlighting that testing volumes were beginning to bottom and a ramp in COVID-19 antibody/serology testing capacity could potentially offset up to 50% of lost normal testing volumes. As the leading provider of diagnostic tests in the U.S., Quest should benefit from ongoing COVID-19 testing in the near term while continuing to capitalize on increasing healthcare access and consolidation within the independent lab industry over the long term.

S&P Global gained 34.5% as the company's rating business benefited from companies pre-emptively issuing record amounts of debt to secure access to liquidity. It's Market Intelligence business also performed well on subscription renewals and increased usage in the work from home environment. The Indices business also benefited from an increase in AUM for most of the first quarter. With a diversified, recurring revenue business model, sticky customers, a wave of debt maturities over the next 5 years and an increasing presence in China, the long-term thesis remains in tact and SPGI remains one of our core holdings.

Detractors from Performance

L3Harris Technologies (“L3”) was a detractor of performance in the quarter, with the stock declining 5.8%. The company reported a slight beat in the quarter but guided to a prolonged period of low demand for flight simulators. Additionally, there were signs of delays (though not cancellations) in orders from some Middle Eastern government customers. On a positive note, the defense business (70% of revenue is generated from the U.S. government) was virtually unaffected by COVID-19 and saw an acceleration in the contract award process. Management also noted merger synergy targets were tracking ahead of schedule and could be exceeded through additional cost savings. We used the weakness to add to the Fund's position in L3 as we see material upside, especially once we get beyond the U.S. election, driven by solid long-term fundamentals and a self-help story.

Huntington Ingalls Industries (“Huntington”) was a detractor of performance with the stock declining 4.2%. Huntington was not immune from COVID-19 related disruptions, reporting that only 70-75% of shipyard employees were showing up for work which would impact delivery schedules and milestone payments. That, in combination with higher debt levels, led to a reduction in calendar year 2020 revenue guidance and EPS. The fund exited its position in Huntington during the quarter.

Portfolio Activity

During the quarter, the fund exited its positions in Booking Holdings Inc. (BKNG), U.S. Bancorp (USB), Wells Fargo & Company (WFC), Cigna Corporation (CI), The Boeing Company (BA), Huntington Ingalls Industries, Inc. (HII) and UniFirst Corporation (UNF). The fund initiated a position in KLA Corporation (KLAC). We saw the COVID-19 sell-off as an opportunity to re-focus the portfolio on our highest conviction ideas.

KLA Corporation is a leading supplier of process control wafer fabrication equipment (“WFE”) for the semiconductor industry. The company supplies all of the leading semiconductor foundries and has a 50%+ share of the process control market. Technology leadership drives pricing power and capacity expansion plans at major customers are expected to provide a growing backlog of revenue over the next 3-5 years. The company also has a fast growing services business with sticky customers and a subscription model which should provide a growing stream of recurring revenue.

Outlook

There are currently two counter-currents driving markets: the severe recessionary conditions caused by shelter-in-place mandates and government actions to counter-act those conditions. Both are very powerful and will likely cause volatility in the markets to remain heightened, especially with risks of flare ups in COVID-19 cases. We believe our strategy of owning high quality dividend growing stocks is an attractive way for investors to navigate this market.

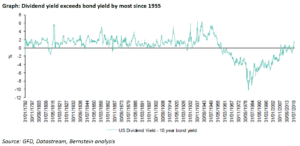

As demonstrated in the graph below, the yields on U.S. dividend-paying stocks have exceed 10-year bond yields for the first time since 1955. Factoring in the risk of inflation stemming from the extraordinary global monetary and fiscal response to COVID-19 and the case for dividend-paying equities is further supported.

Dividend growth investing has been the foundation of the Caldwell U.S. Dividend Advantage Fund’s investment approach, as these stocks typically provide an attractive risk/reward profile over the long-term. We believe that a quality portfolio of dividend growers could stand to be one of the biggest beneficiaries in this low rate environment.

*All data is as of June 30, 2020 unless otherwise indicated. Fund performance is reported on a Canadian dollar, total return basis. Caldwell U.S. Dividend Advantage Fund Series F returns as at June 30, 2020: 1 Year: 6.4%, 3 year: 7.4%, 5 year: 9.3%, SI (July 19, 2015): 7.8%.

The Fund was first offered to the public as a closed-end investment since May 28, 2015. Effective Nov. 15, 2018 the Fund was converted into an open-end mutual fund such that all units held were redesignated as Series F units. Performance prior to the conversion date would have differed had the Fund been subject to the same investment restrictions and practices of the current open-end mutual fund.

The information contained herein provides general information about the Fund at a point in time. Investors are strongly encouraged to consult with a financial advisor and review the Simplified Prospectus and Fund Facts documents carefully prior to making investment decisions about the Fund. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Rates of returns, unless otherwise indicated, are the historical annual compounded returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed; their values change frequently and past performance may not be repeated. The payment of distributions should not be confused with a fund’s performance, rate of return or yield. If distributions paid are greater than the performance of the fund, your original investment will shrink. Distributions paid as a result of capital gains realized by a fund, and income and dividends earned by a fund, are taxable in your hands in the year they are paid. Your adjusted cost base (“ACB”) will be reduced by the amount of any returns of capital and should your ACB fall below zero, you will have to pay capital gains tax on the amount below zero.

Publication date: July 23, 2020.

12303168464egw4gwe4g