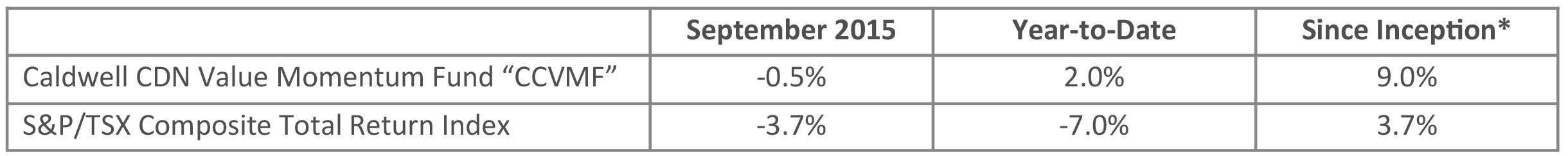

Update on Caldwell Canadian Value Momentum Fund September 2015

* Cumulative return since August 15, 2011

September Recap: The Fund declined 0.5% in September versus a much more severe loss of -3.7% for the TSX Total Return Index. This marks the 16th time the Fund outperformed when the benchmark had a down month. Since inception, the Fund has performed better in 16 of 21 down months for a success ratio of 76%. Continuing with last month’s theme of capital protection, the Fund did a remarkable job of avoiding the most painful parts of the market. Specifically, the Fund continued to have no exposure to Energy (-9.3%) or Materials (-9.8%) and also avoided the heavy losses in Health Care driven by Valeant Pharmaceuticals (-21.9%) and Concordia Healthcare (-44.1%).

The Health Care stocks provide an excellent example of the value of the second phase of the Fund’s investment process – the active overlay. As a reminder, the first phase of the investment process is purely quantitative. It involves a factorbased screening of the Canadian market for companies undergoing positive re-ratings. Once new candidates are identified, the Fund’s managers move to the second phase of the investment process, which involves performing due-diligence to answer two main questions: what is driving momentum and is it sustainable? This is where the health care stocks failed. While strong momentum in the early part of the year caused Valeant and Concordia to rank highly in the quantitative screen, our due-diligence left us uncomfortable with the sustainability of growth drivers. Our bias is to err on the side of capital protection and as such, we passed on buying the shares.

Top performers this month were Alimentation Couche-Tard (+10.1%) and CCL Industries (+8.9%) while the bottom performers were Tricon Capital Group (-9.7%) and AGT Food and Ingredients (-9.3%). Two stocks were added to the portfolio in September: Vecima Networks (VCM) and New Flyer Industries (NFI). Vecima was purchased on the back of a strong earnings report. The company is seeing positive momentum as cable operators increasingly adopt Vecima’s technology solutions and the overall spending environment looks positive. New Flyer Industries is North America’s #1 transit bus manufacturer and parts supplier. It is benefiting from increasing demand for buses on the back of pent-up demand and a healthier government spending environment. Margins are expected to move higher as the industry comes out of a meaningful consolidation phase. These investments have brought the Fund’s cash position down to 20% at the end of the third quarter.

Looking forward, we continue to identify stocks with near-term catalysts to unlock value. Should risk continue to exit the market, the Fund is well positioned.

Wishing you and all of our investors continued success,

The CCVMF Team

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/