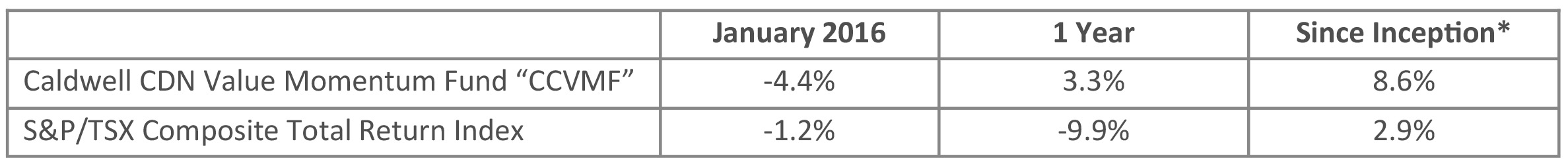

Update on Caldwell Canadian Value Momentum Fund January 2016

*Compounded Annual Return since August 15, 2011

January Recap: The Fund declined -4.4% in January versus a -1.2% loss for the TSX Total Return Index. Investors kicked off the year with a broad-based, global decline in risk appetite. The impact was felt across both equity and bond/credit markets. Risk aversion in the bond market meant that investors flocked to the highest quality credits (government bonds) at the expense of the lowest quality credits (junk bonds) and everything in between. Declining risk appetite in equities saw investors shift portfolios from economically-sensitive, higher beta names, to those business sectors characterized by higher earnings stability. Specific to Canada, Utilities (+5.8%), Telecom (+3.5%) and Consumer Staples (+1.8%) were the best performing sectors. Gold, another area investors often pile into when looking for ‘somewhere to hide’, was also a bright spot. The gold industry group gained 8.1% on the back of a 5.3% increase in the price of gold.

The Fund’s portfolio participated with the market’s sector rotation, especially as there was no significant companyspecific news to drive individual shares higher. Top performers were Premium Brands Holdings (PBH +10.0%) and AGT Food & Ingredients (AGT +3.3%), both in the Consumer Staples sector, while bottom performers were concentrated in the more cyclical Industrials and Consumer Discretionary sectors. While no new positions were added to the portfolio, the strong sector rotation caused our factor-based model to generate a number of new buy signals in late January and into February. Our team is currently working through the due-diligence on these names.

As a reminder, the purpose of having an active-overlay (versus blindly following a quantitative model) is to identify and avoid investing in companies that produce false buy signals. In any screening process, there is no way to capture what one is looking for with 100% accuracy. In the case of the CCVMF, false buys are those stocks where momentum drivers, and therefore share price appreciation, do not appear sustainable. Looking back at 2015, the team did a great job of avoiding false buy signals. Through our due diligence process, a total of twenty stocks were identified as false buys and therefore not purchased for the portfolio. From the time of each stock’s buy signal to the time of this writing, the stocks in this group under-performed the benchmark return by an average of 7.0%, making the active overlay a significant source of alpha-generation for our investors.

Looking forward, we continue to identify stocks with near-term catalysts to unlock value. The Fund remained fairly defensive with a 20% cash position at the end of January.

Wishing you and all of our investors continued success,

The CCVMF Team

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/