December Recap

The Fund declined 4.6% in December versus a loss of 5.4% for the S&P/TSX Composite Total Return Index ("Index”). It was another month of broad-based weakness with only the gold sector posting a positive return. This is now the 7th consecutive month in which the CCVMF out-performed a declining Index. Since inception (August 2011), the fund has outperformed the Index in 27 of 34 down months for a 79% success ratio.

Three stocks were added to the portfolio in December: Badger Daylighting ("BAD"), Alimentation Couche-Tard ("ATD.B") and Metro Inc. ("MRU"). Badger provides non-destructive excavating and related services in Canada and the U.S and owns the largest hydrovac excavation fleet in North America. Business momentum is strong while new segment disclosures illustrate decreased exposure to oil & gas, which should re-rate the multiple higher. BAD has a 17%, 10-year, organic revenue growth rate and management believes they have only scratched the surface on growth opportunity, given low penetration of non-destructive excavation and expansion runway into new geographies.

Revenue and EBITDA are at record highs while the stock still trades meaningfully below its all-time high. While MRU and ATD.B are likely benefiting from the market's shift to defensive stocks, both companies also have company-specific catalysts to drive share prices higher. Metro operates grocery and pharmacy stores across Canada. It is benefiting from a positive inflection in grocery inflation, lower-than-expected headwinds from minimum wage hikes and synergies from the Jean Coutu pharmacy acquisition. Alimentation Couche-Tard is one of the largest convenience store operators and fuel retailers in North America. ATD.B was a very successful holding for the CCVMF between October 2014 and March 2016. We are back in this company after a sideways trading consolidation period which saw the forward Enterprise Value/EBITDA multiple contract from 11.9x to 10.0x. Same store sales growth has inflected positively on the back of food and beverage initiatives while the company continues to see a healthy, multi-year acquisition pipeline.

Full Year 2018 Recap

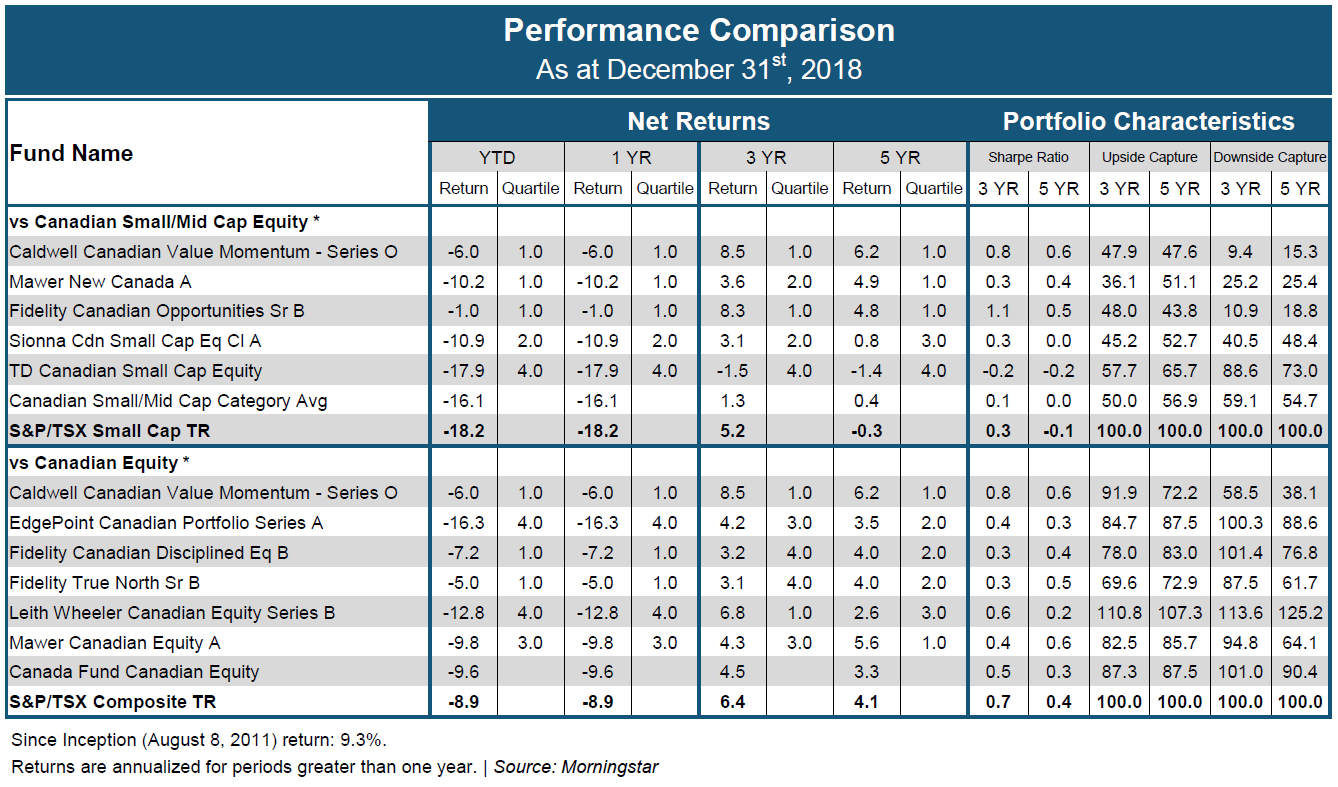

The Fund declined 6.0% in 2018 versus a loss of 8.9% for the Index. Despite the Fund ending the year with a loss, we are pleased to have once again significantly out-performed the Index. Over the past 5 years, the Fund holds a category-best downside capture ratio of 38.1% and ranks in the top 2% of all Canadian Equity funds for the 3-year period, and top 5% for the 5-year period, ending December 31, 2018.

The Fund held a 54.7% cash weighting at the end of December. There has been strong 'risk off' sentiment to the market these last three months with investors focusing more on macro issues (trade/global growth and interest rates) over company-specific drivers. During more challenging markets, it is important to remember the fundamental reasons for owning an investment. Specific to the CCVMF, the fund has generated substantial value to investors over its long-term history, driven by the combination of strong company-specific catalysts and a concentrated portfolio. We continue to look forward to strong results as we progress through 2019 and beyond.

We thank you for your continued support.

The CCVMF Team

The Fund was not a reporting issuer offering its securities privately from August 8, 2011 until July 20, 2017, at which time it became a reporting issuer and subject to additional regulatory requirements and expenses associated therewith.

Unless otherwise specified, market and issuer data sourced from Capital IQ.

As the constituents in the Canadian Equity category largely focus on securities of a larger capitalization and CCVMF considers, and is invested, in all categories, including smaller and micro-cap securities, we have also shown how CCVMF ranks against constituents focused in the smaller cap category. The above list represents 5 of a total of 363 constituents in the Canadian Equity category and 6 of a total of 114 constituents in the Canadian Small/Mid Equity category.

The information contained herein provides general information about the Fund at a point in time. Investors are strongly encouraged to consult with a financial advisor and review the Simplified Prospectus and Fund Facts documents carefully prior to making investment decisions about the Fund. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Rates of returns, unless otherwise indicated, are the historical annual compounded returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed; their values change frequently and past performance may not be repeated. Principal distributor: Caldwell Securities Ltd. Publication date: January 25, 2019.

FundGrade A+® is used with permission from Fundata Canada Inc., all rights reserved. The annual FundGrade A+® Awards are presented by Fundata Canada Inc. to recognize the “best of the best” among Canadian investment funds. The FundGrade A+® calculation is supplemental to the monthly FundGrade ratings and is calculated at the end of each calendar year. The FundGrade rating system evaluates funds based on their risk-adjusted performance, measured by Sharpe Ratio, Sortino Ratio, and Information Ratio. The score for each ratio is calculated individually, covering all time periods from 2 to 10 years. The scores are then weighted equally in calculating a monthly FundGrade. The top 10% of funds earn an A Grade; the next 20% of funds earn a B Grade; the next 40% of funds earn a C Grade; the next 20% of funds receive a D Grade; and the lowest 10% of funds receive an E Grade. To be eligible, a fund must have received a FundGrade rating every month in the previous year. The FundGrade A+® uses a GPA-style calculation, where each monthly FundGrade from “A” to “E” receives a score from 4 to 0, respectively. A fund’s average score for the year determines its GPA. Any fund with a GPA of 3.5 or greater is awarded a FundGrade A+® Award. For more information, see www.FundGradeAwards.com. Although Fundata makes every effort to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by Fundata.

* Categories defined by Canadian Investment Funds Standards Committee ("CIFSC")

12303168464egw4gwe4g