May 2020 Recap:

The Caldwell Canadian Value Momentum Fund (“CVM”) out-performed the S&P/TSX Composite Total Return Index (“Index”) by over 400 basis points, with a gain of 7.2% in May versus a gain of 3.0% for the Index, as the market continued its COVID-19 snap back rally*. The range of sector outcomes remained wide with Technology (+14.6%) and Consumer Discretionary (+8.1%) outperforming REITs (-2.6%) and Utilities (flat). Through the end of May, the price Index is up 36% off of its March 23rd low.

The market's performance year-to-date has a notable negative skew to it with nearly 60% of the constituents under-performing the price Index. The negative skew becomes even more notable if one excludes the numerous Gold names in the Index, given their strong performance this year. Shopify ("SHOP") has been another significant driver with its share price more than doubling year-to-date through May and having overtaken the Royal Bank of Canada as the largest company on the Index.

Top CVM performers in May were Real Matters ("REAL" +48.8%) and Kinaxis ("KXS" +27.1%).

REAL is seeing record demand for its mortgage-related platform as low interest rates have created a multi-year backlog of refinancing opportunity. The company is also gaining share with lenders given its platform significantly improves the efficiency of title and appraisal processes.

Kinaxis is another company seeing record demand as its supply chain software is helping corporations that have been forced to rethink their supply chains. What this market has shown us is that, even in the midst of complete global chaos, there will always be companies that are benefiting from that chaos. This creates opportunities for investors with strategies that are nimble enough to capture those opportunities, which is exactly what the CVM was designed to do.

We remained active in May, adding seven new stocks to the portfolio: Constellation Software ("CSU"), ATS Automation ("ATA"), Champion Iron Ore ("CIA"), WSP Global ("WSP"), Norbord ("OSB"), Intact Financial ("IFC"), and BRP Corp ("DOO").

CSU and IFC add to the theme from last month of owning companies whose earnings streams are relatively resilient to the COVID-19 environment. ATA provides factory automation solutions with attractive exposure to the life sciences end market. We expect the company to benefit from manufacturing plants having to adjust to accommodate COVID-related health guidelines, as well as longer term opportunities in adjusting supply chains, especially in health related areas. CIA's flagship asset is the wholly owned Bloom Lake mine located in northern Quebec. Chinese demand for iron ore has recovered strongly since its economy reopened while iron ore exports from Brazil remain relatively weak. WSP has a strong backlog and is expected to benefit from infrastructure spending globally, along with the potential for attractive acquisitions coming out of this economic pause. Norbord is expected to benefit from positive commentary from U.S. home builders as housing starts rebound. Finally, DOO was seeing very strong innovation-driven market share gains prior to the COVID-19 outbreak and is now seeing stronger than expected demand for its power sport vehicles following a significant decline in its share price.

The Fund held a 12.7% cash weighting at month-end. The CVM has generated substantial value to investors over its long-term history driven by the combination of strong company-specific catalysts and a concentrated portfolio. We continue to look forward to strong results as we progress through 2020 and beyond.

We thank you for your continued support.

The CVM Team

Return since August 15, 2011 (Performance Start Date): 9.0%. | Returns are annualized for periods greater than one year. | Source: Morningstar

The CVM was not a reporting issuer offering its securities privately from August 8, 2011 until July 20, 2017, at which time it became a reporting issuer and subject to additional regulatory requirements and expenses associated therewith.

Unless otherwise specified, market and issuer data sourced from Capital IQ.

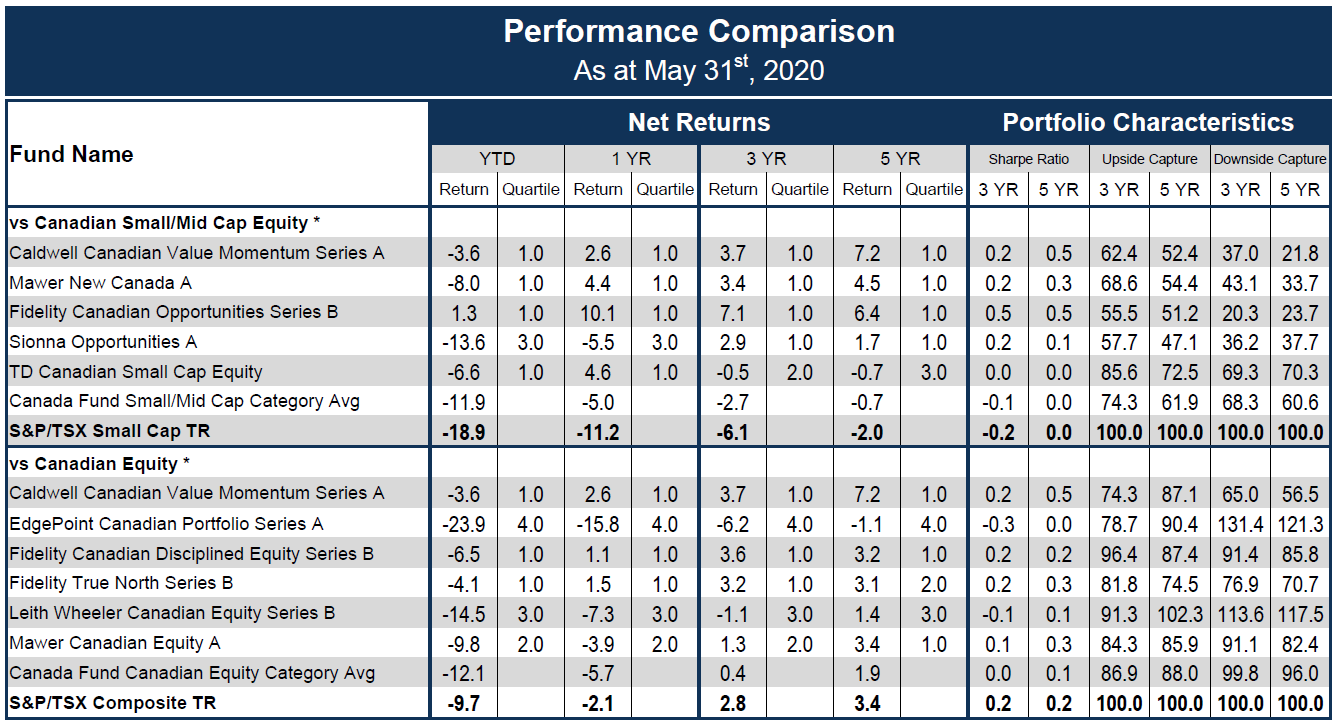

As the constituents in the Canadian Equity category largely focus on securities of a larger capitalization and CVM considers, and is invested, in all categories, including smaller and micro-cap securities, we have also shown how CVM ranks against constituents focused in the smaller cap category. The above list represents 6 of a total of 368 constituents in the Canadian Equity category and 5 of a total of 100 constituents in the Canadian Small/Mid Equity category.

The information contained herein provides general information about the Fund at a point in time. Investors are strongly encouraged to consult with a financial advisor and review the Simplified Prospectus and Fund Facts documents carefully prior to making investment decisions about the Fund. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Rates of returns, unless otherwise indicated, are the historical annual compounded returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed; their values change frequently and past performance may not be repeated. Publication date: June 11, 2020.

The Lipper Fund Awards are based on the Lipper Leader for Consistent Return rating, which is a risk-adjusted performance measure calculated over 36, 60 and 120 months. Lipper Leaders fund ratings do not constitute and are not intended to constitute investment advice or an offer to sell or the solicitation of an offer to buy any security of any entity in any jurisdiction. For more information, see lipperfundawards.com. Lipper Leader ratings change monthly. Lipper Fund Awards from Refinitiv, ©2019 Refinitiv. All rights reserved. Used under license. The Caldwell Canadian Value Momentum Fund Series A in the Canadian Equity Category for the 5-year period (out of a total of 69 funds) ending July 31, 2019. Lipper Leader ratings: 5 (3 years) and 5 (5 years).

FundGrade A+® is used with permission from Fundata Canada Inc., all rights reserved. The annual FundGrade A+® Awards are presented by Fundata Canada Inc. to recognize the “best of the best” among Canadian investment funds. The FundGrade A+® calculation is supplemental to the monthly FundGrade ratings and is calculated at the end of each calendar year. The FundGrade rating system evaluates funds based on their risk-adjusted performance, measured by Sharpe Ratio, Sortino Ratio, and Information Ratio. The score for each ratio is calculated individually, covering all time periods from 2 to 10 years. The scores are then weighted equally in calculating a monthly FundGrade. The top 10% of funds earn an A Grade; the next 20% of funds earn a B Grade; the next 40% of funds earn a C Grade; the next 20% of funds receive a D Grade; and the lowest 10% of funds receive an E Grade. To be eligible, a fund must have received a FundGrade rating every month in the previous year. The FundGrade A+® uses a GPA-style calculation, where each monthly FundGrade from “A” to “E” receives a score from 4 to 0, respectively. A fund’s average score for the year determines its GPA. Any fund with a GPA of 3.5 or greater is awarded a FundGrade A+® Award. For more information, see www.FundGradeAwards.com. Although Fundata makes every effort to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by Fundata.

* Categories defined by Canadian Investment Funds Standards Committee ("CIFSC")

12303168464egw4gwe4g