August Recap:

The Caldwell Canadian Value Momentum Fund (“CCVMF”) gained 1.0% in August versus a gain of 0.4% for the S&P/TSX Composite Total Return Index (“Index”).

Top CCVMF performers in August were Kirkland Lake Gold (“KL”: +18.6%) and Cargojet ("CJT": +13.4%).

Kirkland participated with the broad-based rally in gold. Cargojet moved higher after announcing a strategic agreement, in which Amazon will take up to a 15% ownership in CargoJet, based on long-term delivery commitments. While growth in e-commerce was a key part of the Cargojet thesis, the agreement serves to de-risk the strategy and earnings outlook.

Two stocks were added to the portfolio in August: TMX Group ("X") and Real Matters ("REAL").

TMX Group operates global markets and provides analytic solutions that facilitate the funding, growth and success of businesses, traders and investors. With a new CEO joining 5 years ago, the company has shifted away from traditional exchange trading architecture to focus on becoming a solutions provider within capital formation, data & analytics and derivatives. The company has a clear goal to achieve mid-single-digit revenue growth and double-digit EPS growth, with M&A providing additional upside. Valuation remains compelling with the stock trading below the peer group.

Real Matters is a technology company that is disrupting the mortgage lending and insurance industries. The company has a long growth runway via market share gains given its technology platform and outsourced model result in significantly better outcomes to lenders. Underlying market growth has inflected positively as refinance activity responds to lower interest rates while attractive incremental margins are just starting to get appreciated by investors.

A quick comment on the market: sector leadership has rotated throughout the past twelve months as investor sentiment has shifted between bouts of risk-on and risk-off activity. With no clear leadership, the portfolio today is very balanced between defence (consumer staples, gold, cash) and offence (select industrial, financial and energy names), with the common thread being that there are company-specific catalysts to move share prices higher.

The Fund held a 12.9% cash weighting at month end. The CCVMF has generated substantial value to investors over its long-term history driven by the combination of strong company-specific catalysts and a concentrated portfolio. We continue to look forward to strong results as we progress through 2019 and beyond.

We thank you for your continued support.

The CCVMF Team

The Fund was not a reporting issuer offering its securities privately from August 8, 2011 until July 20, 2017, at which time it became a reporting issuer and subject to additional regulatory requirements and expenses associated therewith.

Unless otherwise specified, market and issuer data sourced from Capital IQ.

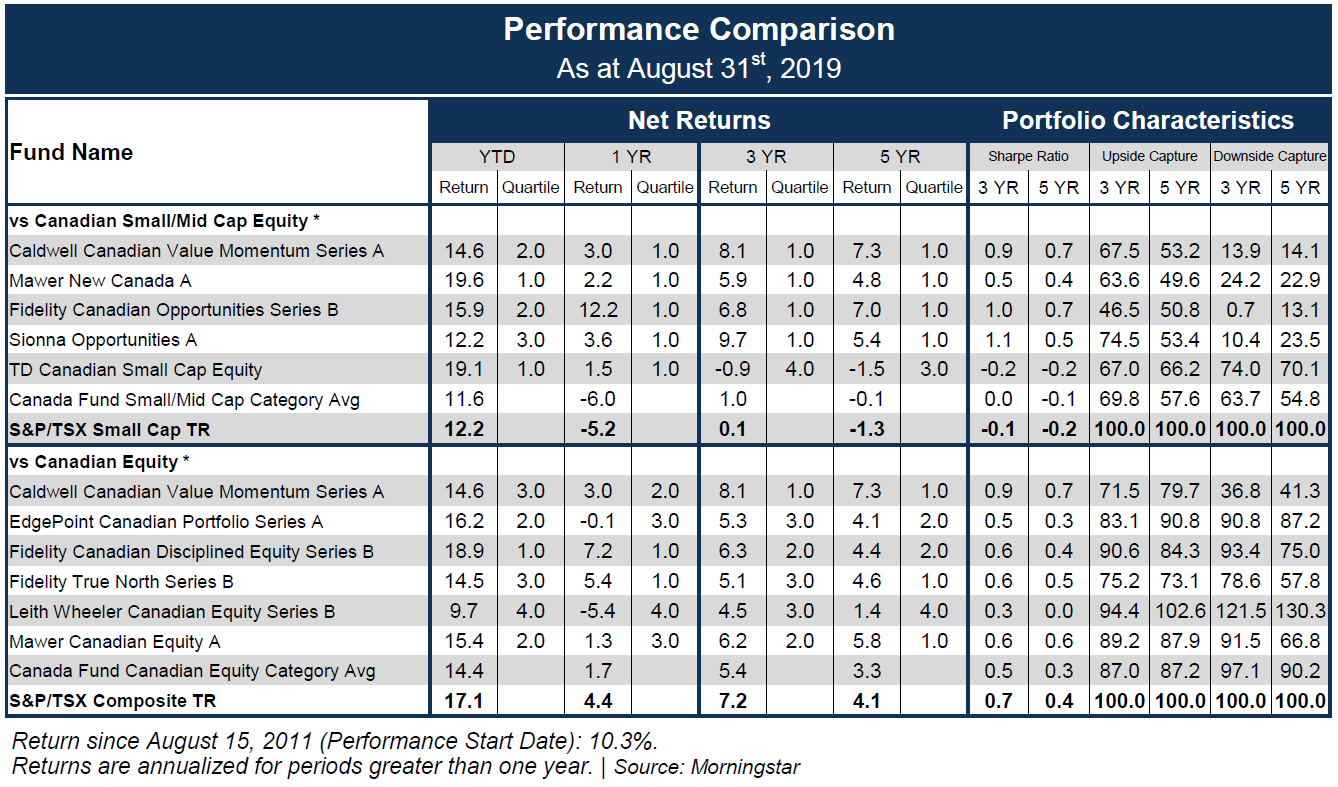

As the constituents in the Canadian Equity category largely focus on securities of a larger capitalization and CCVMF considers, and is invested, in all categories, including smaller and micro-cap securities, we have also shown how CCVMF ranks against constituents focused in the smaller cap category. The above list represents 6 of a total of 372 constituents in the Canadian Equity category and 5 of a total of 110 constituents in the Canadian Small/Mid Equity category.

The information contained herein provides general information about the Fund at a point in time. Investors are strongly encouraged to consult with a financial advisor and review the Simplified Prospectus and Fund Facts documents carefully prior to making investment decisions about the Fund. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Rates of returns, unless otherwise indicated, are the historical annual compounded returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed; their values change frequently and past performance may not be repeated. Publication date: September 17, 2019.

FundGrade A+® is used with permission from Fundata Canada Inc., all rights reserved. The annual FundGrade A+® Awards are presented by Fundata Canada Inc. to recognize the “best of the best” among Canadian investment funds. The FundGrade A+® calculation is supplemental to the monthly FundGrade ratings and is calculated at the end of each calendar year. The FundGrade rating system evaluates funds based on their risk-adjusted performance, measured by Sharpe Ratio, Sortino Ratio, and Information Ratio. The score for each ratio is calculated individually, covering all time periods from 2 to 10 years. The scores are then weighted equally in calculating a monthly FundGrade. The top 10% of funds earn an A Grade; the next 20% of funds earn a B Grade; the next 40% of funds earn a C Grade; the next 20% of funds receive a D Grade; and the lowest 10% of funds receive an E Grade. To be eligible, a fund must have received a FundGrade rating every month in the previous year. The FundGrade A+® uses a GPA-style calculation, where each monthly FundGrade from “A” to “E” receives a score from 4 to 0, respectively. A fund’s average score for the year determines its GPA. Any fund with a GPA of 3.5 or greater is awarded a FundGrade A+® Award. For more information, see www.FundGradeAwards.com. Although Fundata makes every effort to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by Fundata.

* Categories defined by Canadian Investment Funds Standards Committee ("CIFSC")