Key Highlights

- Persistent Inflation: Despite lower energy prices, core inflation remains sticky, driven by rising wages and increased consumer spending.

- Labour Market Strength: Wage growth and longer workweeks indicate a resilient labour market, contradicting expectations of cooling.

- Misaligned Market Expectations: Current market sentiment for aggressive rate cuts appears misaligned with economic data showing strong wage and employment growth.

- Fed’s Historical Approach: The Fed has rarely enacted sharp rate cuts outside of recessions or financial crises, neither of which are imminent.

- Rising Yields: The long-term downtrend in U.S. Treasury yields has ended, with upward pressure expected, due to government spending and quantitative tightening.

In last month’s commentary, a structured approach to understanding the interaction between the market and the Federal Reserve (“Fed”) was outlined, focusing on four key areas: Individual Opinion, Collective Handicapping, Fed Communication, and Fed Action. This framework may prove helpful for decoding current market expectations.

Market Expectations vs. Data Realities

Investor sentiment expects an additional 200 basis points in Fed rate cuts by the end of 2025, following the 50 basis point cut on September 18. The rationale behind this is the belief that inflation is no longer a pressing issue and that the Fed is shifting focus to a weakening labour market.

However, recent data perhaps suggests otherwise.

U.S. Inflation Reacceleration

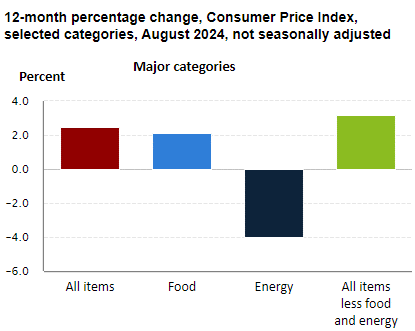

In August, core Consumer Price Index (“CPI”) rose 0.3%, the highest in four months, surpassing expectations of 0.2%. Supercore inflation, defined as services excluding shelter, also increased, and shelter inflation saw its largest jump since early 2024. While crude prices have fallen, inflation across the economy remains persistent, with signs of reacceleration. Lower energy prices provide consumers with more disposable income, potentially boosting spending; this would act as a tailwind for inflation.

12-Month Percentage Change, Consumer Price Index, selected categories, not seasonally adjusted

Source: U.S. Bureau of Labour Statistics, August 2024.

U.S. Labour Market Strength

August’s employment report showed weaker non-farm payrolls, but revisions to previous data were influenced by external factors like weather. The unemployment rate fell to 4.2%, while average hourly earnings surged by 0.4%. The workweek lengthened, driving total weekly income growth of nearly 0.7%. Strong wage growth and longer hours are largely supportive of inflation, thus challenging the narrative of a cooling labour market.

The Atlanta Fed’s GDPNow forecast has been upgraded to 2.9%, reflecting stronger labour market data. This mirrors late 2023 sentiment, where markets initially priced in significant rate cuts, only to reverse course by spring 2024.

Our Perspective: Caution Against Overoptimism

While it’s essential to monitor market sentiment, current expectations of aggressive rate cuts appear misguided. Wage growth is accelerating, the labour market remains strong, and inflation is sticky. Historical precedent suggests that the Fed only cuts rates sharply during recessions or financial crises—neither of which seems imminent.

If the Fed appears to prioritize growth over inflation control, bond investors may become wary of holding 10-year Treasuries at current yields. As shown in the 10-year yield chart (since the 1960s), the long-term downtrend has ended, and an uptrend may be underway.

Key Drivers of Rising Yields

Ultimately, Treasury prices are governed by supply and demand dynamics. While demand may seem strong today, driven by misplaced optimism, supply will continue to grow. Yields are poised to rise, barring significant shifts in current conditions.

U.S. Treasury 10-Year Yield since 1965

Source: Bloomberg,

September 2024.

The commentaries contained herein are provided as a general source of information based on information available as of September 30, 2024 and should not be considered as investment advice or an offer or solicitations to buy and/or sell securities. Every effort has been made to ensure accuracy in these commentaries at the time of publication however, accuracy cannot be guaranteed. Market conditions may change and Caldwell Investment Management Ltd. accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained herein. Investors are expected to obtain professional investment advice.

Published on September 30, 2024