All posts tagged Investing

-

Partners in Prospecting

November 24, 2022The Times They Are A Changin’

I’m convinced the majority of us will be relieved to see the backend of 2022, because it has been a trying time for investors AND ALSO for Investment Advisors. Most Advisors have been telling me that now is a good time for them to begin reaching out to current clients and searching for new clients to expand their books in 2023.

Here’s what successful Advisors have shared with me:

Do you have your comments ready for your existing clients?

In this type of unpredictable environment, clients do not expect you to have ALL the answers and they know you don’t have a crystal ball. However, they do want to know what you are thinking about regarding the big picture and how they can work best with you. Communication is key and having a few soundbites prepared (not more than 3) will help. Keep it simple when discussing the markets or world views so that they will easily understand and connect with you. For example: “I think that interest rates will…and as a result I am changing/adding/redeeming the following in your portfolio…” You may also want to make a quick, informed comment about world events and/or inflation.

Have you checked your client list and considered how you met and obtained your clients in the first place?

Was it through a referral via word of mouth, visits to your website, quarterly newsletters, client events, blog posts, cold calling or some other action? One of the problems related to prospecting is the lack of clarity around it. If you do not measure your results, you will have little to no idea which of your (ideally multiple) prospecting methods are generating the best results. Once you have the clarity, then you can focus on what is bringing those clients in and improve or increase that particular effort.

Work with your Marketing and Compliance teams to ensure you have a website presence.

Advisors have told me that in tracking their “hits” to their websites, the most popular page is their “About Your Team” section. Potential clients like to see and read all about personal and professional profiles of the Advisor and their teams. Hire a professional photographer to take a picture of you and your team members in your office. In addition, this is the perfect place to highlight your credentials including designations (ensure you explain them) as well as your unique skills and experience. For more information, see How Financial Advisor Designations Can Affect Customer Experience.

Good luck with your planning for 2023!

As usual, there is a song title in this Blog Post. Do you recognize it?

About Jennifer Kuta

For more than 25 years, I have worked with Advisors helping them build their businesses. My commitment to you is to partner with you in your practice and offer solutions to help build your business.

Investment involves risk, uncertainty and assumptions. The value of investments rise and fall and there is a risk you may not recoup the amount originally invested. Past performance is not a reliable indicator of future performance.

The contents of this blog are the personal views of the author and not necessarily the views of Caldwell Investment Management Ltd. The views expressed, while based on current market conditions and information, they are subject to change without notice and as such, there can be no assurance that actual results will not differ materially from such expectations. The comments are an illustration of broader themes and intended to be for general information purposes only.

Forward-looking statements are not guarantees of future results as they involve uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

The contents are provided as general in nature and should not be relied upon nor construed to be the rendering of specific tax, legal, accounting or professional investment advice. Readers should consult with their own accountants, lawyers and/or financial advisors for advice on their specific circumstances before taking any action.

The information contained herein is from sources believed to be reliable, but accuracy cannot be guaranteed. No representations or warranty, expressed or implied is made by Caldwell Investment Management Ltd. or its affiliates. -

Partners in Prospecting

September 6, 2022Taking Care of Business

Taking Care of Business: How to articulate your practice’s unique business model

Over the years, I’ve noticed the most successful Investment Advisors know how to articulate their unique business model. For this blog post, I decided to go to an industry authority for her advice. Christine Timms was an Investment Advisor (“IA”) for Merrill Lynch Canada and then CIBC Wood Gundy for a total of 33 years. She was a successful IA reaching her firm’s Chairman’s Club level for the last 24 years of her career. She retired five years ago at career high levels of assets under management and revenue leaving her clientele in the hands of two members of her team.

You have written a series of three Handbooks for the Professional Financial Advisor. Your handbook Business Models for Financial Advisors has resonated with Investment Advisors. Why would you say that is?

IAs have too much to do and not enough time to do it, even if they have large teams. They recognize the need to focus efforts and maximize productivity in order to serve clients well, grow their practice and satisfy compliance requirements. A well thought out, articulated written business model helps Advisors do this. The book provides an organized approach to articulating an Advisor’s unique business model and discusses many practical considerations for the development and implementing of specific business model items. For example, it explains how I narrowed down the investment strategies and choice of securities to include in recommendations to my clients. This is particularly relevant for knowing your product.

During my 33 years as an IA, I met many IAs with long successful careers. I learned that no two IAs are exactly alike. They all have distinguishing characteristics, different skill sets and different clienteles. Each IA employs different combinations of successful and valid approaches to client contact, investing, financial planning, charging clients, etc. The successful IA’s approach to the services offered generally matches the needs of the IA’s unique clientele. There may be almost as many unique business models as there are IAs.Tell us how an articulated Business Model benefits both Investment Advisors in the early stages of their career as well as more established IAs?

Writing down a complete business model forces an IA to identify exactly what services they are offering or wish to offer and to whom they offer or wish to offer their services. An IA with a written business model will find it easier to stop trying to be “all things to all people.” An IA will be able to focus their on-going learning on topics relevant to a significant number of their clients. It will be easier to choose the most relevant industry courses. It will also be easier to apply solutions found for one client to other clients facing similar situations. As a result, the IA will become more proficient in the services offered and in promoting their services to prospects. All the IA’s clients will benefit, and the IA will maximize the effectiveness of their time and money invested in their career/practice. A well-articulated business model will give added confidence to an IA helping them project confidence to existing and prospective clients. As the IA’s practice grows, it will also provide structure and facilitate the delegation of duties to team members. A well thought out written business model should lead to happier clients as well as more enjoyable and productive workdays for the IA and their team. A win-win!

In addition, IAs looking for a colleague to take over during emergencies or upon retirement will find it easier to compare practices. Furthermore, those looking to be successors will be able to show those retiring how they serve clients compared to the retiring IA’s approach.You talk about the six components for a Business Model checklist. Can you please elaborate?

I have identified six major components of an IA’s business model

- Identify the most compatible and sustainable clients for your practice

Qualities and expectations of clients you serve - Establish your unique client service model

What services/products do you wish to offer clients?- client communication (methods, frequency)

- investing (document investment selection process)

- financial planning (level of forecasting, items covered)

- tax returns and tax strategies

- Determine your processes for delivery of services/products and practice management

How will you implement your service model? - Determine needed resources and suppliers/sources

What resources are required for the processes you use to deliver the services? What resources are readily available through your firm and external sources? How much of your own time and money is needed? - Pricing for clients

How and how much are clients paying for the services/products they receive? - IA compensation

How are you paid?

The work involved in articulating a business model may seem daunting to an IA who juggles so many balls daily. Do you have any additional tips or aids that will help IAs articulate their business models?

As I looked back on my career, I realized that I gradually made groups of inter-related decisions that formed an unarticulated, unwritten business model that was best for the clients I wished to serve. I can see now that the more business model decisions I made, the more focused and efficient my practice became. I had removed the stress of trying to be all things to all people, giving me greater peace of mind. I am confident that I would have arrived at my final business model and all of its benefits sooner, if I had used a written business model development process….so I created a process to provide a quick orderly progression through the six business model components mentioned earlier. I expanded the six business model components into a detailed, customizable, checklist template bundle. The checklists can be used to quickly document, develop or analyse an existing or desired unique business model. They allow an IA to add items and details I may not have thought of to my ready-made lists.

The following link takes the reader to a demo of the templates recently updated to expand the section documenting an Investment Advisor’s investment selection process: www.christinetimms.com/template-tutorials

The handbook includes discussions regarding many of the decisions made by IAs as they progress through the checklists for the various business model components. All three handbooks are available on Amazon.ca and Indigo.ca

Whether you are a new Advisor looking to create a unique business model from scratch, or a seasoned Advisor who wants a refresher, your prospects and clients will benefit from your capabilities.As usual, there is a song title in this Blog Post. Do you recognize it?

Christine Timms is the author of three Handbooks for the Professional Financial Advisor including “Business Models for Financial Advisors” (available in paperback and ebook). www.christinetimms.com provides descriptions and testimonials, as well as written, audio versions of the introductions of each book and video demos/tutorials for downloadable templates www.christinetimms.com/template-tutorials .

About Jennifer Kuta

Jennifer Kuta is a Vice President, Business Development and Sales at Caldwell Investment Management Ltd. and is responsible for providing sales support to portfolio managers, wholesalers and external investment advisors. Prior to joining Caldwell, she was an independent business consultant and trainer with more than 25 years of experience in selling, facilitating and coaching within the financial services industry. Over this period, she has been committed to working with advisors to help them build their businesses.

Partners in Prospecting addresses common concerns Investment Advisors face daily. The blog aims to provide step-by-step solutions to arm our Partners with viable solutions. If you would like to read more of Partners in Prospecting blog posts, click here.

About Caldwell Investment Management Ltd.

Caldwell Investment Management Ltd. is a leading independent investment management firm that has been providing multiple award-winning innovative solutions to meet the requirements of individual and institutional investors for over three decades.

Caldwell Investment Management Ltd. is committed to partnering with advisors in their practice and to offer solutions to help build their business

Investment involves risk, uncertainty and assumptions. The value of investments rise and fall and there is a risk you may not recoup the amount originally invested. Past performance is not a reliable indicator of future performance.

The contents of this blog are the personal views of the author and not necessarily the views of Caldwell Investment Management Ltd. The views expressed, while based on current market conditions and information, they are subject to change without notice and as such, there can be no assurance that actual results will not differ materially from such expectations. The comments are an illustration of broader themes and intended to be for general information purposes only.

Forward-looking statements are not guarantees of future results as they involve uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

The contents are provided as general in nature and should not be relied upon nor construed to be the rendering of specific tax, legal, accounting or professional investment advice. Readers should consult with their own accountants, lawyers and/or financial advisors for advice on their specific circumstances before taking any action.

The information contained herein is from sources believed to be reliable, but accuracy cannot be guaranteed. No representations or warranty, expressed or implied is made by Caldwell Investment Management Ltd. or its affiliates. - Identify the most compatible and sustainable clients for your practice

-

Partners in Prospecting

June 28, 2022Leader of the Pack

Leader of the Pack: What is the Value of an Investment Advisor?

Investors may not like the fees that they are charged by professionals such as lawyers and accountants, but they do understand the value they receive in return. So why is it so difficult for investors to accept and understand that Investment Advisors also need to make a living? Perhaps investors have been influenced by watching too many Discount Brokerage commercials, which make it sound as if Investment Advisor fees are not only exorbitant, but also are not worth it.

Our Chairman, Thomas S. Caldwell, C.M., recently spoke about this very issue which he calls The Big Con.

It is very important to keep your unique selling proposition top of mind with your clients and prospects.

Here are three reasons why you, as an Advisor, are exceptionally positioned to add value to any investor looking for financial, investment and life advice.

1) You’re The Expert

As an Advisor, a large part of your role is to optimize your clients’ portfolios. Unless the Do-It-Yourselfer is a day trader, then they are probably dabbling with investments by taking stock tips from friends, relatives, blogs or Googling stocks currently in the news. Most prospective clients wouldn’t attempt to “take the law” in their own hands when dealing with a legal issue, because they look for trained lawyers with experience. Your expertise is your advantage and the more you can share your credentials the better you will position yourself as a Professional. Everyone accepts that Professionals require a fee for service, and the majority of the public does not work for free.

In a recent Investment Executive article, full-service advisors add more than enough value to client accounts to surpass the typical advisory fee of 1%, according to Russell Investments Canada’s 2022 Value of an Advisor study highlighted in The Investment Executive.

2) You Can Quell the Emotions During Volatile Times

One Advisor who was talking to some soccer dads at his son’s game, was bluntly asked: “You’re an Investment Advisor, why don’t you recommend a good stock for us to buy.” His answer “Well, I could do that. But the issue is, will you know when to trim or sell the entire position? Creating optimized portfolios is a big part of my role as an Advisor.” I don’t think most of the dads would have liked that answer, but others gave him an opportunity to review their own portfolios. In these volatile times, Advisors tell me they proactively spend time quelling their clients’ emotions while working with them to ensure that the clients’ financial plans remain focused on their goals.

3). You have a track record

Over the past year, Advisors have added value of 3.85%, the seventh annual Russell Investments study found, with behavioural coaching efforts contributing the most, at 1.93%, as Advisors help their clients stay focused on saving money for long term goals, according to the same Russell Investments study published in The Investment Executive.

Educating clients and prospects will set you apart as an Advisor and your knowledge equips you with a competitive advantage. You should be direct and upfront when explaining how you are compensated. This may seem like a relatively straightforward statement, however, in an environment where fees are increasingly scrutinized, and clients are trained to be suspicious, it is prudent to be transparent. As we’ve been discussing in this blog, it is important to be as transparent and forthcoming as possible. Highlight what is included in your fees, what is extra and if there are any referral or commission agreements in place. In the current environment, clients need the expertise and experience that you bring to the table. At the same time, you earn your fees while you help to keep your client focused on their financial plan.

As usual, there is a song title in this Blog Post. Do you recognize it?

About Jennifer Kuta

For more than 25 years, I have worked with Advisors helping them build their businesses. My commitment to you is to partner with you in your practice and offer solutions to help build your business.

Investment involves risk, uncertainty and assumptions. The value of investments rise and fall and there is a risk you may not recoup the amount originally invested. Past performance is not a reliable indicator of future performance.

The contents of this blog are the personal views of the author and not necessarily the views of Caldwell Investment Management Ltd. The views expressed, while based on current market conditions and information, they are subject to change without notice and as such, there can be no assurance that actual results will not differ materially from such expectations. The comments are an illustration of broader themes and intended to be for general information purposes only.

Forward-looking statements are not guarantees of future results as they involve uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

The contents are provided as general in nature and should not be relied upon nor construed to be the rendering of specific tax, legal, accounting or professional investment advice. Readers should consult with their own accountants, lawyers and/or financial advisors for advice on their specific circumstances before taking any action.

The information contained herein is from sources believed to be reliable, but accuracy cannot be guaranteed. No representations or warranty, expressed or implied is made by Caldwell Investment Management Ltd. or its affiliates. -

Partners in Prospecting

April 6, 2022Trusted Advisor

Trust in Me: Is a Trusted Advisor an outdated cliché or does it pay?

In the Financial Services Industry, becoming a Trusted Advisor has been seen as the ultimate goal when interacting with both prospects and clients. Has this term become overused and outdated? Some Sales experts believe in some instances, it has. Check out Collen Francis, at Engage Selling’s view on the term in her two-minute video Graduate From Trusted Advisor to Object of Interest.

The term Trusted Advisor has a place in our Industry. Recently I was speaking to an Advisor who said he was struggling with conveying his unique value. He said that many Financial Services Platforms offer about the same menu of Products and Services. He asked, “With all the offerings being similar, how do I become a Trusted Advisor?” It’s a good question and it sparked me to remember how crucial it is to develop a relationship with your client that is based on trust. Moreover, this must be the basis of the relationship starting with the very first contact.

Now for you veterans out there, and I know there are many, you know that earning customer trust is a process. The key question, when we prospect, is how can we accelerate the trust-building process. In this blog post, we will discuss five key questions in a prospect’s mind that need to be answered to develop a Trust-Based Selling relationship. These answers can be used when you speak to prospects or clients, updating your marketing material, or enhancing your web presence (if your Compliance allows).

What are your background, experience, and qualifications?

Prospective clients need to know that their potential advisor has sufficient training, knowledge, and experience to advise them on the issues that matter most to them and more importantly, on the issues they may not be aware of. This question will also allow you to speak about professional qualifications and designations such as a CFA, CIM, or CFP. In addition, successful Advisors have often entered into the profession after many years of working with entrepreneurs and other like-minded people that may later become their clients. An Advisor who was a former business owner is a perfect example of this, thus possessing the unique ability (vs. others) of truly understanding and specializing in business owners’ challenges and investment portfolios. Having a particular niche such as this is an excellent way to gain trust and further grow the business.

How are you compensated?

This may seem like a relatively straightforward question, however, in an environment where fees are increasingly scrutinized, and clients are trained to be suspicious (think discount broker television ads), it is important to be as transparent and forthcoming as possible. Highlight any referral or commission agreements in place, what is included in your fees, what is extra, etc.

Are we a good fit?

Focus on the type of clients you and the team typically work with. If possible, use client testimonials to personalize your story and further enhance credibility. Potential clients are looking for someone they feel comfortable speaking with and with whom they can be open and honest in sharing their hopes, fears, dreams, etc. It is important that you convey in your message that what is important to them is important to you.

What role does technology play in your business?

Technology is becoming more and more engrained into financial services, whether it is employed in trading tools and automation, facilitating timely trades and the delivery of sophisticated strategies, or creating enhanced risk management techniques to allocate investor capital. Regardless of your comfort with technology, be aware that younger investors tend to favour financial advice that is easily integrated with their technological world (e.g. access to portfolios, money transfers, client communication, etc.). Using some of the tools at your disposal now, or potentially investing in technology, may help the team develop a solid pipeline of new clients and prospects. In addition, introducing technology has proven to help create efficiencies and increase profitability.

Can I trust my Advisor to help me reach my goals and objectives?

This last question provides you the chance to showcase your team’s added value. Explaining how portfolios and investments are created and customized to client needs will illustrate your team’s ability to create income and build the wealth required for your clients to retire comfortably. You will also want to circle back to the value-added professional services offered (financial, tax, and estate planning, legal, etc.). Illustrating how your team can assist with the client’s investment needs as well as their interests can be a powerful inducement to trust and work with you.

All these critical questions for new clients will help you in demonstrating your accessibility, personal competence, and transparency while you lay the foundation for a trust-based relationship. Whatever plan you create for your client must relate to the client’s goals as well as their situation.

About Jennifer Kuta

For more than 25 years, I have worked with Advisors helping them build their businesses. My commitment to you is to partner with you in your practice and offer solutions to help build your business.

Investment involves risk, uncertainty and assumptions. The value of investments rise and fall and there is a risk you may not recoup the amount originally invested. Past performance is not a reliable indicator of future performance.

The contents of this blog are the personal views of the author and not necessarily the views of Caldwell Investment Management Ltd. The views expressed, while based on current market conditions and information, they are subject to change without notice and as such, there can be no assurance that actual results will not differ materially from such expectations. The comments are an illustration of broader themes and intended to be for general information purposes only.

Forward-looking statements are not guarantees of future results as they involve uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

The contents are provided as general in nature and should not be relied upon nor construed to be the rendering of specific tax, legal, accounting or professional investment advice. Readers should consult with their own accountants, lawyers and/or financial advisors for advice on their specific circumstances before taking any action.

The information contained herein is from sources believed to be reliable, but accuracy cannot be guaranteed. No representations or warranty, expressed or implied is made by Caldwell Investment Management Ltd. or its affiliates. -

Partners in Prospecting

February 2, 2022When your Prospect is “As Cold As Ice”

You’ve spent a few meetings probing and conducting a needs analysis. You’ve checked, double checked and triple checked to ensure your prospect is aligned with you. After gathering all relevant information, you work tirelessly on a proposal. All you want now is to close that deal.

The problem is – your prospect has gone radio silent. You have tried numerous times, to follow up and speak directly to your prospect. All to no avail.

Sound familiar?

Understandably, you feel frustrated. You are not alone. Whether you are new to your business or a seasoned professional, it happens to everyone.

What should you do?

You want clarification that your prospect is still interested. You want to appeal to your prospect in a way that reminds them why they want to partner with you. It is important not to be dismissive or aggressive with them. Always be careful to give them an exit strategy. It’s never easy to lose a prospective client but sometimes you just have to lick your wounds and move on.

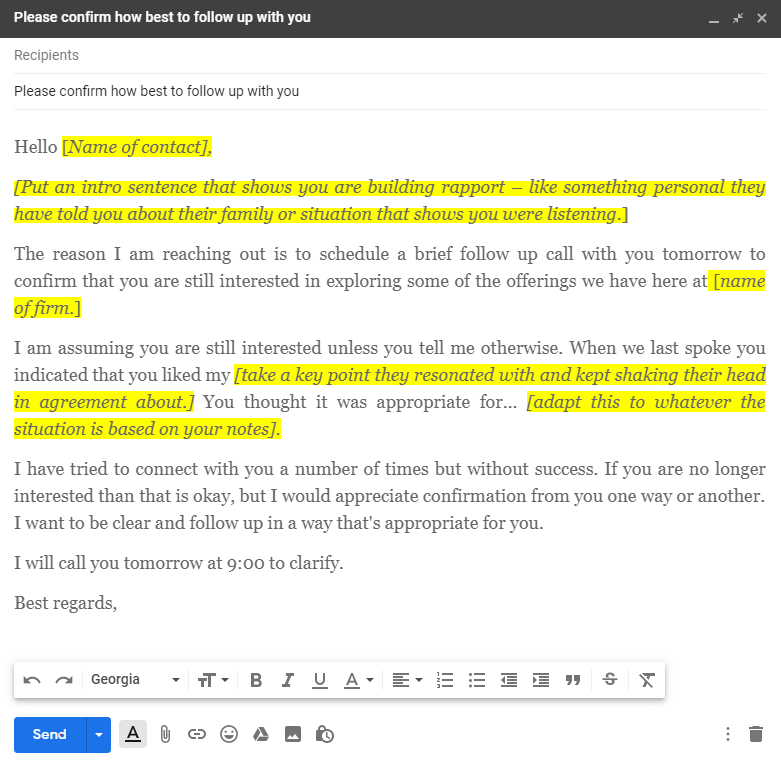

Email Template for Interested Prospect Gone Cold

Below is a template I created and tweak to adopt to various situations. I hope you find it helpful.

See below for additional resources that you may find helpful:

If you’ve completed the meeting successfully, here’s a helpful podcast that gives you a quick insight on what to do after your meeting: Meetings are important whether virtual or in person. When you leave a meeting, what are you going to do? | Caldwell Investment Management Ltd.

Getting referrals is a great way to increase your prospect list, and get more meetings. It can be an uncomfortable process, sometimes even a difficult conversation to have; but, there are more benefits to asking for the business rather than not asking at all. Closed mouths don’t get fed!: Call Me: Five Simple Steps for Obtaining Referrals | Caldwell Investment Management Ltd.

You are a professional, you are amazing at what you do, and you’re in this line of business for a reason! Talk about yourself, tell clients what you’re offering, tell prospects about what they get when they work with you. Take yourself to the top because: You’re the Top: The Value of Advice as Your Differentiator – How to Stand Out from the Crowd | Caldwell Investment Management Ltd.

Note: There is a song title in this blog post. Did you find it?About Jennifer Kuta

For more than 25 years, I have worked with Advisors helping them build their businesses. My commitment to you is to partner with you in your practice and offer solutions to help build your business.

Investment involves risk, uncertainty and assumptions. The value of investments rise and fall and there is a risk you may not recoup the amount originally invested. Past performance is not a reliable indicator of future performance.

The contents of this blog are the personal views of the author and not necessarily the views of Caldwell Investment Management Ltd. The views expressed, while based on current market conditions and information, they are subject to change without notice and as such, there can be no assurance that actual results will not differ materially from such expectations. The comments are an illustration of broader themes and intended to be for general information purposes only.

Forward-looking statements are not guarantees of future results as they involve uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

The contents are provided as general in nature and should not be relied upon nor construed to be the rendering of specific tax, legal, accounting or professional investment advice. Readers should consult with their own accountants, lawyers and/or financial advisors for advice on their specific circumstances before taking any action.

The information contained herein is from sources believed to be reliable, but accuracy cannot be guaranteed. No representations or warranty, expressed or implied is made by Caldwell Investment Management Ltd. or its affiliates.