Key Takeaways:

- Bank of Canada Caution: Rising wage pressures may undermine the Bank’s dovish policy stance despite recent Consumer Price Index (CPI) trends.

- Resilient U.S. Growth: Wage growth, strong discretionary spending, and upward GDP revisions signal ongoing economic strength.

- Inflation Risks Remain: Climbing Producer Prices (PPI) point to future CPI pressures, particularly in services.

- Federal Reserve Policy Uncertainty: Elevated inflation and asset prices cast doubt on further rate cuts beyond December.

- Canadian Dollar Weakness: Fiscal deficits and U.S. dollar strength continue to weigh on the Canadian dollar, with further downside risks remaining.

Bank of Canada Rate Cut

On December 11, 2024, the Bank of Canada cut its policy rate by 50 basis points (bps) to 3.25%, following a jump in the November unemployment rate to 6.8%. November CPI rose 1.9% year-over-year, with monthly CPI unchanged, validating the Bank’s dovish stance. However, rising wage pressures remain a concern. Public sector wage settlements in 2024 have consistently been in the high single digits, with unresolved disputes like the Canada Post strike likely to influence future negotiations. As public sector wage growth spills into the private sector, businesses will retain pricing power, raising inflation risks despite subdued economic growth.

U.S. Economy: Persistent Strength and Inflationary Signals

While the U.S. labour market has eased, it remains strong, with average hourly earnings growing 4.0% year-over-year and 0.4% month-over-month in November. Upward revisions to September and October nonfarm payrolls further highlight this resilience.

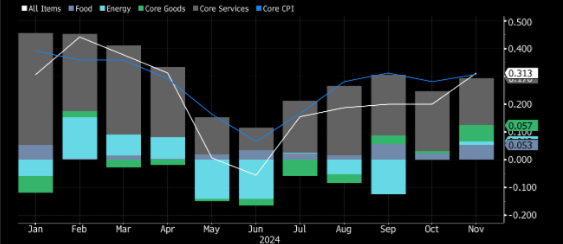

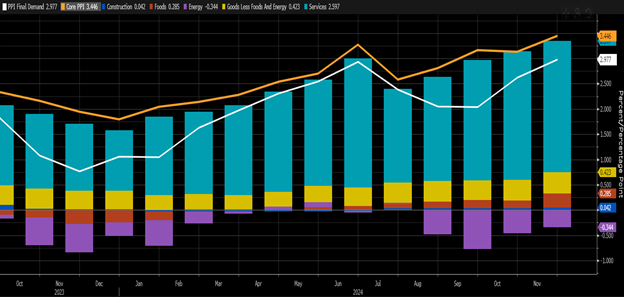

Falling core goods prices have driven much of the disinflationary progress, but price pressures in services remain elevated. The November CPI showed increases across all major categories, including core goods. Adding to concerns, the Producer Price Index (PPI) is climbing again, with services as a major contributor. Higher PPI suggests future upward pressure on CPI as businesses pass costs to consumers.

Strong wage growth, rising interest income, and near-record asset prices continue to fuel discretionary spending, particularly in services, further supporting inflation. The Federal Reserve Bank of Atlanta Fed’s Q4 GDPNow forecast stands at 3.1% annualized, signalling above-trend economic growth.

U.S. Consumer Price Index & Components

Source: Bloomberg, November 2024.

U.S. Producer Price Index & Components

Source: Bloomberg,

November 2024.

Federal Reserve Policy: Uncertainty Ahead

The Federal Reserve’s (Fed) recent rate cuts stand out historically—occurring amid strong economic growth and record-high asset prices. Following a 25 bps cut in November, the path forward for further easing has become less clear. Rising inflation, a tight labour market, and elevated asset prices make additional cuts harder to justify. At the upcoming December 18 Federal Reserve Open Market Committee meeting, another 25 bps cut is widely expected, but markets are increasingly pricing out future rate reductions.

Canadian Dollar Vulnerability

The Canadian dollar fell below key support at 71.50 U.S. cents after Canada’s Finance Minister resigned on December 16, coinciding with the release of a fiscal update showing a deficit ballooning to C$61.9 billion (from C$40 billion). The Canadian dollar now trades in the 69-cent range, with little technical support until 68.00 U.S. cents.

While the Bank of Canada nears the end of its easing cycle, upward pressure on U.S. Treasury yields and the pricing-out of future Fed rate cuts will continue to strengthen the U.S. dollar against the Canadian dollar.

Source: Thomson Reuters, November 2024.

The commentaries contained herein are provided as a general source of information based on information available as of September 30, 2024 and should not be considered as investment advice or an offer or solicitations to buy and/or sell securities. Every effort has been made to ensure accuracy in these commentaries at the time of publication however, accuracy cannot be guaranteed. Market conditions may change and Caldwell Investment Management Ltd. accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained herein. Investors are expected to obtain professional investment advice.

Published on December 20, 2024