July 2020 Recap:

The Fund gained 4.5% in July, in line with the 4.5% gain for the S&P/TSX Composite Total Return Index (“Index”)1. All eleven sectors posted a positive return for the month, led by Materials (+13.1%) on the back of strength in the Gold sub-industry (+15.3%). Technology (+6.1%) and Consumer Staples (+6.2%) continued to perform well while returns in Financials (+0.1%) and REITs (+0.7%) remained muted.

Top CVM performers in July were B2Gold (“BTO” +20.2%), Wesdome Gold ("WDO" +16.9%) and Real Matters (“REAL” +12.5%)2.

While both BTO and WDO benefited from a stronger gold price, WDO moved higher on solid drill results from its Eagle River mine. Recall that when investing in commodity-driven stocks, we look for situations where management teams have the ability to drive value beyond just the commodity price, WDO being a great example this month. Nevertheless, the strength in the gold price is driving considerable free cash flow generation at gold miners, with BTO doubling its dividend for the 2nd time this year in early August. REAL's momentum continued into their Q2 report, where the company beat EBITDA expectations by 30% on already raised estimates given a 20% EBITDA beat in Q1. REAL continues to see a strong mortgage re-finance pipeline and is executing very well, with notable share gains with leading lenders.

Two stocks were added to the portfolio in July: Martinrea (“MRE”) and Linamar (“LNR”).

Both companies are auto parts suppliers. While the auto industry has been hit hard through COVID-19, production levels appear to have bottomed in Q2 and are snapping back faster than expected in Q3, especially in North America where auto OEMs are looking to rebuild depleted inventories. The auto suppliers have some of the lowest multiples in the market today. As an example, MRE is trading at approximately 5x 2019 actual and 6x 2021 expected EPS.

The Fund held a 12.5% cash weighting at month-end. The CVM has generated substantial value1 to investors over its long-term history driven by the combination of strong company-specific catalysts and a concentrated portfolio. We continue to look forward to strong results as we progress through 2020 and beyond.

We thank you for your continued support.

The CVM Team

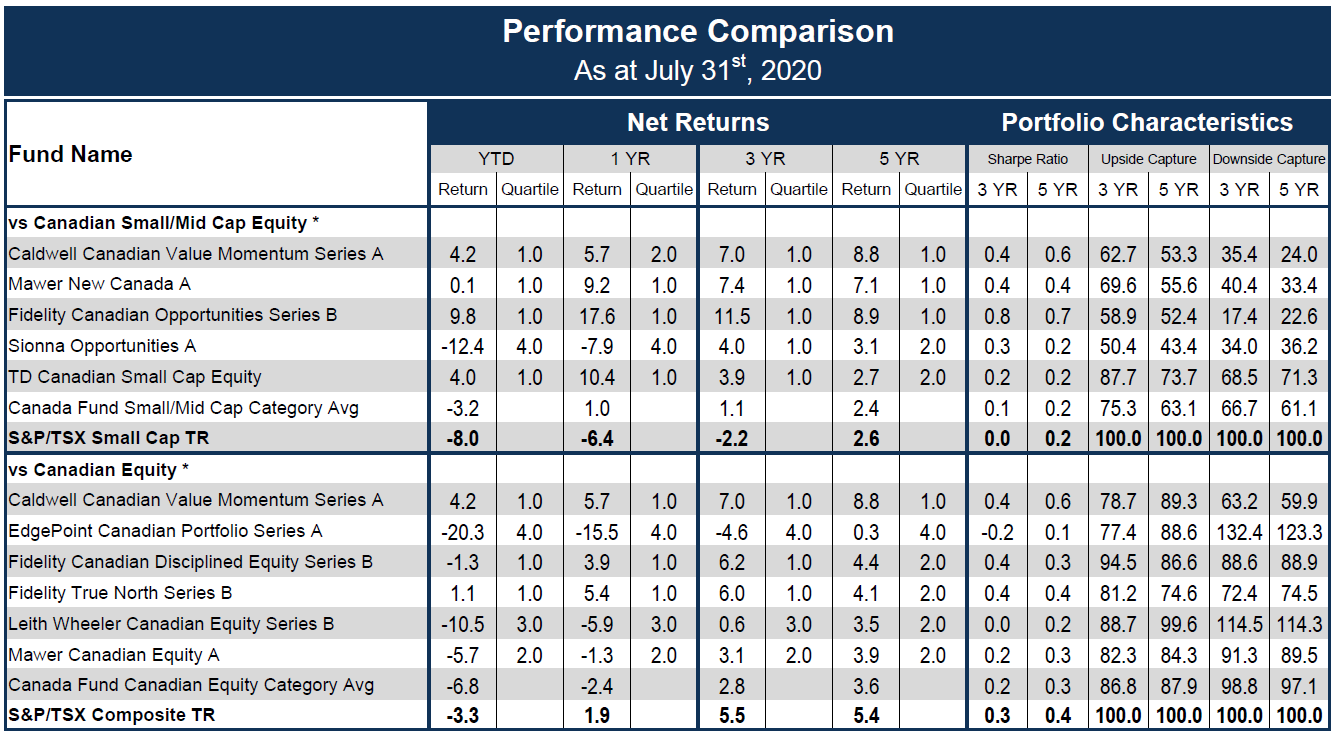

1See table for standard performance data.

2Actual Investments, first purchased: BTO - 02/26/2020, WDO - 10/21/2019, REAL - 08/20/2019.

Return since August 15, 2011 (Performance Start Date): CVM 9.8%, Index 5.9%. | Returns are annualized for periods greater than one year. | Source: Morningstar

The CVM was not a reporting issuer offering its securities privately from August 8, 2011 until July 20, 2017, at which time it became a reporting issuer and subject to additional regulatory requirements and expenses associated therewith.

Unless otherwise specified, market and issuer data sourced from Capital IQ.

As the constituents in the Canadian Equity category largely focus on securities of a larger capitalization and CVM considers, and is invested, in all categories, including smaller and micro-cap securities, we have also shown how CVM ranks against constituents focused in the smaller cap category. The above list represents 6 of a total of 363 constituents in the Canadian Equity category and 5 of a total of 98 constituents in the Canadian Small/Mid Equity category.

The information contained herein provides general information about the Fund at a point in time. Investors are strongly encouraged to consult with a financial advisor and review the Simplified Prospectus and Fund Facts documents carefully prior to making investment decisions about the Fund. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Rates of returns, unless otherwise indicated, are the historical annual compounded returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed; their values change frequently and past performance may not be repeated.

The Lipper Fund Awards are based on the Lipper Leader for Consistent Return rating, which is a risk-adjusted performance measure calculated over 36, 60 and 120 months. Lipper Leaders fund ratings do not constitute and are not intended to constitute investment advice or an offer to sell or the solicitation of an offer to buy any security of any entity in any jurisdiction. For more information, see lipperfundawards.com. Lipper Leader ratings change monthly. Lipper Fund Awards from Refinitiv, ©2019 Refinitiv. All rights reserved. Used under license. The Caldwell Canadian Value Momentum Fund Series A in the Canadian Equity Category for the 5-year period (out of a total of 69 funds) ending July 31, 2019. Lipper Leader ratings: 5 (3 years) and 5 (5 years).

FundGrade A+® is used with permission from Fundata Canada Inc., all rights reserved. The annual FundGrade A+® Awards are presented by Fundata Canada Inc. to recognize the “best of the best” among Canadian investment funds. The FundGrade A+® calculation is supplemental to the monthly FundGrade ratings and is calculated at the end of each calendar year. The FundGrade rating system evaluates funds based on their risk-adjusted performance, measured by Sharpe Ratio, Sortino Ratio, and Information Ratio. The score for each ratio is calculated individually, covering all time periods from 2 to 10 years. The scores are then weighted equally in calculating a monthly FundGrade. The top 10% of funds earn an A Grade; the next 20% of funds earn a B Grade; the next 40% of funds earn a C Grade; the next 20% of funds receive a D Grade; and the lowest 10% of funds receive an E Grade. To be eligible, a fund must have received a FundGrade rating every month in the previous year. The FundGrade A+® uses a GPA-style calculation, where each monthly FundGrade from “A” to “E” receives a score from 4 to 0, respectively. A fund’s average score for the year determines its GPA. Any fund with a GPA of 3.5 or greater is awarded a FundGrade A+® Award. For more information, see www.FundGradeAwards.com. Although Fundata makes every effort to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by Fundata.

*Categories defined by Canadian Investment Funds Standards Committee (“CIFSC”).

Publication date: August 13, 2020.

12303168464egw4gwe4g