Partners in Prospecting

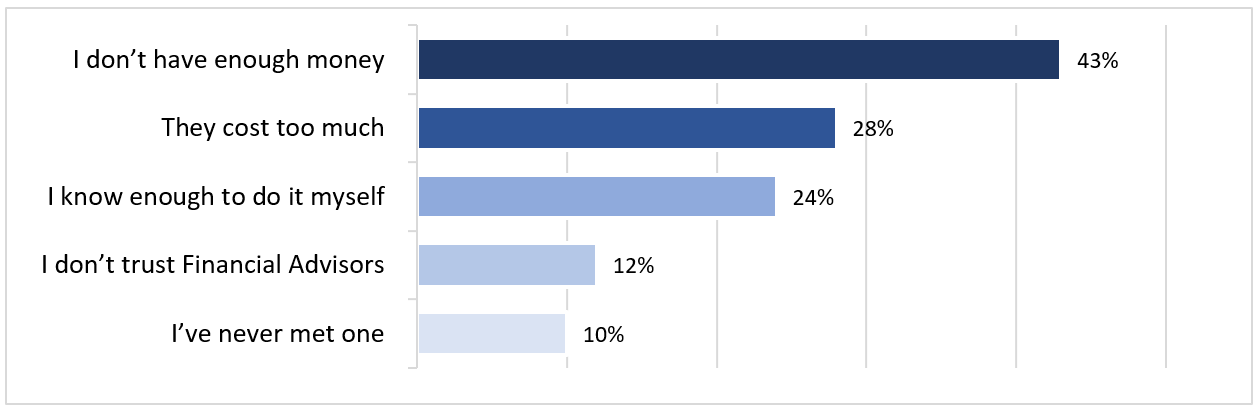

Top 5 reasons Canadians DO NOT have a Financial Advisor

Credo Consulting released a research earlier in 2019 highlighting the Top 5 Reasons Canadians do not work with a Financial Advisor. This information might be helpful in your prospecting efforts and in overcoming investor objections. I have provided some ammunition for each of the top 5 reasons below and suggest you address these directly with potential clients in your marketing materials, on your website, on the phone and during in-person meetings.

If you think that you know another “top reason” that does not appear on this list, please let us know!

1. I don’t have enough money (43%)

How much money are we talking about? It’s never too late or early to start saving and getting investment advice. Not all Financial Advisors look for high net worth clients only. There are many competent Financial Advisors on the horizon looking to grow with you.

2. They cost too much (28%)

Like Lawyers, Accountants, Tax Consultants and other Financial Professionals, Advisors do charge fees. Look for an Advisor that is upfront and transparent about the fees they charge. These include referral or commission agreements in place. Many clients that have investment help from Financial Advisors indicate their net returns on their investments are worth the fees. In addition, Advisors take the burden of growing assets from the client by taking a holistic approach to their lives.

3. I know enough to do it myself (24%)

It is important for prospective clients to know that their potential Advisor has sufficient training, knowledge and experience to advise them on the issues that matter most to them and, more importantly, on the issues they may not be aware of. This question will also give you the opportunity to speak about professional qualifications and designations such as a CFP or CFA. In addition, successful advisors have often entered into the profession after many years of working with entrepreneurs and other like-minded people that may later become their clients. You can ask your prospects if they think they have the sufficient training to make both buy and sell order decisions on a daily basis. A Financial Advisor role is a full-time job. Does a prospect or client have enough hours in the day to pursue an advisory role?

4. I don’t trust Financial Advisors (12%)

Here is the perfect opportunity for you to use testimonials* and/or referrals from your existing clients to establish the trust factor. Also – a perfect opportunity for you to mention your licencing requirements and fiduciary responsibilities. IIROC AdvisorReport is a useful resource to direct your clients to.

*Refer to OSC staff notice 33-747 www.osc.gov.on.ca page 34-35 for guidance.

5. I’ve never met one (10%)

If 10% of investors have never met a Financial Advisor – it is important to get your name out there and ensure you are in the Google search results. Periodically, check in with current clients to see if they have friends or family that do not have a Financial Advisor and ask them for a referral.

About Jennifer Kuta

For more than 25 years, I have worked with Advisors helping them build their businesses. My commitment to you is to partner with you in your practice and offer solutions to help build your business.

Investment involves risk, uncertainty and assumptions. The value of investments rise and fall and there is a risk you may not recoup the amount originally invested. Past performance is not a reliable indicator of future performance. The contents of this blog are the personal views of the author and not necessarily the views of Caldwell Investment Management Ltd. The views expressed, while based on current market conditions and information, they are subject to change without notice and as such, there can be no assurance that actual results will not differ materially from such expectations. The comments are an illustration of broader themes and intended to be for general information purposes only. Forward-looking statements are not guarantees of future results as they involve uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations. The contents are provided as general in nature and should not be relied upon nor construed to be the rendering of specific tax, legal, accounting or professional investment advice. Readers should consult with their own accountants, lawyers and/or financial advisors for advice on their specific circumstances before taking any action. The information contained herein is from sources believed to be reliable, but accuracy cannot be guaranteed. No representations or warranty, expressed or implied is made by Caldwell Investment Management Ltd. or its affiliates.

Vice President, Business Development and Sales