The global capital market reaction to the evolving developments surrounding the COVID-19 virus and its potential ensuing disruptions to global economic supply chains has been considerable. Canada’s market has not been immune to these events. However, the out-performance of the Caldwell Canadian Value Momentum Fund (“CVM” or “the Fund”) during this recent market correction has been very encouraging as CVM's strategy has been working exactly as we anticipated and as we have communicated it would have to our investors over the last several years. The Fund's down capture ratio from Monday, March 2nd to Thursday, March 12th was only 54.5%, meaning that CVM participated in roughly half of the market's decline during this period. In addition, the turnover of the Fund's portfolio to-date has been approximately $30 Million or 60%, as we have been actively adjusting the portfolio by selling weakness and rotating into strength. Our investment process is designed to marry the discipline of a quantitative model with the insight and expertise of a dedicated asset manager. We believe this investment process has enabled us to navigate this market well. While we expect continued volatility moving forward, the Fund has demonstrated significant Alpha generation since its inception in August 2011. We thank our supporters for placing their confidence in us and for providing us with an opportunity to safeguard their investments during this volatile period.

February 2020 Recap:

The Fund declined 5.7% in February versus a loss of 5.9% for the S&P/TSX Composite Total Return Index (“Index”). We usually write about what worked and what didn't but the market's risk-off nature was broad-based with every business sector trading lower. Even gold, which has historically acted as a safe haven, traded down with the broader market, and on some days, led the market lower.

While COVID-19 is capturing headlines, the indiscriminate selling suggests something bigger, with drastic measures and business disruption re-awakening liquidity concerns. A just-in-time, leveraged, economy with limited spare capacity in some critical areas is not suited to prolonged disruptions. Additionally, the market has mostly benefited from a positive ETF-driven feedback loop: it’s possible that we are starting to see what a negative feedback loop looks like.

As bottom-up investors who focus on company-specific catalysts, there are many examples of stock moves that simply don't make sense. However, it is impossible to know the path of markets and how long this macro-driven, disrupted market will last. As such, we believe an actively managed portfolio such as the CVM is best positioned to help investors navigate these markets.

Two stocks were added to the portfolio in February: B2Gold (“BTO”) and Stantec (“STN”).

BTO has several positive company-specific characteristics but the stock will ultimately trade on sentiment and fund flows.

Stantec is back to being a pure-engineering firm after a failed attempt at adding a construction capability. This is positive news as financial results have started to reflect the more attractive consistency of the engineering business model. While government infrastructure budgets are already increasing, the current state of markets despite years of monetary stimulus suggests that governments will increasingly need to tap fiscal measures to once again stimulate the economy.

The Fund held a 22.2% cash weighting at month-end. The CVM has generated substantial value to investors over its long-term history driven by the combination of strong company-specific catalysts and a concentrated portfolio. We continue to look forward to strong results as we progress through 2020 and beyond.

We thank you for your continued support.

The CVM Team

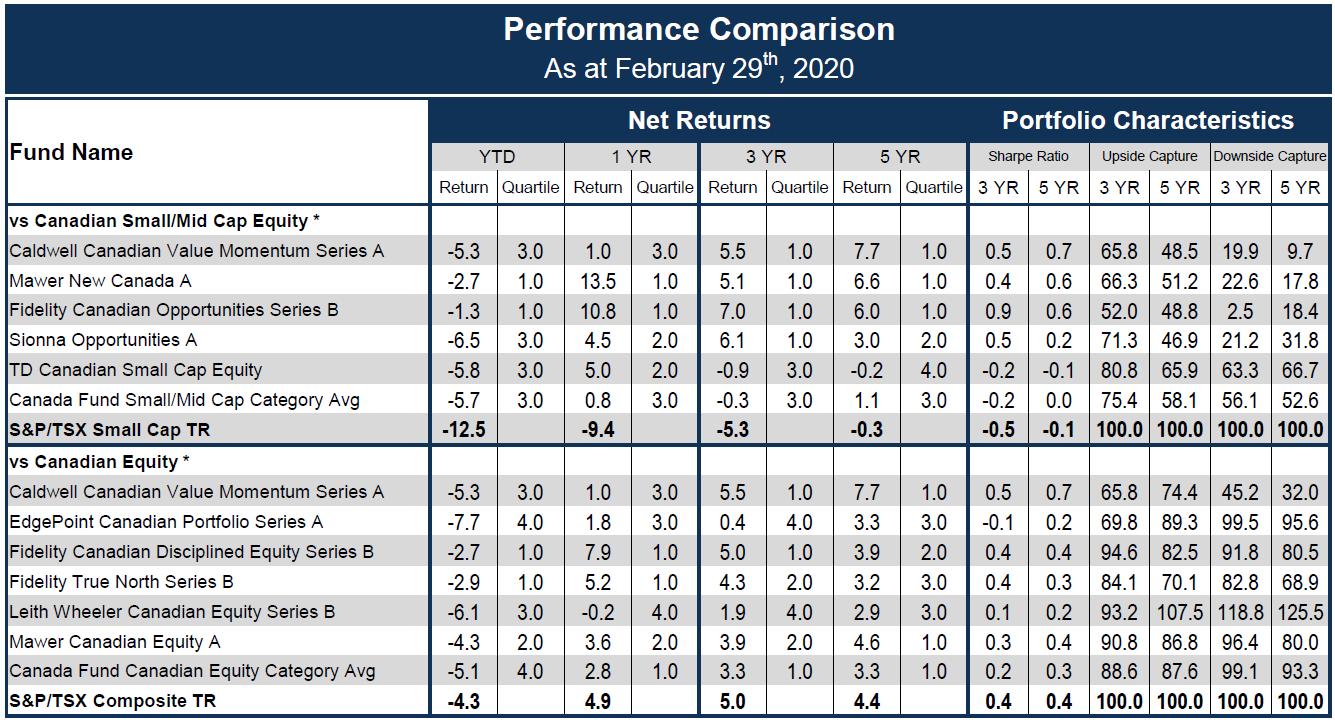

Return since August 15, 2011 (Performance Start Date): 9.1%. | Returns are annualized for periods greater than one year. | Source: Morningstar

The CVM was not a reporting issuer offering its securities privately from August 8, 2011 until July 20, 2017, at which time it became a reporting issuer and subject to additional regulatory requirements and expenses associated therewith.

Unless otherwise specified, market and issuer data sourced from Capital IQ.

As the constituents in the Canadian Equity category largely focus on securities of a larger capitalization and CCVMF considers, and is invested, in all categories, including smaller and micro-cap securities, we have also shown how CVM ranks against constituents focused in the smaller cap category. The above list represents 6 of a total of 379 constituents in the Canadian Equity category and 5 of a total of 102 constituents in the Canadian Small/Mid Equity category.

The information contained herein provides general information about the Fund at a point in time. Investors are strongly encouraged to consult with a financial advisor and review the Simplified Prospectus and Fund Facts documents carefully prior to making investment decisions about the Fund. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Rates of returns, unless otherwise indicated, are the historical annual compounded returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed; their values change frequently and past performance may not be repeated. Publication date: March 13, 2020.

The Lipper Fund Awards are based on the Lipper Leader for Consistent Return rating, which is a risk-adjusted performance measure calculated over 36, 60 and 120 months. Lipper Leaders fund ratings do not constitute and are not intended to constitute investment advice or an offer to sell or the solicitation of an offer to buy any security of any entity in any jurisdiction. For more information, see lipperfundawards.com. Lipper Leader ratings change monthly. Lipper Fund Awards from Refinitiv, ©2019 Refinitiv. All rights reserved. Used under license. The Caldwell Canadian Value Momentum Fund Series A in the Canadian Equity Category for the 5-year period (out of a total of 69 funds) ending July 31, 2019. Lipper Leader ratings: 5 (3 years) and 5 (5 years).

FundGrade A+® is used with permission from Fundata Canada Inc., all rights reserved. The annual FundGrade A+® Awards are presented by Fundata Canada Inc. to recognize the “best of the best” among Canadian investment funds. The FundGrade A+® calculation is supplemental to the monthly FundGrade ratings and is calculated at the end of each calendar year. The FundGrade rating system evaluates funds based on their risk-adjusted performance, measured by Sharpe Ratio, Sortino Ratio, and Information Ratio. The score for each ratio is calculated individually, covering all time periods from 2 to 10 years. The scores are then weighted equally in calculating a monthly FundGrade. The top 10% of funds earn an A Grade; the next 20% of funds earn a B Grade; the next 40% of funds earn a C Grade; the next 20% of funds receive a D Grade; and the lowest 10% of funds receive an E Grade. To be eligible, a fund must have received a FundGrade rating every month in the previous year. The FundGrade A+® uses a GPA-style calculation, where each monthly FundGrade from “A” to “E” receives a score from 4 to 0, respectively. A fund’s average score for the year determines its GPA. Any fund with a GPA of 3.5 or greater is awarded a FundGrade A+® Award. For more information, see www.FundGradeAwards.com. Although Fundata makes every effort to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by Fundata.

* Categories defined by Canadian Investment Funds Standards Committee ("CIFSC")

12303168464egw4gwe4g

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/

-

Oksana Poyaskovahttps://caldwellinvestment.com/author/oksana/