Key Highlights

- Economic Data Fluctuations: Economic data is constantly changing, with revisions and adjustments requiring a focus on the broader macroeconomic environment.

- Non-Farm Payrolls Revision: The significant downward revision of non-farm payrolls highlights the importance of considering revisions and the broader context when interpreting labour market data.

- Inflation Persistence: High U.S. deficit spending and strong wage growth suggest inflation may remain stubborn, even if the Federal Reserve (Fed) cuts rates.

- Bond Market Dynamics: Bond prices are likely to be influenced by supply and demand, with recent auctions indicating that demand may not be keeping pace with supply.

- Data-Driven Approach: Prioritizing data and logic over market speculation is crucial for informed decision-making.

This week’s surge of U.S. economic data caused another fluctuation in expectations for Federal Reserve rate cuts. A structured framework is essential for analyzing these developments effectively.

The Four Levels of Fed Analysis

- Individual Opinion

- Market Sentiment

- Fed Communication

- Fed Actions

Individual Opinion

Opinions on Fed actions abound, but they rarely impact actual decisions. While some opinions may temporarily influence markets, they typically have minimal effect on Fed policy.

Market Sentiment

Media coverage often focuses on the ‘rate cut probabilities’ derived from Fed fund futures, which reflect the last traded prices but lack predictive accuracy. For example, in late 2023, markets expected multiple rate cuts in 2024, but by spring, these expectations diminished significantly as economic data contradicted initial forecasts.

Fed Communication

The Fed’s guidance can shift over time. In December 2023, the Fed indicated three potential rate cuts for 2024, only to revise this expectation to nearly zero by late spring. Historically, the Fed’s forecasting accuracy has been low.

Fed Actions

Historically, the Fed often diverges from its stated intentions and may change course abruptly, as seen in late 2018 when rate hikes and Quantitative Tightening were halted in response to market stress.

Recent Developments

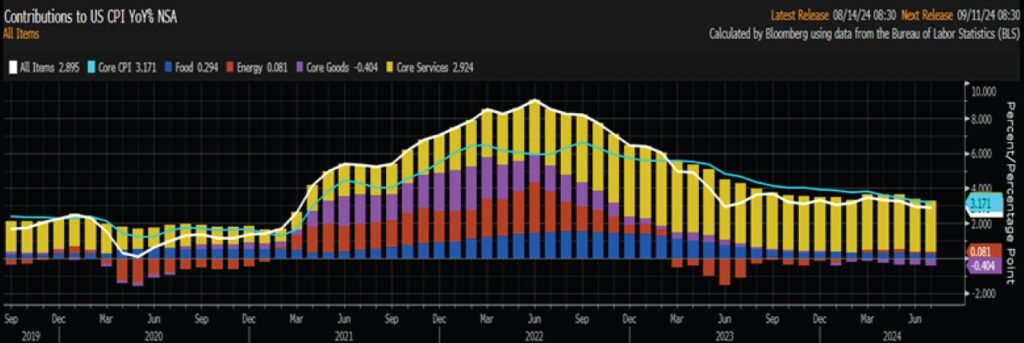

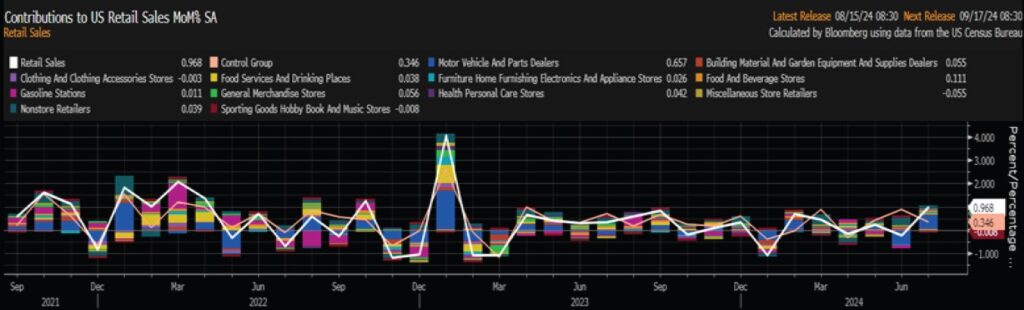

The latest U.S. Comsumer Price Index (CPI) report, released on August 14, 2024, indicated some moderation in inflation, leading to a slight reduction in expected rate cuts for 2024, from 106 to 103 basis points. However, persistent inflation in core services, driven by sticky wages, kept CPI above the Fed’s 2.0% target. Stronger-than-expected U.S. retail sales further reduced expectations, with markets now anticipating 95 basis points of cuts for the year.

U.S. CPI Year-Over-Year

Source: Bloomberg,

August 2024.

U.S. Retail Sales Monthly Change

Source: Bloomberg,

August 2024.

Additionally, the recent downward revision of over 800,000 non-farm payrolls for the 12-month period ending March 2024 captured significant attention. This revision, while notable, pertains to data far in the past and does not account for employment data beyond March 2024, which could be subject to further revisions. The Federal Reserve was already aware of this adjustment and had discussed it, suggesting that its impact on future policy decisions may be minimal. Moreover, the revision does not include illegal immigrants holding jobs outside the survey, meaning that the downward adjustment may not fully represent the total employment picture and could be partially offset by this uncounted labour force.

The commentaries contained herein are provided as a general source of information based on information available as of August 26, 2024 and should not be considered as investment advice or an offer or solicitations to buy and/or sell securities. Every effort has been made to ensure accuracy in these commentaries at the time of publication however, accuracy cannot be guaranteed. Market conditions may change and Caldwell Investment Management Ltd. accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained herein. Investors are expected to obtain professional investment advice.

Published on August 26, 2024