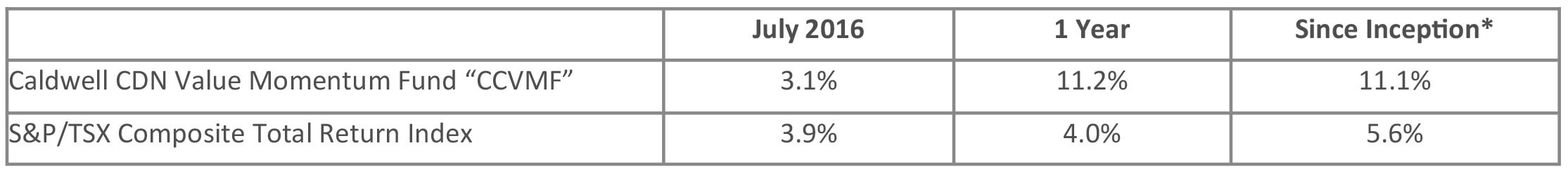

Update on Caldwell Canadian Value Momentum Fund July 2016

*Compounded Annual Return since August 15, 2011

July Recap: The Fund gained 3.1% in July versus a gain of 3.9% for the S&P/TSX Composite Total Return Index (“Index”). We are enthusiastic advocates for investors gaining a better understanding of how different investments behave and what drives their performance. To that end, we have previously highlighted that the Fund tends to outperform in months that the Index declines (70% success rate). We believe this is because the stocks in the portfolio have strong catalysts to unlock value, which make them less susceptible to broader-based changes in market sentiment. Similarly, we looked back at how the Fund performs when market sentiment rises sharply, defined by a monthly move of over 3% for the Index. Out of 11 months that the Index returned over 3% since the Fund’s inception (August 2011), the Fund outperformed in only 4 of those months (approximately 1/3 of the time). As such, we find that the Fund’s relative performance in July was very typical of how the strategy has historically performed.

Top CCVMF performers in July were Hardwood Distribution (+21%), Tree Island Steel (+20%) and Calian Group (+19%). We noted Hardwood’s sizeable acquisition of Rugby in last month’s note and believe the market has started to recognize the combined company’s earnings potential. Tree Island continued its strong performance from last month as its Q2 earnings report further solidified the company’s growth strategy in investors’ minds. Calian Group announced the extension of a major contract which included a significant increase in contract value.

The Fund’s performance was held back by a couple of stocks that declined on what we view as temporary factors. Wi-Lan (-27%) moved lower as its Q2 results were well below analyst estimates. The contract nature of Wi-Lan’s business means that quarterly results can be very lumpy, which is what the company experienced in Q2. The underlying investment thesis on Wi-Lan remains intact and we believe the company will sign significant amounts of new contracts in the upcoming quarters. AGT (-11%) was lower on a temporary crop shortage that is expected to only impact Q2 results. Supply and demand fundamentals remain attractive beyond the temporary supply disruption.

We noted in our March 2016 Commentary that the CCVMF is continually identifying new opportunities to grow its value via the ownership of stocks that are undergoing a positive re-rating by the market. New crops of investments enable the Fund to continue adding value even after periods of very strong results. Calian and Tree Island are good proof points of this as they were purchased in February and May 2016, respectively, after a 2015 that saw particularly strong performance. While there were no changes to the portfolio in July, we continue to work through due diligence on a number of potential investments. Given the macro-driven market thus far in 2016, we are taking care to only invest in companies where we see sustainable momentum drivers.

The CCVMF ended July with a cash balance of 8%. We look forward to tracking the progress of the portfolio’s holdings as we see a meaningful and diverse set of catalysts to drive continued growth.

Wishing you and all of our investors continued success,

The CCVMF Team

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/

-

Curtis Luttorhttps://caldwellinvestment.com/author/cluttor/