Market Commentary

U.S. markets continued higher in the third quarter of 2020 (“Q3”) as economic growth improved and management teams signaled that COVID-19 related disruptions bottomed in early Q2. The headline unemployment rate fell from 14.7% in April to 7.9% in September as businesses continued re-opening, and recent data releases from banks, payment companies and government highlight that consumer spending held up well into Q3. Uncertainty remains, however, as the last round of fiscal stimulus ended in July and Washington has yet to agree on a new package. Year-to-date bankruptcies also remain at their highest level since 2012. To aid in the recovery, The Federal Reserve indicated that interest rates are likely to stay at near-zero until 2022, which should act as a continued tailwind to markets.

Performance Summary

The Caldwell U.S. Dividend Advantage Fund Series F (“Fund”) gained 4.9%*(in $CAD terms) in Q3. Performance was positively impacted by allocations to the Information Technology, Consumer Discretionary and Materials sectors.

Currency holdings continued to be a headwind in Q3, with the USD depreciating by 2.1%, while allocations to the Healthcare, Communication Services and Consumer Staples sectors detracted from performance.

Contributors to Performance**

Qualcomm Inc. (“Qualcomm”) was a strong contributor of performance, gaining 29.0% in Q3. As a leading supplier of advanced smartphone chipsets, the company is well positioned to benefit from the gradual uptake of 5G phones, particularly in China where demand in 2020 has recovered faster than expected. Additionally, sanctions on Huawei provide an opportunity for Qualcomm to gain market share in China as local phone makers look for substitute suppliers. With a long growth runway, increased content opportunities and highly probable market share gains, we believe Qualcomm will continue to cement its position as a market leader over the long-term.

Air Products and Chemicals, Inc. (“Air Products”) was another leading contributor of performance, gaining 23.4%. An increased focus on sustainable manufacturing and increasingly stringent environmental regulations have forced companies around the world to rethink key production inputs. As a leading producer of industrial gases, Air Products is well positioned to facilitate the transition to relatively cleaner fuel sources, particularly in the oil & gas, metals & mining and electronics sectors. Execution on the company’s pricing strategy has also remained strong, keeping margin expansion on track through the pandemic.

Broadcom Inc. (“Broadcom”) gained 15.4% as the company benefitted from ongoing cloud computing and telecommunications network buildouts in its semiconductor solutions business. Similar to Qualcomm, the company also benefitted from a stronger than expected rebound in China and a sole source agreement with Apple ensures Broadcom is the only supplier of certain critical parts for the next 3 generations of 5G iPhones. The relatively new, high margin Infrastructure software segment also continues to gain momentum with Fortune 500 customers. In all, Broadcom continues to be a core holding given its strong growth outlook, free cash flow generation and dividend growth potential.

Detractors from Performance**

CVS Health Corporation (“CVS”) was a leading detractor of performance, falling 10.1%. The COVID-19 environment put pressure on the retail segment’s profitability, with increased cleaning/PPE costs and lower foot traffic weighing on high margin front of store goods such as health and beauty products. Consumers’ unwillingness to visit the doctor’s office also weighed on new prescription starts, which negatively impacted the Retail and Pharmacy Services segment. Lastly, investors remain concerned about reduced commercial enrollment in the company’s Health Insurance segment given ongoing and potential future layoffs across the U.S. The fund exited its position in CVS towards the end of the quarter.

Automatic Data Processing, Inc. (“ADP”) was another detractor of performance, falling 6.3%. The pandemic has negatively impacted the company’s outlook, with management signaling the worst is yet to come and suggesting the business wouldn’t return to pre-COVID-19 growth prior to 2022. With new bookings still down roughly 50% exiting the quarter and retention likely to deteriorate further, the fund exited its position early in the quarter.

Portfolio Activity**

During the quarter, the fund initiated positions in Alimentation Couche-Tard Inc. (“ATD.B”), Church & Dwight Co., Inc. (“CHD”), Dollar General Corporation (“DG”), Intercontinental Exchange, Inc. (“ICE”), Tetra Tech, Inc. (“TTEK”), Amphenol Corporation (“APH”), Broadridge Financial Solutions, Inc. (“BR”) and CDW Corporation (“CDW”).

Alimentation Couche-Tard Inc. is a consolidator in the convenience store/gas station industry, leveraging its scale to reduce costs and improve margins of acquired chains. Even with 12,500 locations across North America and Europe, it and 7-eleven only have approximately 15% of the market. As a result, we believe the company’s proven execution capabilities will allow it to continue taking share for many years to come, aided by strong free cash flow generation and an under-levered balance sheet.

Church & Dwight Co., Inc. is a leading consumer products company, best known for its Arm & Hammer product line. Product quality and recognition is often on par with leading national brands however price points occupy a position somewhere between value and premium. Due to this positioning and a likely permanent shift in consumer purchasing habits (such as more frequent vitamin and cleaning supply purchases), we believe the company is well positioned to capitalize on potential consumer trade down activity. The company’s acquisition strategy has also helped drive above market growth over the last 3 years which we believe will continue in the near and medium term.

Dollar General Corporation is the largest discount retailer in the U.S. with over 16,000 locations nationwide. The rollout of fresh produce and perishable goods is helping drive increased basket sizes and customer stickiness while also taking market share in the company’s core underserved rural markets. An opportunity for an additional 12,000 stores provides a leg of sustainable long-term growth while other initiatives such as refreshed non-consumable and private label products provide a tailwind to margins. Similar to Church and Dwight, we believe the company will also benefit from trade down activity in the near to medium term.

Intercontinental Exchange, Inc. is a global financial exchange operator and owner of the NYSE. Its trading business enjoys high barriers to entry (and margins), benefits from periods of volatility and produces mission critical data used by financial market participants, thus providing a separate, recurring revenue stream with extremely high renewal rates. More recently, ICE acquired Ellie Mae, completing its end-to-end solution for the digitization of the U.S. mortgage industry. We believe ICE can capitalize on record low mortgage rates and a large refinance backlog in the near term while working to incorporate transaction information into its data products over the long term.

Tetra Tech, Inc. is a global provider of consulting and engineering services to government and private sector clients. Its expertise in water and environmental projects makes it the go-to firm for numerous government customers which has contributed to healthy growth in the backlog over the last 5 years. Selective M&A and international expansion will also contribute to growth going forward. The firm recently worked to reduce its exposure to the oil and gas sector while focusing on higher value-add projects which should provide a tailwind to margins over the medium to long term.

Amphenol Corporation is a leading global manufacturer of interconnect, sensor and antenna products that help advance the “electronification of everything” trend. As the most diversified interconnect player, the company is not overly exposed to cyclical fluctuations in any single sector while benefitting from long term secular trends across multiple industries such as electric vehicles and advanced driver assistance systems, cloud datacenter buildouts and 5G network/mobile phone rollouts. A decentralized business model allows real-time response capabilities to changes in demand while also protecting against margin compression during slowdowns. Lastly, we believe the current environment will provide attractive acquisition opportunities that have historically contributed to above-market growth.

Broadridge Financial Solutions, Inc. provides products and services aimed at streamlining investor relations and back office operations in the financial service industry. The company’s scale makes it extremely hard for competitors to enter the market and as a result, it processes communications for over 80% of publicly traded shares in the U.S. and more than 75% internationally. Going forward, we believe the company will benefit from long-term outsourcing trends as companies in the financial services industry focus on improving their bottom line.

CDW Corporation is one of the largest U.S. information technology re-sellers, offering more than 100,000 products and services from over 1,000 vendor partners. In the last 5 years, the company has consistently expanded its total addressable market, adding services such as cloud integration, while taking market share from less nimble competitors. The pandemic has highlighted the need for IT upgrades across nearly every sector in the economy, which we believe will support a continuation of the company’s long term track record of above market growth. Additionally, integration services (approximately 5% of sales) will provide a tailwind to margins as they become a greater portion of the revenue mix.

Outlook

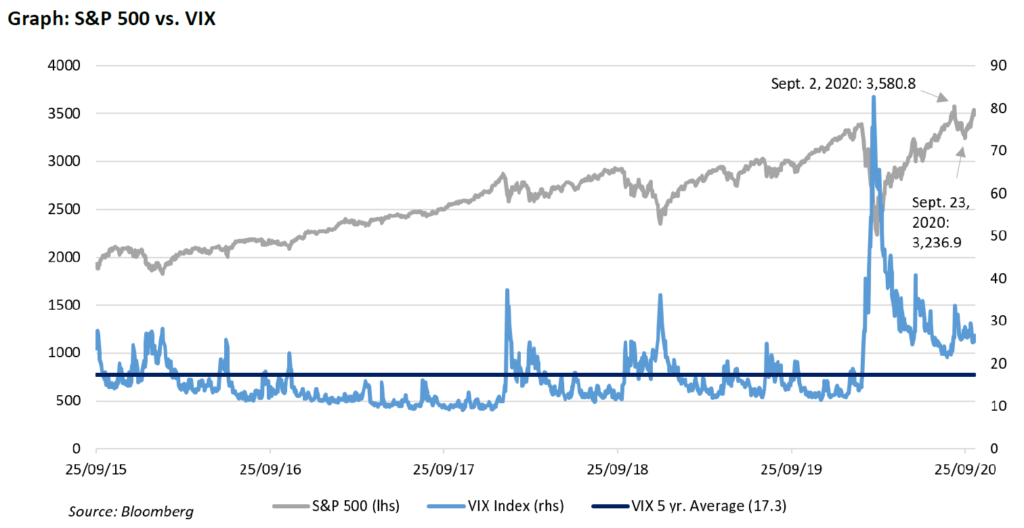

Market volatility has fallen from its March highs but will likely remain elevated due to the U.S. election, rolling COVID-19 case flare-ups, rising bankruptcies and disagreement surrounding a new stimulus package. For example, the S&P 500 reached all-time highs on September 2, 2020 only to decline roughly 10% over the subsequent two weeks.

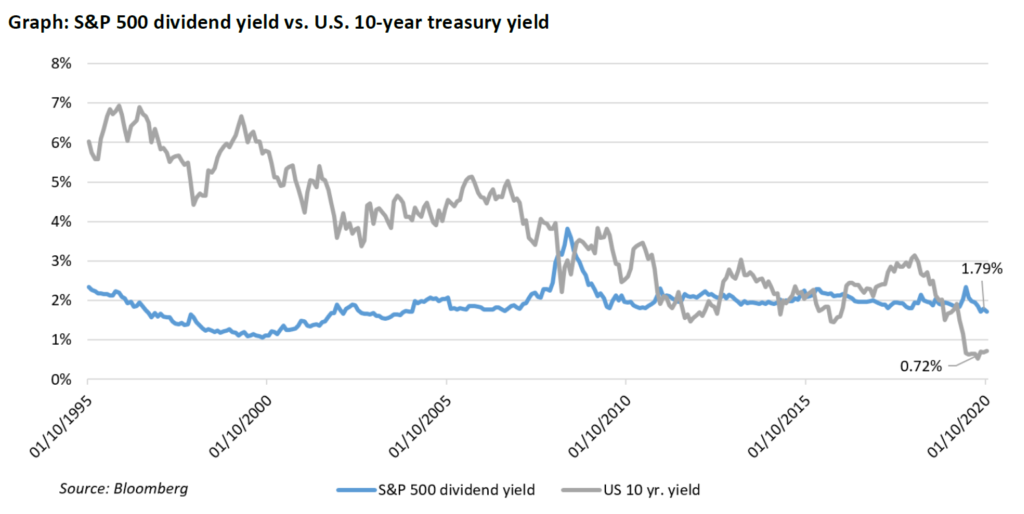

Dividend growth investing has been the foundation of the Caldwell U.S. Dividend Advantage Fund’s investment approach, as these stocks typically provide an attractive risk/reward profile over the long-term. As such, we believe our strategy of owning high quality dividend growing stocks is an attractive way for investors to navigate this market, particularly as interest rates are likely to remain at historical lows for the foreseeable future.

*Caldwell U.S. Dividend Advantage Fund Series F returns as at September 30, 2020: 1 Year: 8.8%, 3 year: 9.2%, 5 year: 10.2%, Since Inception (July 19, 2015): 8.4%.

**Current investments, first purchased: Qualcomm Inc. -10/29/2019, Air Products and Chemicals, Inc. - 12/31/2015, Broadcom Inc. - 11/1/2018, Alimentation Couche-Tard Inc. - 9/3/2020, Church & Dwight Co., Inc. - 9/25/2020, Dollar General Corporation - 7/27/2020, Intercontinental Exchange, Inc. - 9/25/2020, Tetra Tech, Inc. - 9/25/2020, Amphenol Corporation - 7/27/2020, Broadridge Financial Solutions, Inc. - 7/30/2020, CDW Corporation - 7/29/2020. Former investments, sold: CVS Health Corporation - 9/22/2020, Automatic Data Processing, Inc. - 7/30/2020.

All data is as of September 30, 2020 unless otherwise indicated. Fund performance is reported on a Canadian dollar, total return basis.

The Fund was first offered to the public as a closed-end investment since May 28, 2015. Effective Nov. 15, 2018 the Fund was converted into an open-end mutual fund such that all units held were redesignated as Series F units. Performance prior to the conversion date would have differed had the Fund been subject to the same investment restrictions and practices of the current open-end mutual fund.

The information contained herein provides general information about the Fund at a point in time. Investors are strongly encouraged to consult with a financial advisor and review the Simplified Prospectus and Fund Facts documents carefully prior to making investment decisions about the Fund. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Rates of returns, unless otherwise indicated, are the historical annual compounded returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed; their values change frequently and past performance may not be repeated. The payment of distributions should not be confused with a fund’s performance, rate of return or yield. If distributions paid are greater than the performance of the fund, your original investment will shrink. Distributions paid as a result of capital gains realized by a fund, and income and dividends earned by a fund, are taxable in your hands in the year they are paid. Your adjusted cost base (“ACB”) will be reduced by the amount of any returns of capital and should your ACB fall below zero, you will have to pay capital gains tax on the amount below zero.

Publication date: October 16, 2020.

12303168464egw4gwe4g