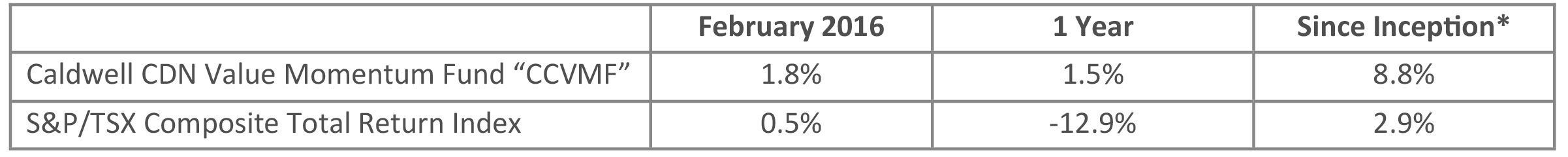

Update on Caldwell Canadian Value Momentum Fund February 2016

*Compounded Annual Return since August 15, 2011

February Recap: The Fund gained 1.8% in February versus a gain of 0.5% for the TSX Total Return Index. After a strong and broad-based ‘risk-off’ rotation last month, money moved back into both cyclical and defensive sectors. The Materials sector (+17.8%) had a particularly impressive move as the gold index (+30%) continued higher from last month and base metals stocks reversed sharply off of lows (First Quantum +63%; Teck Resources +50%). The Fund managed to outperform the index despite a 20% cash balance and no exposure to gold or base metals. This was due to good performance across several of the Fund’s holdings, as well as having no exposure to Valeant (-27%), which dragged the index down once again.

Top performers in February were Premium Brand Holdings (+11.5%), CCL Industries (+4.8%) and Vecima (+4.8%). Vecima started moving higher after earnings beat estimates and the company raised full year guidance on the back of securing orders. There was no particular news behind the moves in Premium or CCL.

We mentioned last month that the team was working through due diligence on multiple new buy signals that were prompted by the market’s rotation. Three stocks were added to the portfolio in February as a result: Imvescor Restaurant Group (IRG), CGI Group (GIB.A) and Calian Technologies (CTY).

Imvescor operates 227 franchised family restaurants under the Pizza Delight, Trattoria di Mikes, Scores and Baton Rouge brands. A new, operationally-focused CEO took over in September 2014 and is executing both a turn-around and growth plan. The company has made great strides on same store sales and sees opportunity to grow revenue significantly over the next several years. This is a true value play with shares trading at a substantial discount to the North American restaurant peer group.

CGI Group operates in the technology consulting and business process outsourcing space and plays to the trend of helping companies drive revenue and become more efficient through the use of technology. It is seeing improving sales and bookings, along with margin expansion, as its efficiency program bears fruit and it laps lower margin, legacy contracts from the acquisition of Logica.

Calian has a very diverse set of operating assets. Its businesses include defense and emergency preparedness training, groundbased satellite communications systems, IT services and resource planning, health clinic management, and recruiting and workforce management. The company appointed a new CEO in April 2015 and the plan is to build out each business segment. The current backlog implies upside to revenue growth while margins should expand over time as new business is scaled.

The market’s rotation also triggered sell signals on a number of the Fund’s holdings, which we subsequently executed. As such, the Fund remained fairly defensive with a 23% cash position at the end of February. We continue to work through the due diligence of numerous other potential buys and will manage the cash according to the attractiveness of opportunities presented.

Wishing you and all of our investors continued success,

The CCVMF Team

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/